Topics

-

Electoral trust

-

Prevention of Money Laundering Act | Enforcement Directorate

-

Microfinance Institutions | Reserve Bank of India

-

India and Bhutan

-

Antarctic Treaty

-

Peter Pan Syndrome

-

Electoral trust

#GS2 #Accountability #Government policies

Context: The Paribartan Electoral Trust funded by the MP Birla Group has declared a donation of Rs 3 crore through electoral bonds in 2019-20. This is the first instance of an electoral trust donating money through electoral bonds.

Key Details:

- The Trust hasn’t revealed the names of the political parties that received this money, citing anonymity guaranteed under the electoral bond scheme.

- According to the Association of Democratic Reforms (ADR), this “practice is against the spirit of the Electoral Trusts Scheme, 2013 and the Income Tax Rules, 1962 which make it mandatory for trusts to furnish each and every detail about the donor contributing to the trust.

- If Electoral trusts start adopting this precedent of donating through bonds, it will be a complete situation of unfair practices i.e. total anonymity, unchecked and unlimited funding, free flow of black money circulation, corruption, foreign funding, corporate donations and related conflict of interest etc.

- Such a practice completely negates the very purpose behind the inception of the Electoral Trusts Scheme, 2013 and Rule 17CA of the I.T Rules, 1962.

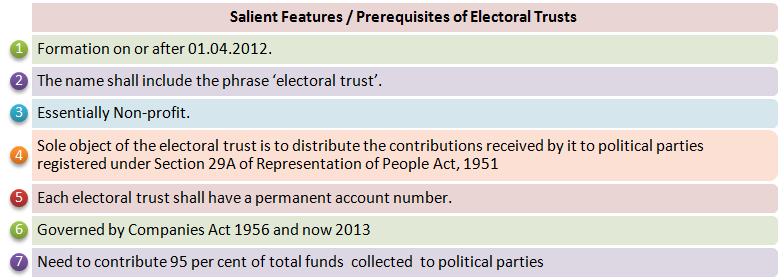

About the Electoral Trust Scheme:

- An Electoral Trust is a non-profit company established for orderly receipt of the voluntary contributions from any person (or company) for distributing the same to the respective political parties, registered under Section 29A of the Representation of People Act, 1951.

- Such a company is registered under Companies Act comes under the purview of CBDT for tax matters.

- Electoral Trusts are relatively new in India and are part of the ever-growing electoral restructurings in the country.

- Electoral Trusts Scheme, 2013 was notified by the Central Board of Direct Taxes (CBDT).

- The provisions related to the electoral trust are under Income-tax Act, 1961 and Income tax rules-1962.

- An electoral trust can accept contributions only by cheque, demand draft or account transfer to the bank.

Criteria for Approval of Trusts:

- An electoral trust shall be considered for approval if it fulfills following conditions, namely:-

- The company registered for the purposes of section 25 of the Companies Act, 1956.

- The object of the electoral trust shall not be to earn any profit or pass any direct or indirect benefit to its members or contributors.

Who can contribute to Electoral Trusts:

The Electoral Trust may receive Voluntary Contributions From:

- An individual who is a citizen of India;

- A company which is registered in India; and

- A firm or Hindu undivided family or an Association of persons or a body of individuals, resident in India.

Trust shall not accept contributions From-

- An individual who is not a citizen of India.

- Any other electoral trust which has been registered as a company under section 25 of the Companies Act, 1956 and approved as an electoral trust under the Electoral Trusts Scheme, 2013;

- A Government company as defined in section 2 of the Companies Act, 2013.

- A foreign source as defined in section 2 of the Foreign Contribution (Regulation) Act, 2010.

Significance of Scheme:

- Electoral Trusts are designed to bring in more transparency in the funds provided by corporate entities to the political parties for their election related expenses.

- The Election Commission had also circulated guidelines for submission of contribution reports of electoral trusts to submit an annual report containing details of contributions received by the electoral trusts and disbursed by them to political parties in the interest of transparency.

Electoral Bonds:

- Electoral Bond is a financial instrument for making donations to political parties.

- The features of electoral bonds and the process involved are:

- These bonds are issued by notified banks.

- The donor may approach these banks and purchase the bonds.

- The donor shall be permitted to buy the bonds through cheque/digital payment. Hence the identity of the donors is protected (if the donors are identified, they may get caught up in political rivalry-especially if the donor is a businessman).

- The donor donates these bonds to the political party.

- The political party has to encash it into the account which is registered with the Election Commission of India.

