Topics

- India Joins OECD/G20 Inclusive Framework Tax Deal

- Output Pact by OPEC +

- Solicitor General of India

- A farmer-friendly solution to cut cattle methane emissions

- Sir Chettur Sankaran Nair

- Discrete auroras on Mars

- India Joins OECD/G20 Inclusive Framework Tax Deal

#GS2 #International Treaties #International Organisations

Context: India joins OECD/G20 Inclusive Framework tax deal.

Highlights:

- Recently, Majority of the members OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting, including India adopted a high-level statement containing an outline of a consensus solution to address the tax challenges arising from the digitalisation of the economy.

- The signatories of the plan amounted to 130 countries and jurisdictions, representing more than 90% of global GDP.

- The new framework seeks to address the tax challenges arising from the digitalisation of economies.

- It also seeks to address concerns over cross-border profit shifting and bring in subject-to-tax rule to stop treaty shopping.

- Treaty shopping is an attempt by a person to indirectly access the benefits of a tax treaty between two countries without being a resident of any of those.

Two Pillar Plan:

Pillar One:

- It will ensure a fairer distribution of profits and taxing rights among countries with respect to the largest MNEs, including digital companies.

- It would re-allocate some taxing rights over MNEs from their home countries to the markets where they have business activities and earn profits, regardless of whether firms have a physical presence there.

- According to OECD, more than USD 100 billion of profit are expected to be reallocated to market jurisdictions each year.

Pillar Two:

- It is about minimum tax and subject-to-tax rules (All sources of income liable to tax without taking account of tax allowances).

- It seeks to put a minimum standard tax rate among countries through a global minimum corporate tax rate, currently proposed at 15%.

- This is expected to generate an additional USD 150 billion in tax revenues.

Expected Outcome:

- If implemented, countries such as the Netherlands and Luxembourg that offer lower tax rates, and so-called tax havens such as Bahamas or British Virgin Islands, could lose their sheen.

- It will make sure that large multinational companies pay their share of tax everywhere.

- The two-pillar package is expected to provide much-needed support to governments needing to raise necessary revenues to repair their budgets and their balance sheets while investing in essential public services, infrastructure and the measures necessary to help optimise the strength and the quality of the post-Covid recovery.

India’s Stand:

- India will have to roll back the equalisation levy that it imposes on companies such as Google, Amazon and Facebook when the global tax regime is implemented.

What is Equalisation levy?

- In 2016, India imposed an equalisation levy of 6% on online advertisement services provided by non-residents. This was applicable to Google and other foreign online advertising service providers.

- The government expanded its scope from April 1, 2020, by imposing a 2% equalisation levy on digital transactions by foreign entities operating in India or having access to the local market.

- India favours a wider application of the law to ensure that the country won’t collect less under the proposed framework than it gets through the equalisation levy.

- India is in favour of a consensus solution which is simple to implement and simple to comply with.

- The solution should result in allocation of meaningful and sustainable revenue to market jurisdictions, particularly for developing and emerging economies.

- The Two Pillar Plan justifies India’s stand for a greater share of profits for the markets and consideration of demand side factors in profit allocation.

What is BEPS?

- Base Erosion and Profit Shifting (BEPS) is a tax avoidance strategy used by multinational companies by exploiting gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations.

- In order to combat this, many countries entered into agreements to share tax information with each other to enhance transparency and make such profit shifting that much harder.

- Here, profits are shifted from jurisdictions that have high taxes (such as the United States and many Western European countries) to jurisdictions that have low (or no) taxes (so-called tax havens).

- The BEPS Action Plan adopted by the OECD and G20 countries in 2013 recognised that the way forward to mitigate risk from base erosion and profit shifting was to enhance transparency.

- BEPS practices cost countries USD 100-240 billion in lost revenue annually.

