Daily Current Affairs 01st September – Topics

- Supreme Court on Fundamental Rights to Reside and to Move About Freely

- Era of leaded petrol over globally: UNEP

- Oil palm plan for northeast, Andamans a recipe for disaster

- Small Finance Banks

- New initiative in Jammu & Kashmir to restore lost glory of Pashmina shawls

- BH Series Registration

1.Supreme Court on Fundamental Rights to Reside and to Move About Freely

#GS2 #Indian Constitution-Significant Provisions-Fundamental rights #Judiciary #Judgments & Cases

Context: Supreme court, in a recent judgement while setting aside an externment order against a journalist ruled that a person cannot be denied on flimsy grounds his fundamental right to reside or move freely anywhere in the country.

Background:

- Amaravati City’s Deputy Commissioner of Police, had passed the externment order under the Maharashtra Police Act, 1951, directing journalist Rahmat Khan not to enter or return to Amravati City or Amravati Rural District for 01 year from the date on which he leaves or is taken out.

- Khan had been filing applications under the Right to Information Act, seeking info from administration on alleged illegalities in the fund distribution to several madrassas run by Madrasi Baba Education Welfare Society.

What is an Externment order?

- It is a system of preventing people from entering into a particular place for a certain period, due to their capability to disturb that place’s conditions by criminal activity, as exhibited by their prior behaviour, this system of restraining the criminal activities is known as externment.

Supreme Court’s judgement:

- SC ruled, that a person cannot be denied his fundamental right to reside anywhere in the country or to move freely throughout the country, on flimsy grounds.

- The drastic action of externment should only be taken in exceptional cases, to maintain law and order in a locality and/or prevent a breach of public tranquillity and peace.

- The SC said that provisions under Maharashtra Police Act are intended to prevent lawlessness and deal with a class of lawless elements in society who cannot be brought to book by conventional methods of penal action, upon judicial trial.

Is externment a coherent deterrence solution?

In Favour:

- Just the use of the procedural penal laws has been inadequate to preserve peace in society. Therefore, gradually, discretionary power has been granted to administrative authorities by the State to maintain the status quo in a healthy environment.

- It was necessary for the lawmakers to implement the externment laws to guarantee the restrictions on criminal acts to keep away the criminals from indulging in such activities as prohibited by law.

- The necessary safeguards for the use of discretionary powers were that the judiciary can always check and balance the discretion on a case-to-case basis.

Against:

- It was contended that these laws have partially disturbed natural justice’s principle, which is based on Articles 14 and 21 of the Constitution.

- These principles are concerned in cases where the administrative actions have caused bias in carrying out a decision concerning a person’s conviction.

- One such concept was ‘Audi Alteram Partem’, which says that No party shall remain unheard in the Court of law.

- In the case, Nawabkhan Abbaskhan v. the State of Gujarat, the court clearly ruled out that any order of externment, where the affected party is not heard before concluding a decision, is null and void.

- The court stated its concern that no order of externment shall violate the rule of Audi Alteram Partem and must not violate the rights guaranteed by the Indian Constitution.

Freedom of Movement:

- Article 19(1)(d) of the Indian Constitution allows every citizen to move freely throughout the territory of the country.

- This right is protected against only state action and not private individuals.

- This right is available only to the citizens and to shareholders of a company but not to foreigners or legal persons like companies or corporations, etc.

- Article 19(5) mentions reasonable restrictions on 2 grounds for this, namely, the interests of the general public and the protection of interests of any scheduled tribe.

Freedom to Reside and Settle:

- Article 19(1)(e) of the Indian Constitution provides right “to reside and settle in any part of the territory of India” to every citizen of the country.

- This right is also subject to reasonable restrictions mentioned in clause (5) of Article 19.

- Right to reside and the right to move freely throughout the country are complementary and often go together.

Way Forward:

- We can agree that these externment laws for stopping a person from going in a certain area are a coherent solution for discouraging a criminal only to the extent where the discretion of the administrative authorities is not violating the fundamental rights of the citizens of India.

- The assertion of which would be done by the judiciary on a case-to-case basis.

2.Era of leaded petrol over globally: UNEP

#GS3 # Environmental Pollution & Degradation- Cause and Source; Prevention and Control # International Environment Agencies & Agreements

Context: Recently, the United Nations Environment Programme (UNEP) announced that the use of leaded petrol has been eradicated from the globe.

What is leaded petrol:

- The main difference between leaded and unleaded fuel is the additive tetraethyl lead.