- The bonds are issued in multiples of Rs. 1,000, Rs. 10,000, Rs. 1 lakh, Rs. 10 lakh and Rs. 1 crore without any maximum limit.

- State Bank of India is authorised to issue and encash these bonds, which are valid for fifteen days from the date of issuance.

- These bonds are redeemable in the designated account of a registered political party.

- The bonds are available for purchase by any person (who is a citizen of India or incorporated or established in India) for a period of ten days each in the months of January, April, July and October as may be specified by the Central Government.

- A person being an individual can buy bonds, either singly or jointly with other individuals.

- They ensure that the funds being collected by the political parties are accounted for money or clean money.

-

Prevention of Money Laundering Act | Enforcement Directorate

#GS3 #Badloans #Publicsectorbanks

Context: Assets worth ?8,441.5 crore have been transferred to public sector banks that suffered losses due to frauds committed by businessmen.

Background:

- The banks had suffered losses of ?22,585.83 crore due to frauds committed allegedly by businessmen Vijay Mallya, Nirav Modi and Mehul Choksi.

- Based on the cases registered by the Central Bureau of Investigation, the ED had taken up a money laundering probe.

- ED unearthed a money trail of domestic and international transactions and stashing of assets abroad by the accused persons and their associates.

- Accused used dummy entities controlled by them for rotation and siphoning off the funds provided by the banks.

Key Details:

- As on date, out of the total attached/ seized assets of Rs 18,170.02 crore under provisions of PMLA, assets worth Rs 330 crore has been confiscated and assets worth Rs 9042 crore, representing 40% of the total loss to the bank, have been handed over to the Public Sector banks.

- The attached assets include assets worth Rs 969 crore located in foreign countries

- The ED has transferred shares attached by it (worth Rs 6,600 crore) to a State Bank of India-led consortium as per the order of the PMLA (Prevention of Money Laundering Act) Special Court, Mumbai.

- The Debt Recovery Tribunal, on behalf of the consortium, sold the shares.

- Prosecution complaints were filed against all three accused.

- Extradition requests were sent for them to the United Kingdom (Mr. Mallya and Mr. Modi) and Antigua and Barbuda (Mr. Choksi).

Prevention of Money Laundering Act:

- The PMLA was enacted in 2002 and it came into force in 2005. The chief objective of this legislation is to fight money laundering.

- The Act enables government authorities to confiscate property and/or assets earned from illegal sources and through money laundering.

- Under the PMLA, the burden of proof lies with the accused, who has to prove that the suspect property/assets have not been obtained through proceeds of crime.

- Various actions can be initiated against persons found to be guilty of money laundering, such as:

- Freezing or seizing of property and records, and/or attachment of property obtained through crime proceeds.

- Rigorous imprisonment for a minimum of 3 years and a maximum of 7 years.

- If the crime of money laundering is involved with the Narcotic Drugs and Psychotropic Substances Act, 1985, the punishment can go up to 10 years, along with fine.

- The Enforcement Directorate (ED) is responsible for investigating offences under the PMLA. Also, the Financial Intelligence Unit – India (FIU-IND) is the national agency that receives, processes, analyses and disseminates information related to suspect financial transactions.

What is Money Laundering?

- Money laundering is the process of making large amounts of money generated by criminal activity, such as drug trafficking or terrorist funding, appear to have come from a legitimate source.

- Criminal activities like illegal arms sales, smuggling, drug trafficking and prostitution rings, insider trading, bribery and computer fraud schemes produce large profits.

- Thereby it creates the incentive for money launderer to “legitimize” the ill-gotten gains through money laundering.

- The money so generated is called ‘dirty money’ and money laundering is the process of conversion of ‘dirty money’, to make it appear as ‘legitimate’ money.

Enforcement Directorate:

- Directorate of Enforcement is a specialized financial investigation agency under the Department of Revenue, Ministry of Finance, Government of India.

- On 1 May 1956, an ‘Enforcement Unit’ was formed, in Department of Economic Affairs, for handling Exchange Control Laws violations under Foreign Exchange Regulation Act, 1947.

- In the year 1957, this Unit was renamed as ‘Enforcement Directorate’.

- ED enforces the following laws:

- Foreign Exchange Management Act,1999 (FEMA)

- Prevention of Money Laundering Act, 2002 (PMLA)

Debt Recovery Tribunals (DRT):

- DRTs were established to facilitate the debt recovery involving banks and other financial institutions with their customers.