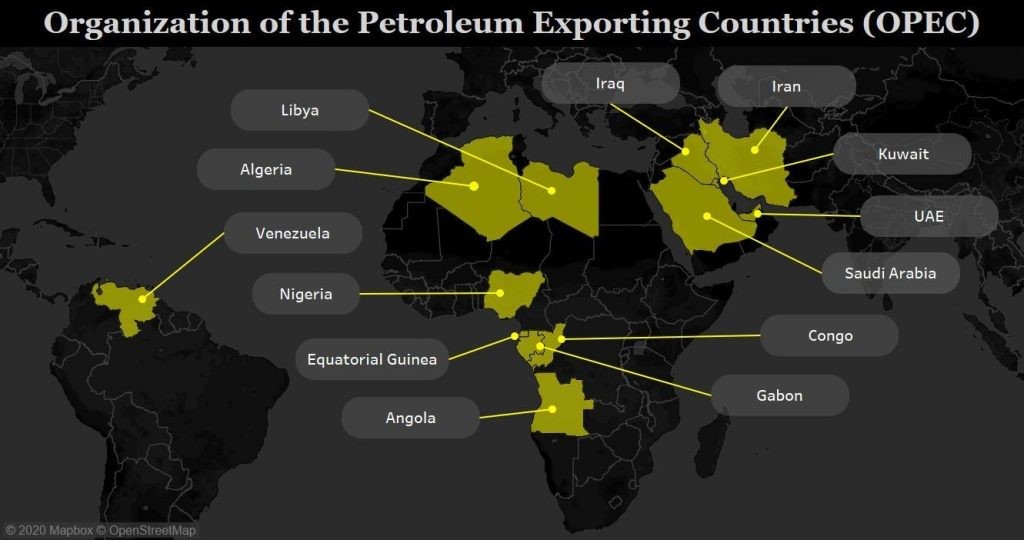

- Output Pact by OPEC +

#GS2 #International Organizations #Growth and Development

Context: Recently, the United Arab Emirates (UAE) pushed back against a plan by the Organization of the Petroleum Exporting Countries (OPEC) oil cartel and allied producing countries to extend the global pact to cut oil production beyond April 2022.

The Output Pact & Fluctuating Oil Price:

- The OPEC+ group of countries had, in April 2020, entered into a two-year agreement (Output Pact), which entailed steep cuts in crude production to deal with a sharp fall in the price of oil as a result of the Covid-19 pandemic.

- The price of Brent crude hit an 18-year low of under 20$ per barrel in April 2020 as economic activity around the world crashed as countries dealt with the pandemic.

- The initial production cut by OPEC+ was about 10 million barrels per day or about 22 per cent of the reference production of OPEC+ nations.

- In November 2020, the prices started rising and in July 2021, they were USD 76.5 per barrel (from 40$ in October 2020) especially due to the steady rollout of vaccination programmes around the world.

- OPEC+, however, maintained lower levels of production despite crude oil prices reaching pre-Covid levels, with Saudi Arabia, notably, announcing a further cut in production of 1 million barrels per day for the February-to-April period, which helped boost rising prices even further.

- The OPEC+ group ran into sharp criticism from developing economies, including India, for deliberately maintaining low supply levels to raise prices.

- In April, OPEC+ agreed to gradually increase crude production, including a phased end to Saudi Arabia’s 1 million barrel per day cut in production by July.

UAE’s Objection: What is the Issue?

- UAE agreed that there was a need to increase crude oil production from August 2021, but did not agree to a condition by the OPEC Joint Ministerial Monitoring Committee (JMMC) that the two-year production agreement be extended by six months.

- The UAE’s key objection to the existing agreement is the reference output used to calculate the total production apportioned to each oil-exporting country.

- The UAE noted that the baseline production level reference used in the current agreement was not reflective of the UAE’s production capacity and, therefore, led to the UAE being apportioned a lower share of total production of crude oil.

- It also said that baseline reference production levels were unfair and that it would be open to extending the agreement if baseline production levels were reviewed to be fair to all parties.

How will this impact India?

- India is the world’s third-biggest oil importer. India imports about 84% of its oil and relies on West Asian supplies to meet over three-fifths of its demand.

- As one of the largest crude-consuming countries, It is concerned that such actions by producing countries have the potential to undermine consumption-led recovery and more so hurt consumers, especially in our price-sensitive market. India believes that the high price of crude oil is slowing down the economic recovery of developing economies post the pandemic.