- The combustion of leaded petrol causes the lead to be released into the air.

- The practice of adding tetraethyl lead to petrol was started soon after its anti-knock and octane-boosting properties were discovered.

- It is a deadly neurotoxin.

Background:

- Since 1922, the use of tetraethyllead as a petrol additive to improve engine performance was started. By the 1970s, almost all petrol produced around the world contained lead.

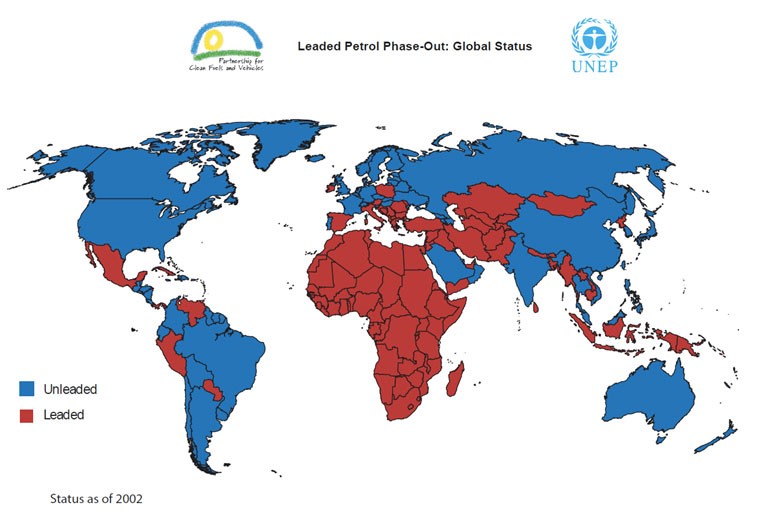

- The campaign to eliminate leaded fuel was led and supported by the UNEP and its Partnership for Clean Fuels and Vehicles (PCFV) was started in 2002.

- In 2002, the Partnership for Clean Fuels and Vehicles (PCFV) was set up at the World Summit on Sustainable Development.

- With the creation of PCFV, global target for elimination of leaded petrol was set. At that time, 117 countries were still using leaded petrol.

- The PCFV is a public-private partnership that brought all stakeholders together, offering technical assistance, raising awareness, overcoming local challenges and resistance from local oil dealers and producers of lead, as well as investing in refinery upgrades.

- By the 1980s, most high-income countries had prohibited the use of leaded petrol, yet as late as 2002, almost all low- and middle-income countries, including some Organisation for Economic Co-operation and Development (OECD) members, were still using leaded petrol.

- While all countries have followed different timelines for the lead phaseout, developing countries, especially those in Africa and a few in Asia have taken the longest time.

- Alegria was producing leaded fuel until July 2021, became the last country to eliminate leaded fuel.

Significance:

- Exhausts from petrol vehicles using leaded petrol has been a substantial source of lead exposures.

- Fumes from leaded petrol results in heart disease, stroke and cancer.

- It also affects the development of the human brain, especially harming children, with studies suggesting it reduced 5-10 IQ points.

- Prohibiting the use of leaded petrol has been projected to stop more than 1.2 million premature deaths per year, increase IQ points among children, save USD 2.45 trillion for the global economy, and decrease crime rates.

- This has also eliminated the largest source of lead pollution.

- This is expected to boost the realization of several Sustainable Development Goals, including good health and well-being (SDG3), clean water (SDG6), clean energy (SDG7), sustainable cities (SDG11), climate action (SDG13) and life on land (SDG15).

- It also offers an opportunity for restoring ecosystems, especially in urban environments, which have been particularly degraded by this toxic pollutant.

India and leaded petrol:

- India was among those nations that took primary action to phase out leaded petrol.

- The process of phase down that had started in 1994, got accomplished in 2000.

- Initially, low-leaded petrol was introduced in Delhi, Mumbai, Calcutta and Madras in 1994, followed by unleaded petrol in 1995.

- The process was catalysed by the Supreme Court order that had directed introduction of unleaded petrol to enable adoption of catalytic converters in petrol cars.

- Many Indian refineries also took voluntary steps to not to use MMT (Methylcyclopentadienyl manganese tricarbonyl), yet another hazardous neurotoxin which numerous developed countries have virtually banned by setting an exceptionally low permissible limit for its use.

Way Forward:

- There are still other sources of lead in the atmosphere like the industrial processes or contamination of soil due to legacy emissions of lead that need to be addressed.