- They enforce the provisions of the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993 and also Securitization and Reconstruction of Financial Assets and Enforcement of Security Interests (SARFAESI) Act, 2002.

- Appeals against orders passed by DRTs lie before Debts Recovery Appellate Tribunal (DRAT).

- A DRT is presided over by a presiding officer who is appointed by the central govt. and who shall be qualified to be a District Judge; with tenure of 5 years or the age of 62, whichever is earlier.

- No court in the country other than the SC and the HCs and that too, only under articles 226 and 227 of the Constitution have jurisdiction over this matter.

- The central government, in 2018, raised the pecuniary limit from Rs 10 lakh to Rs 20 lakh for filing application for recovery of debts in the Debts Recovery Tribunals by such banks and financial institutions.

-

Microfinance Institutions | Reserve Bank of India

#GS3 #Banking sector # NBFCs #Financial Inclusion

Context: Recently, the Reserve Bank of India (RBI) releases framework for regulation of microfinance loans, seeks feedback from stakeholders.

Key Details:

- It proposed to lift the interest rate cap on Microfinance Institutions (MFIs), and said all micro loans should be regulated by a common set of guidelines irrespective of who gives them.

- There are no micro loans-specific structures for lenders such as banks and non-banking financial institutions (NBFCs), even as they are responsible for extending 70 per cent of the microfinance loans.

- It has suggested a common definition of microfinance loans for all regulated entities.

- It believes that the interest rate ceiling for NBFC-MFIs also has had an unintended consequence of creating a regulatory prescribed benchmark for other microlenders

- Microfinance loans should mean collateral-free loans to households with annual household income of Rs 1,25,000 and Rs 2,00,000 for rural and urban/semi urban areas, respectively.

- For this purpose, ‘household’ means a group of persons normally living together and taking food from a common kitchen.

- RBI has mooted capping the payment of interest and repayment of principal for all outstanding loan obligations of the household as a percentage of the household income, subject to a limit of maximum 50%.

- Non-banking Financial Company (NBFC)-MFIs, like any other NBFC, shall be guided by a board-approved policy and the fair practices code, whereby disclosure and transparency would be ensured.

- There would be no ceiling prescribed for the interest rate.

- There would be no collateral allowed for micro loans.

- There can be no prepayment penalty, while all entities have to permit the borrowers to repay weekly, fortnightly or monthly instalments as per their choice.

Significance of Proposal:

- The idea is to harmonize regulations across categories of microlenders.

- RBI has reposed faith in the maturity of the microfinance sector with this step.

- This is a forward-looking step where the responsibility is of the institution to fix a reasonable interest rate on transparent terms.

- This is expected to address concerns related to over-indebtedness of microfinance borrowers and to enable a market mechanism to bring down interest rates.

Microfinance Institution (MFI):

- Microfinance is the provision of financial services to low-income clients or solidarity lending groups including consumers and the self-employed, who traditionally lack access to banking and related services.

- It covers a wide range of services like credit, savings, insurance, remittance and also non-financial services like training, counselling

- Microcredit is delivered through a variety of institutional channels viz.,

- Scheduled commercial banks (SCBs) (including small finance banks (SFBs) and regional rural banks (RRBs))

- Cooperative banks,

- Non-banking financial companies (NBFCs)

- Microfinance institutions (MFIs) registered as NBFCs as well as in other forms.

- MFIs are financial companies that provide small loans to people who do not have any access to banking facilities.

- The definition of “small loans” varies between countries. In India, all loans that are below Rs. 1 lakh can be considered as microloans.

What are Non-Banking Financial Company (NBFC)- MFIs?

- NBFC MFI is a non-deposit taking NBFC (other than a company licensed u/s 25 of the Indian Companies Act, 1956) that meets the following conditions:

- Minimum Net Owned Funds (NOF) of Rs.5 crore. (For those registered in the North Eastern Region of the country, Rs. 2 crore is required as minimum NOF).

- At least 85% of its Total Net Assets are in the nature of “Qualifying Assets.”

What are Qualifying Assets?

- “Net assets” are total assets excluding cash, bank balances, and money market instruments.

- “Qualifying assets” are those assets which have a substantial period of time to be ready for its intended use or sale.

-

India and Bhutan

#GS2 #International relations #Bilateral groupings #GS3 #Taxation

Context: Recently, Bhutan’s Tax Inspectors Without Borders (TIWB) programme launched in partnership with India.

About the programme:

- It is a joint initiative of the United Nations Development Programme (UNDP) and the Organisation for Economic Cooperation and Development (OECD).