- If the UAE and other OPEC+ nations do not reach an agreement to increase production in August, expected relief in the form of lower crude oil prices could be delayed.

- India is currently facing record-high prices of petrol and diesel, with pump prices of the former exceeding Rs 100 per litre in 13 states and Union Territories.

- High crude prices have led to Indian oil marketing companies hiking the price of petrol by about 19.3% and that of diesel by about 21% since the beginning of 2021.

- The high prices might also increase the Current Account Deficit and put inflationary pressure on the Indian economy.

Organization of the Petroleum Exporting Countries:

- It is a permanent, intergovernmental organization, created at the Baghdad Conference in 1960, by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela.

- Headquarters is located at Vienna, Austria.

- OPEC’s main objectives are:

- Unification and coordination of petroleum policies among Member Countries, in order to achieve just and stable prices for petroleum producers

- Ensuring of an efficient, economic and regular supply of petroleum to consuming nations and an adequate return of investment

- OPEC membership is open to any country that is a substantial exporter of oil and which shares the ideals of the organization.

- Today OPEC is a cartel that includes 14 nations, predominantly from the middle east whose sole responsibility is to control prices and moderate supply.

Organization of the Petroleum Exporting Countries Plus

- The non-OPEC countries which export crude oil along with the 14 OPECs are termed as OPEC plus countries.

- OPEC plus countries include Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

- Saudi and Russia, both have been at the heart of a three-year alliance of oil producers known as OPEC Plus — which now includes 11 OPEC members and 10 non-OPEC nations — that aims to shore up oil prices with production cuts.

3.Solicitor General of India:

#GS2 #Statutory, Various quasi-judicial bodies

Context: A delegation of Trinamool Congress (TMC) MPs recently met President Ram Nath Kovind and sought the removal of Tushar Mehta as the Solicitor General of India, on the grounds of “criminal misconduct” and “gross impropriety” following his meeting with BJP MLA Suvendu Adhikari.

What’s the ongoing issue?

- The Solicitor General of India is the second highest law officer of the country and advises Government of India and its various organs and in crucial legal matters such as Narada and Sarada cases.

- Suvendu Adhikari is an accused in the 2016 Narada tapes case.

- Experts says, such a meeting between an accused in grave offences, with the learned Solicitor General who is advising such investigation agencies (CBI) and representing the CBI in the Supreme Court and the Calcutta High Court in the agency’s probe against senior TMC leaders in the matter is in direct conflict of interest with the statutory duties of learned Solicitor General of India and raises extremely serious doubts of impropriety.

- Also, Such meetings make a mockery of the criminal justice system and would only serve to destroy the common man’s faith in the judiciary.

The office of Solicitor General:

- The Solicitor General of India is subordinate to the Attorney General for India.

- They are the second law officer of the country, assists the Attorney General, and is assisted by Additional Solicitors General for India.

- He also advises the government in legal matters.

- Solicitor general is appointed for period of three years by Appointment Committee of Cabinet chaired by Prime Minister.

- However, unlike the post of Attorney General for India, which is a Constitutional post under Article 76 of the Constitution of India, the posts of the Solicitor General and the Additional Solicitors General are merely statutory.

Duties of Solicitor General are laid out in Law Officers (Conditions of Service) Rules, 1987:

- To give advice to the Government of India upon such legal matters, and to perform such other duties of a legal character, as may from time to time, be referred or assigned to him by the Government of India.

- To appear, whenever required, in the Supreme Court or in any High Court on behalf of the Government of India in cases (including suits, writ petitions, appeal and other proceedings) in which the Government of India is concerned as a party or is otherwise interested;

- To represent the Government of India in any reference made by the President to the Supreme Court under Article 143 of the Constitution; and

- To discharge such other functions as are conferred on a Law Officer by or under the Constitution or any other Law for the time being in force.

As law officers represent the Government of India, there are certain restrictions which are put on their private practice. A law officer is not allowed to:

- Hold briefs in any court for any party except the Government of India or the government of a State.