- Urgent action is still required to halt lead pollution from other sources – such as lead in paints, leaded batteries, and lead in household items.

- Oil palm plan for northeast, Andamans a recipe for disaster

#GS2 #Government policies and interventions #GS3 #Agriculture # Major Crops Cropping Patterns in Various Parts of the Country

Context: Environmental experts and politicians have raised concerns over the union government proposal to promote oil palm cultivation in the North-eastern states and in the Andaman and Nicobar Islands.

Background:

- Recently, Prime Minister Narendra Modi has announced a National Mission on Edible Oil-Oil Palm to boost palm oil production and help increase farm incomes.

- To boost domestic oilseed production and make the country self-sufficient in cooking oils.

- Harness domestic edible oil prices that are decided by expensive palm oil imports.

- To raise the domestic production of palm oil by three times to 11 lakh MT by 2025-26.

Components of the scheme:

- The special stress of the scheme will be in north-eastern states and the Andaman and Nicobar Islands due to the favourable weather circumstances in the regions.

- Under the scheme, oil palm farmers will be given financial assistance and will get remuneration under a price and viability formula.

- This will also help farmers and producers by providing them with quality seeds and technology to promote farming to produce palm oil and other oil seeds.

Concerns raised by the activists and politicians:

- The apprehensions are mainly expressed on the ground that promotion of oil palm cultivation will further result in environmental degradation (oil palm is an invasive species) of the primeval ecosystem already threatened by numerous other threats.

- Oil palm is not a natural product of north-eastern India.

- Invasive species don’t allow local species to grow and wildlife to move through.

- The oil palm is a water-intensive, monoculture crop.

- The high levels of investment and the long wait for high returns tend to attract large corporate investors and leave small farmers at the mercy of government subsidies and other support.

- Land productivity for palm oil is higher than for oilseeds, which create apprehension for more land to be given for oil palm cultivation.

- In many South-East Asian countries, plantation of palm oil trees has replaced massive tracts of rainforests.

- It could also detach tribal people from their identity linked with the community ownership of land and “create havoc on the social fabric”.

- Focus areas are “biodiversity hotspots and ecologically fragile” and oil palm plantations would remove forest cover and extinguish the habitat of threatened wildlife.

- Oil palm requires 300 litres of water per tree per day, as well as high Pesticide use, leading to consumer health concerns as well.

- The most crucial issue in the cultivation of oil palm has been the inability of farmers to realise a remunerative price of fresh fruit bunches (FFBs).

- FFBs (Fresh Fruit Bunches) of oil palm are highly perishable and need to be processed within twenty-four hours of harvest.

- Although it shares similarly suitable climatic conditions, Sri Lanka has recently renounced oil palm, it is planning to destroy existing plantations and ban palm oil imports as the crop has substituted more environmentally friendly and employment generating plantation crops, dried up local streams, and shows signs of becoming an invasive species threatening native plants and animals.

Need for the scheme:

- It will incentivise production of palm oil to reduce dependence on imports and help farmers cash in on the huge market.

- India is the largest consumer of vegetable oil in the world. Of this, palm oil imports are almost 60% of its total vegetable oil imports.

- India’s vegetable oil imports have surged to 1.5 crore tonnes from 40 lakh tonnes in just 20 years.

- As per the traders and industry officials, these imports could reach 20 million by 2030, boosted by a growing population with higher incomes and a taste for calorie-laden curry and fried food.

- 97 percent of palm oil in India is imported from Malaysia and Indonesia.

- In 2016-2017, with an average price of Rs 520 per 10 kg, India’s palm oil import bill was approximately Rs 47,000 crore.

- India is producing only 1.027 per cent of its requirement.

- Also, in India, 94.1 per cent of its palm oil is used in food products, especially for cooking purposes. This makes palm oil extremely critical to India’s edible oils economy.

Way Forward:

- Government should focus on providing subsidies to oilseeds that are native to India and that are suitable for dryland agriculture to attain self-reliance without depending on oil palm.

- Government can provide incentives and support to small farmers and encourage them to grow oil palm voluntarily.

- India can disincentive the import of crude palm oil by increasing the import duty on it.

- Andhra Pradesh currently grows more than 90% of India’s oil palm. Union government can implement Andhra Pradesh model in other potential states to boost oil palm production.

- A strong and robust, long-term policy mechanism will give this crop required push across India.