- It is intended to support developing countries to strengthen national tax administrations through building audit capacity and to share this knowledge with other countries.

- The TIWB Programme aims to strengthen tax administrations of developing countries by transferring technical know-how and skills to their tax auditors, and through the sharing of general audit practices and dissemination of knowledge products with them.

- This programme is expected to be of about 24 months’ duration.

- The focus of the programme will be in the area of International Taxation and Transfer Pricing.

Benefits of the programme:

- Through this India in collaboration with the UNDP and the TIWB Secretariat aims to aid Bhutan in strengthening its tax administration by transferring technical know-how and skills to its tax auditors, and through sharing of best audit practices.

- The TIWB Programme complements the efforts of the international community to strengthen cooperation on tax matters and contribute to domestic tax mobilisation efforts of developing countries.

- India has been supportive in capacity building in tax matters in developing countries. India being a global leader in this respect has a very important role to play in South-South Cooperation in tax matters.

-

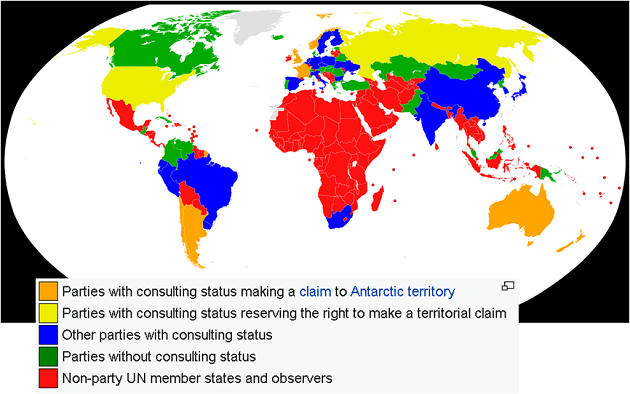

Antarctic Treaty

#GS2 #International treaties

Context: Recently, the 60th anniversary of the Antarctic Treaty was celebrated.

About the Treaty:

- The Antarctic Treaty was signed between 12 countries in Washington on 1st December 1959 for making the Antarctic Continent a demilitarized zone to be preserved for scientific research only.

- The twelve original signatories are Argentina, Australia, Belgium, Chile, France, Japan, New Zealand, Norway, South Africa, the Union of Soviet Socialist Republics, the UK and the US.

- The Antarctic treaty remains the only example of a single treaty that governs a whole continent.

- It is also the foundation of a rules-based international order for a continent without a permanent population.

- The treaty entered into force in 1961 and currently has 54 parties. India became a member of this treaty in 1983.

- Antarctica is defined as all of the land and ice shelves south of 60°S latitude.

- The treaty sets aside Antarctica as a scientific preserve, establishes freedom of scientific investigation, and bans military activity on the continent.

- The treaty was the first arms control agreement established during the Cold War. Since September 2004, the Antarctic Treaty Secretariat headquarters has been located in Buenos Aires, Argentina.

How has Antarctica been changing?

- In September, a report on oceans released by the IPCC said that between 2006 and 2015, the Antarctic ice sheet lost about 155 billion tonnes of mass on average every year.

- This ice melt from Antarctica likely contributed to sea-level rises.

- The main sources of environmental damage to the continent include planet-wide impacts such as global warming, ozone layer depletion, impacts of fishing and hunting (of whales and seals) and lastly, the impact of visitors which includes scientists and tourists.

Way Forward:

- While the Antarctic Treaty has been able to successfully respond to a range of challenges, circumstances are radically different in the 2020s compared to the 1950s. Antarctica is much more accessible, partly due to technology but also climate change.

- More countries now have substantive interests in the continent than the original 12. Some global resources are becoming scarce, especially oil.

- There is considerable speculation as to China’s interests in Antarctic resources, especially fisheries and minerals, and whether China may seek to exploit weaknesses in the treaty system to secure access to those resources.

- Therefore, all of the treaty signatories, but especially those with significant stakes in the continent, need to give the future of the treaty more attention.