- Advice any party against the Government of India or a Public Sector Undertaking, or in cases in which he is likely to be called upon to advise, or appear for, the Government of India or a Public Sector Undertaking;

- Defend an accused person in a criminal prosecution, without the permission of the Government of India; or

- Accept appointment to any office in any company or corporation without the permission of the Government of India;

- Advise any Ministry or Department of Government of India or any statutory organisation.

- A farmer-friendly solution to cut cattle methane emissions:

#GS3 #Environmental Degradation #Agriculture resources #Air Pollution

Context: Indian Council of Agricultural Research (ICAR) has developed an anti-Methanogenic feed supplement ‘Harit Dhara’ (HD).

Methane Emissions from Cattle:

- The 2019 Livestock Census showed India’s cattle population at 193.46 million, along with 109.85 million buffaloes, 148.88 million goats and 74.26 million sheep.

- Belching cattle, buffaloes, sheep and goats in India emit an estimated 9.25 million tonnes (mt) to 14.2 mt of methane annually, out of a global total of 90 mt-plus from livestock.

- Methane’s global warming potential – 25 times of carbon dioxide (CO2) over 100 years, makes it a more potent greenhouse gas, which is a cause of concern.

- Being largely fed on agricultural residues – wheat/paddy straw and maize, sorghum or bajra stover – ruminants in India tend to produce 50-100% higher methane than their industrialised country counterparts that are given more easily fermentable/digestible concentrates, silages and green fodder.

Methane Production in Cattle:

- Rumen, the first of the four stomachs where they eat plant material, cellulose, fibre, starch and sugars. These get fermented or broken down by microorganisms prior to further digestion and nutrient absorption.

- Carbohydrate fermentation leads to production of CO2 and hydrogen.

- These are used as substrate by archaea (microbes) in the rumen with structure similar to bacteria, to produce methane, which the animals then expel through burping.

About Harit Dhara:

- Harit Dhara’ when given to bovines and sheep, it not only cuts down their methane emissions by 17-20%, but also results in higher milk production and body weight gain.

- “An average lactating cow or buffalo in India emits around 200 litres of methane per day, while it is 85-95 litres for young growing heifers and 20-25 litres for adult sheep. Feeding Harit Dhara can reduce these by a fifth.

- It is a win-win for both the environment and livestock farmers.

Benefits:

- HD decreases the population of protozoa microbes in the rumen, responsible for hydrogen production and making it available to the archaea (structure similar to bacteria) for reduction of CO2 to methane.

- It has been made from tannin-rich plant-based sources. Tropical plants containing tannins, bitter and astringent chemical compounds, are known to suppress or remove protozoa from the rumen.

- Fermentation after using HD will help produce more propionic acid, which provides more energy for lactose (milk sugar) production and body weight gain.

- The biological energy loss from methane emission can be rechannelled and utilised by the animal for milk production and growth.

- Feeding 500 g Harit Dhara to lactating cattle and buffaloes would increase milk output by 300-400 ml/animal/day.

- The additional weight gain will, likewise, be 20-25 g/day from 150 g for growing bovines and about 7 g/day from 50 g for adult sheep.

- At Rs 30/litre milk price, the benefit-cost ratio for the dairy farmer works out to 3:1.

Government Initiatives related to Livestock:

- Animal Husbandry Infrastructure Development Fund (AHIDF) set up to support private investment in Dairy Processing, value addition and cattle feed infrastructure.

- Rashtriya Gokul Mission which is aimed at developing and conserving indigenous breeds of bovine population.

- National Livestock Mission to ensure quantitative and qualitative improvement in livestock production systems and capacity building of all stakeholders.

- National Programme for Bovine Breeding: This programme is being implemented for enhancing productivity of the milch animals through extension of Artificial Insemination (AI) coverage.

- This is done through establishment of Multi-Purpose AI Technicians in Rural India (MAITRIs); strengthening of existing AI centres; monitoring of AI etc

- National Animal Disease Control Programme.

- National Artificial Insemination Programme.