4.Small Finance Banks

#GS3 # Mobilisation of Resources – Role of Savings & Investment # Banking Sector & NBFCs

Context: Recently, the Reserve Bank of India (RBI) said it has received applications from Cosmea Financial Holdings Pvt. Ltd and Tally Solutions Pvt. Ltd to set up small finance banks (SFBs) under the “on-tap” small finance bank licensing guidelines of 2019.

- An “on-tap” facility would mean the RBI will accept applications and grant licences for banks throughout the year.

Background:

- RBI had set up a panel led by former deputy governor Shyamala Gopinath earlier this year to assess applications for universal and small finance banks, which are mandated to focus on priority sector lending and small loans.

- The last time RBI handed out universal bank licences was in 2014, giving them to IDFC Ltd and Bandhan Financial Services

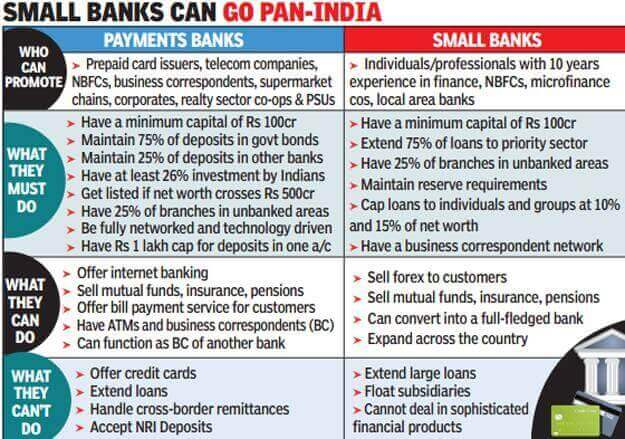

What are Small Finance Banks:

- Small finance banks are a type of niche banks in India.

- They can provide basic banking service of acceptance of deposits and lending.

- The main objective of these is to provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

- Undertake other non-risk sharing simple financial services activities such as the distribution of mutual fund units, insurance products, pension products, etc. with the prior approval of the RBI.

- They are registered as a public limited company under the Companies Act, 2013.

Basic requirement:

- The minimum paid-up equity capital for small finance banks shall be ?200 crore.

- They need to open at least 25% of its banking outlets in unbanked rural centres.

- They are required to extend 75% of its adjusted net bank credit to the Priority Sector Lending (PSL).

- At least 50% of its loan portfolio should constitute loans and advances of up to Rs. 25 lakhs.

- The maximum loan size and investment limit exposure to a single and group debtor would be restricted to 10% and 15% of its capital funds, respectively.

- If the initial shareholding by promoters in the bank is in excess of 40% of paid-up voting equity capital, it should be brought down to 40% within a period of 5 years.

- They are also subjected to Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) requirements.

- They are governed by the provisions of Reserve Bank of India Act, 1934, Banking Regulation Act, 1949 and other relevant statutes.

Guidelines for ‘on-tap’ Licencing:

- Under the on-tap regulations, the minimum paid-up voting equity capital or net worth requirement is ?200 crore.

- For Primary Urban Co-operative Banks, wanting to voluntarily transiting into SFBs, initial requirement of net worth shall be at Rs. 100 crores, which will have to be increased to Rs. 200 crores within five years from the date of commencement of business.

- Small Finance Banks will be given scheduled bank status instantly upon commencement of operations.

- The payment banks can apply for conversion into SFB after 5 years of operations if they are otherwise eligible as per these guidelines.

Payments Bank v/s Small Banks:

5.New initiative in Jammu & Kashmir to restore lost glory of Pashmina shawls

#GS2 #Government policies and interventions #Issues related to women #GS3 #Employment

Context: A Centre for Excellence (CFE) has been setup in J&K to restore the lost hand-driven processes involved in the intricate shawl weaving industry.

Key Details:

- Shawl trader Mujtaba Kadri, who owns the ‘Me&K’ brand and Aadhyam-Aditya Birla Group has set up the Centre for Excellence (CFE) at the old city’s Narwara area to restore the lost hand-driven processes involved in the intricate shawl weaving industry.

- It will start enrolling women weavers from September 1.

- The CFE has decided to double the wages for women from ?1 per knot, of 10 threads with 10-inch-long yarn, to ?2.

- The first bulk of Pashmina wool tufts will be given to women spinners free of cost.

- This will not force them for any investment, as previously they were charged for the first bulk.

Significance and need of the initiative:

- Spinning on a traditional Kashmiri charkha allows longer threads of Pashmina wool with fine hair-like size, unlike machines, and adds to the softness and warmth of the product.