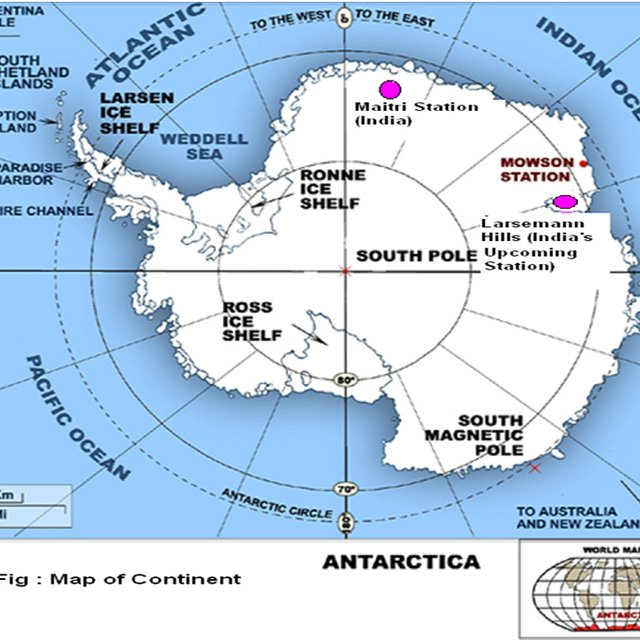

Indian Antarctic Programme:

- It is a scientific research and exploration program under the National Centre for Antarctic and Ocean Research (NCPOR). It started in 1981 when the first Indian expedition to Antarctica was made.

- NCPOR is the nodal agency for planning, promotion, coordination and execution of the entire gamut of polar and southern ocean scientific research in the country as well as for the associated logistics activities.

- Dakshin Gangotri: Dakshin Gangotri was the first Indian scientific research base station established in Antarctica, as a part of the Indian Antarctic Program.

- Maitri: Maitri is India’s second permanent research station in Antarctica. It was built and finished in 1989.

- Bharti: Bharti, India’s latest research station operation since 2012. It has been constructed to help researchers work in safety despite the harsh weather.

- It is India’s first committed research facility and is located about 3000 km east of Maitri.

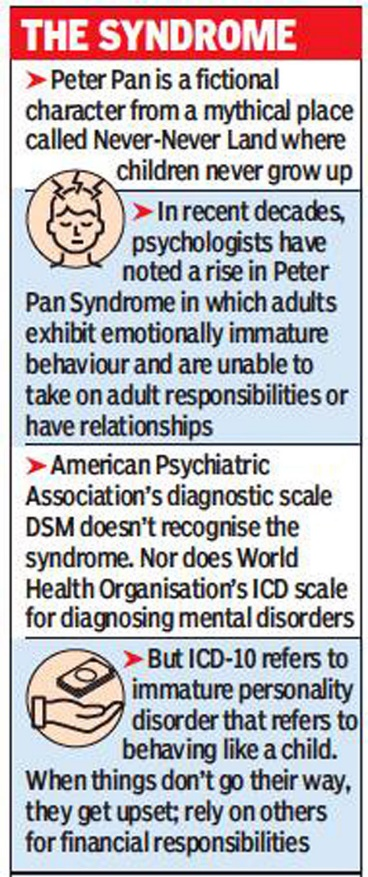

6.Peter Pan Syndrome

#GS3 #Science #GS1 #Health

Context: Recently, a special court in Mumbai granted bail to an accused of sexually assaulting a minor as he was suffering from Peter Pan Syndrome (PPS).

About:

- The term ‘Peter Pan Syndrome’ first appeared in 1983, in Dr Dan Kiley’s book. He described it as a “social-psychological phenomenon”.

- While the World Health Organization doesn’t recognise Peter Pan Syndrome as a health disorder, many experts believe it is a mental health condition that can affect one’s quality of life.

- Peter Pan Syndrome is not currently considered a psychopathology.

- It is said that people who develop behaviours of living life carefree, finding responsibilities challenging in adulthood and basically, “never growing up” suffer from Peter Pan Syndrome.

- It could affect one’s daily routine, relationships, work ethic, and result in attitudinal changes.

- The affected people have body of an adult but the mind of a child.

- The syndrome can affect anyone, irrespective of gender, race or culture. However, it appears to be more common among men.

Courses we offer :

- UPSC Civil Services Coaching ( We are the best top rated IAS Academy in Vijayawada and Andhra Pradesh by Times of India Excellence award)

- Degree with IAS (BA and BSc plus UPSC Coaching)

- Inter with IAS (Sarat Chandra Junior College provides intermediate plus UPSC Coaching with HEC, MEC, CEC along with CLAT, IIT HSEE, IPMAT)

Free Material / Resources :

- Daily Current Affairs

- UPSC Civil service Daily Mains Questions

- UPSC Previous Papers

- Current Affairs Daily Quiz

- ncert materials

- UPSC CSE Mains GS 1

- UPSC CSE Mains GS 2

- UPSC CSE Mains GS 3