- Sir Chettur Sankaran Nair

#GS1 #Indian Freedom Movement #Personalities

Context: Filmmaker Karan Johar recently announced his decision to produce the biopic of Sir Chettur Sankaran Nair based on the book, ‘The case that shook the empire’ written by Raghu Palat and Pushpa Palat in 2019.

About Mr. Nair:

- Born in the year 1857 in Mankara village of Malabar’s Palakkad district.

- An acclaimed lawyer and judge in the Madras High Court and one of the early builders of the Indian National Congress who had also served as its president in 1897.

- Known for being a passionate advocate for social reforms and a firm believer in the self-determination of India.

- In 1897, he became the youngest president of the INC in the history of the party till then, and the only Malayali to hold the post ever.

- In 1902, Lord Curzon appointed him a member of the Raleigh University Commission.

- In 1904, he was appointed as Companion of the Indian Empire by the King-Emperor.

- He was appointed as a permanent judge in the Madras High Court in 1908.

- Sankaran Nair was knighted in 1912.

- In 1915 he joined the Viceroy’s Council as member for education.

- He also served as chairman of the All-India Committee, which in 1928–29 rather ineffectually met with the Simon Commission concerning Indian constitutional problems.

- He founded and edited the Madras Review and the Madras Law Journal.

Role in Freedom Movement:

- As a fervent freedom fighter, he firmly believed in India’s right for self-government.

- His criticisms in 1908, against biasness of English Jury while discussed Montagu- Chelmsford reforms infuriated the Anglo-Indian community who petitioned the Viceroy and the Secretary of State for India objecting to his appointment as high court judge the first time.

- In 1919, he played an important role in the expansion of provisions in the Montagu-Chelmsford reforms which introduced a system of dyarchy in the provinces and increased participation of Indians in the administration.

- He resigned from the Viceroy’s council in 1919 in protest against the protracted use of martial law to quell unrest in the Punjab.

- His resignation shook the British government. In the immediate aftermath, press censorship in Punjab was lifted and martial law terminated.

- Further, a committee was set up under Lord William Hunter to examine the disturbances in Punjab.

- In his book ‘Gandhi and Anarchy’, which was published in 1922, Nair spelt out his critique of Gandhi’s methods, especially those of non-violence, civil disobedience and non-cooperation.

- He believed that any of these movements was destined to lead to riots and bloodshed.

- In the same book, he also accused Lieutenant-Governor of Punjab Michael O’Dwyer for his coercive methods that led to the death of hundreds of innocent men and women at Jallianwala Bagh.

- Thereafter, O’Dwyer sued Nair for defamation in England, with the expectation that an English court would side with him. As was well known, a large section of the English people did strongly believe that General Dyer’s act at Jallianwala was justified and was in fact responsible for saving Britain’s empire in India.

- Nair had lost the case and was held guilty for defaming O’Dwyer. He had to pay £500 and expense of the trial to the plaintiff.

- Though Nair lost the case, the trial had a resounding impact on the British Empire in India.

- At a time when the nationalist movement was gaining momentum, Indians saw in the judgement a clear bias of the British government and an effort to shield those who committed atrocities against their own people.

- The verdict was momentous in that it strengthened the determination of the nationalists to fight for self-government.

Social Reforms:

- As a Madras High Court judge, his best-known judgments clearly indicate his commitment to social reforms.

- In Budasna v Fatima (1914), he passed a radical judgement when he ruled that those who converted to Hinduism cannot be treated as outcastes.

- In a few other cases, he upheld inter-caste and inter-religious marriages.

- Discrete auroras on Mars

#GS1 #Important Geophysical Phenomena #Space Technology

Context: Recently, the UAE’s Hope spacecraft has captured images of glowing atmospheric lights in the Mars night sky, known as discrete auroras.

- The Hope Probe, the Arab world’s first mission to Mars, took off from Earth in July 2020, and has been orbiting the Red Planet (Mars) since February 2021. It is expected to create the first complete portrait of the planet’s atmosphere.