- Over the period of time, women working in this sector has reduced due to poor wages, old techniques of weaving and the emergence of machines

- As per few estimates, women’s participation in shawl weaving has come down significantly from o1 lakh to just around 10,000 in the Kashmir Valley.

- This has impacted the processes involved in hand-made shawls such as sorting, dusting, de-hairing, combing, spinning and finishing, all which were dominated by the female labour force.

- The CFE is likely to create employment and improve the economic prospects of women weavers, who have for generations sustained the intricate and fancied Kashmiri shawls.

Other initiatives taken toward this:

- The Directorate of Handicrafts and Handloom, Kashmir, has declared a Minimum Support Price (MSP) for geographical indication (GI)-certified hand-made Pashmina shawls.

- The minimum wage for a spinner has been fixed at ?1.25 now.

- The government is planning to announce the Minimum Support Price of ?12,000 for GI-certified plain Pashmina hand-spun and hand-woven shawls, to ensure that those who employ old techniques and processes are “incentivised and promoted”.

- The fixing of wages for the first time will help in reviving hand-spinning and hand-weaving.

About Pashmina:

- Pashmina denotes to a fine variant of spun cashmere, the animal-hair fibre forming the downy undercoat of the Changthangi goat.

- A traditional producer of pashmina wool in the Ladakh region of the Himalayas are a people known as the

- These are a nomadic people and inhabit the Changthang plateau of Tibet

- The main centre of pashmina fabric production is in the old district of the city of Srinagar.

- The approximate time put into producing a single traditional pashmina stole (70x200cm) is 180 hours.

- BH Series Registration

#GS2 #Government policies and interventions #Good Governance #GS3 #Infrastructure – Roads

Context: Union Ministry of Road Transport and Highways has notified Bharat “BH” series of registration to free vehicle owners from the complications of relocating a vehicle.

Existing system of relocating a vehicles

- Under Section 47 of the Motor Vehicles Act, 1988, a person is permitted to keep the vehicle for -1 year in any state outside the registered state.

- Person has to get a No Objection Certificate (NOC) from the “parent state”.

- The parent state’s NOC is a must for assignment of a new registration in another state.

- The vehicle must be re-registered in the state where it is relocated by paying road tax to the new state.

- Person can apply for refund of the road tax in the parent state on a pro rata basis.

- This charge is collected for 15 years(registered life of the vehicle) upfront by the parent state and it has to refund the remaining road tax.

About the new BH series:

- It is a new system of registration of vehicles intended at reducing the red-tape and other complications.

- The union government amended Rule 47 of the Central Motor Vehicle Rules, 1989, to mandate that vehicles bearing the BH registration mark will not require to be re-registered in a new state once it relocates.

- It will be completely online and will come into force from September 15 this year.

Who can avail this?

- Anyone who is a government/PSU employee, state or Centre.

- In private sector, an employee of a company that has offices in at least four states/UTs is eligible on voluntary basis.

- The registration number will be randomly generated by computer.

System of tax payment under BH Series:

- Vehicles registering under the BH system will be imposed road tax for 02 years and in multiple of 02 thereafter, instead of the person paying for the whole amount of 15 years’ worth of road tax up front.

- This frees the person from the hassle of refund and other red tapes.

- After the completion of 14th year, the tax shall be levied annually which shall be half of the amount which was charged earlier

Road tax

- Road tax will be charged at 8% if the cost of the vehicle is below Rs 10 lakh

- It is 10% for those costing between Rs 10-20 lakh.

- And for vehicles costing more than Rs 20 lakh, the tax is 12 per cent

- Diesel vehicles will be charged 2% extra.

- Electric vehicles shall be charged 2 per cent less tax.

How does a BH number look like?

- A typical BH number may look like “21 BH XXXX AA”.

- YY– Year of First Registration

- BH– Code for Bharat Series

- ####– 0000 to 9999 (Random Number)

- XX – Alphabets (AA to ZZ)

Expected Benefits of BH Series?

- Registration under BH series will enable free movement of the vehicles across borders of any states in India.

- This will ease the ownership transfer of used vehicles.

- This Cuts the tax burden of vehicle and registration relocation.

- Online system promotes ease of governance and transparency.

- Less tax on electric vehicles gives boost to India’s effort towards Electric mobility and decarbonisation of transportation.

Daily Current Affairs 01st September – 2021

Our Courses

Watch Our Videos on Youtube