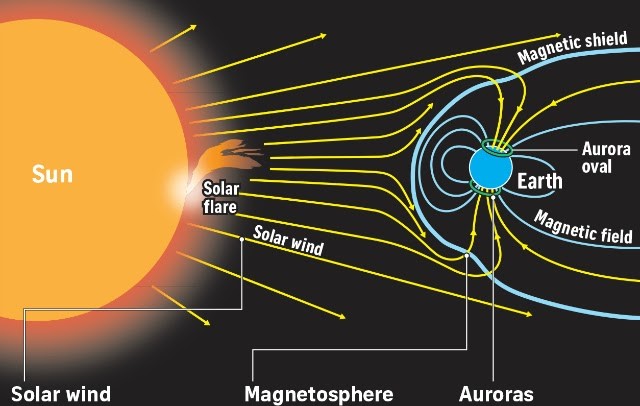

Auroras:

- An Aurora is a display of light in the sky predominantly seen in the high latitude regions (Arctic and Antarctic). It is also known as a Polar light.

- They commonly occur at high northern and southern latitudes, less frequent at mid-latitudes, and seldom seen near the equator.

- While usually a milky greenish color, auroras can also show red, blue, violet, pink, and white. These colors appear in a variety of continuously changing shapes.

- Auroras are not just something that happens on Earth. If a planet has an atmosphere and magnetic field, they probably have auroras.

What causes an aurora on Earth?

- Auroras are caused when charged particles ejected from the Sun’s surface — called the solar wind — enter the Earth’s atmosphere.

- The typical aurora is caused by collisions between charged particles from space with the oxygen and nitrogen in Earth’s upper atmosphere.

- These particles are harmful, and our planet is protected by the geomagnetic field, which preserves life by shielding us from the solar wind.

- However, at the north and south poles, some of these solar wind particles are able to continuously stream down, and interact with different gases in the atmosphere to cause a display of light in the night sky.

- This display, known as an aurora, is seen from the Earth’s high latitude regions (called the auroral oval), and is active all year round.

How are Martian auroras different?

- Unlike auroras on Earth, which are seen only near the north and south poles, discrete auroras on Mars are seen all around the planet at night time.

- Unlike Earth, which has a strong magnetic field, the Martian magnetic field has largely died out. This is because the molten iron at the interior of the planet– which produces magnetism– has cooled.

- However, the Martian crust, which hardened billions of years ago when the magnetic field still existed, retains some magnetism.

- So, in contrast with Earth, which acts like one single bar magnet, magnetism on Mars is unevenly distributed, with fields strewn across the planet and differing in direction and strength.

- These disjointed fields channel the solar wind to different parts of the Martian atmosphere, creating “discrete” auroras over the entire surface of the planet as charged particles interact with atoms and molecules in the sky– as they do on Earth.

Aurora borealis and australis:

- In the northern part of our globe, the polar lights are called aurora borealis or Northern Lights and are seen from the US (Alaska), Canada, Iceland, Greenland, Norway, Sweden and Finland.

- In the south, they are called aurora australis or southern lights, and are visible from high latitudes in Antarctica, Chile, Argentina, New Zealand and Australia.

Significance of the findings:

- Studying Martian auroras is important for scientists, for it can offer clues as to why the Red Planet lost its magnetic field and thick atmosphere– among the essential requirements for sustaining life.

- With the information gathered during the UAE’s Mars mission, scientists will have a better understanding of the climate dynamics of different layers of Mars’ atmosphere.

What is a Magnetosphere?

- It is that area of space, around a planet, that is controlled by the planet’s magnetic field.

- The shape of the Earth’s magnetosphere is the direct result of being blasted by solar wind. The solar wind compresses its sunward side to a distance of only 6 to 10 times the radius of the Earth.

- A supersonic shock wave is created sunward of Earth called the Bow Shock.

- Most of the solar wind particles are heated and slowed at the bow shock and detour around the Earth in the Magneto sheath.

- The solar wind drags out the night-side magnetosphere to possibly 1000 times Earth’s radius; its exact length is not known.

- This extension of the magnetosphere is known as the Magnetotail. The outer boundary of Earth’s confined geomagnetic field is called the Magnetopause.

- The Earth’s magnetosphere is a highly dynamic structure that responds dramatically to solar variations.