Daily Current Affairs 15th September -2021

Topics

- Parliamentary Standing Committee on Commerce

- T+1 Settlement System

- Revised guidelines for trade credit insurance

- Task Force on Coal-Based Hydrogen Production

- Battle of Saragarhi

1) Parliamentary Standing Committee on Commerce

#GS3 #Effects of Liberalization on the Economy #Investment models #Free Trade Agreements #GS2 #Government Policies & Interventions for Development

Context: Parliamentary panel on commerce recently submitted its report in Rajya Sabha expressing concerns over exports and made few recommendations.

Key concerns raised by panel on Commerce:

- On Exports:

- India’s exports contracted from 2019-20, registering a negative growth rate of (-)15.73% in 2020.

- Domestic exporters are at a disadvantage in the USA and European markets while competing with other exporting countries due to absence of Free Trade Agreements with USA and European Union countries.

- Freight Rates:

- Ministry of Railways is unable to provide competitive freight rate for movement of export consignment.

- The share of rail freight compared to road freight is only 35% whereas the trend is reversed in developed countries.

- Panel expressed concerns on the exorbitant rates charged by the intermediary, i.e., the shipping lines on movement of empty containers from port to Inland Container Depots (ICDs).

- This adversely affects the competitiveness of India’s exports in global markets.

Key recommendations:

- Panel recommended government to step up its effort in export promotion,expand its export baskets and penetrate new export markets to recover from its current slump and increase its share in globalexports.

- To provide affordable credit to the export sector, the panel has recommended extension of interest subsidy scheme for at least 05 years or till the time our interest rates are at par with rates of the competing countries.

- It has advised to promote EOUs (export-oriented units) and provide necessary support/incentives, including tax incentives, to enable the sustained increase of exports from these units.

- Panel recommended Union Government to iron out issues regarding exports and sign Free trade agreements With European Union and United States.

- Panel has suggested that the commerceministry should engage with its finance ministry for additional allocation under the recently ntified tax rebate scheme for exporters ‘RoDTEP’ as the budget allocation of Rs 12,500 crore for the programme would be inadequate to meet its objectives.

- Last month, the government announced rates of tax refundsunder the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme for 8,555 products, such as marine goods, yarn, dairy items.

- The Committee also recommends the Ministry of Railways to undertake a detailed study on the reason for the low share of rail and take a concerted effort to increase the share of rail in freight traffic, the report said.

- Panel suggested a distance-based concession in the rail freight to the exporters located away from the sea port to ensure that they are able to deliver their export at a competitive rate.

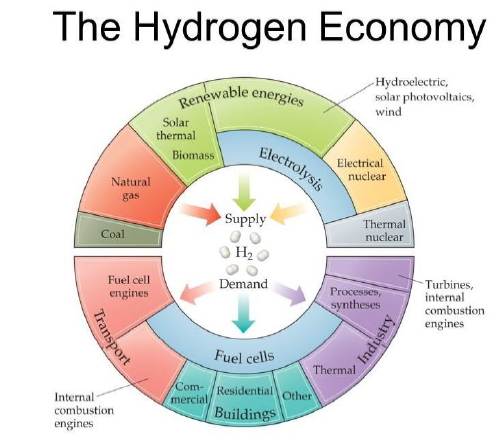

India and Free Trade Agreements:

- A Free Trade Agreement is an arrangement between two or more countries or trading blocs that primarily agree to reduce or eliminate customs tariff and non-tariff barriers on substantial trade between them.

- FTAs, normally cover trade in goods (such as agricultural or industrial products) or trade in services (such as banking, construction, trading etc.).

- FTAs can also cover other areas such as intellectual property rights (IPRs), investment, government procurement and competition policy etc.

- The first Region Trade Agreement of which India became a member was the Bangkok Agreement in 1975.

- In 2005, this reincarnated as Asia Pacific Trade Agreement (APTA).

- India’s first bilateral FTA with Sri Lanka (ISFTA) came into effect in March 2000.

- After India opted out of the Regional Comprehensive Economic Partnership (RCEP) in November 2019, FTAs went into cold storage for India.

- But in May 2021 came the announcement that India-EU talks, which had stalled in 2013, would be resumed.

- This was followed by the news that FTAs with other countries like the UAE, Australia and Britain, too, are in various stages of discussion.

- Recently, the new US administration has indicated that it is no longer interested in securing a bilateral Free Trade Agreement (FTA) with India

- The US is India’s largest trading partner, and one with whom it has a significant trade surplus.

Issues in India’s Foreign Trade Policy:

- Poor Manufacturing Contribution:In the recent years, manufacturing sector holds a share of 14% in India’s GDP.

- For advanced and developed nations like Germany, the US, South Korea and Japan, the comparable figures are 19%, 11%, 25% and 21%, respectively.

- Absence of Ease of Trading:Inadequate information on FTAs, complicated principles of origin criteria, low margins of preference, higher compliance costs and regulatory deferrals prevented exporters from using preferential routes.

- Less competitive in the global market: India’s exporters face several domestic issues such as higher logistics costs, supply-side constraints, thereby making them less competitive in the global market.

- Protectionism: The Aatmanirbhar Bharat campaign has exacerbated the view that India is increasingly becoming a protectionist closed market economy.

- Non-Tariff Barriers: Indian exporters still face an assortment of non-tariff barriers such as import controls, import permits, sanitary and phytosanitary measures, product standards and technical barriers in partner nations.

Way Forward:

Having walked out of RCEP, India needs to demonstrate to its potential FTA partners, including the EU and the UK, that it is a viable alternative to China in a post-Covid world.

- The share of manufacturing in theGDP needs to rise through efficient implementation of schemes such as the Make in India initiative.

- India’s trade policy framework must be supported by economic reforms that result in an open, competitive, and technologically innovative Indian economy.

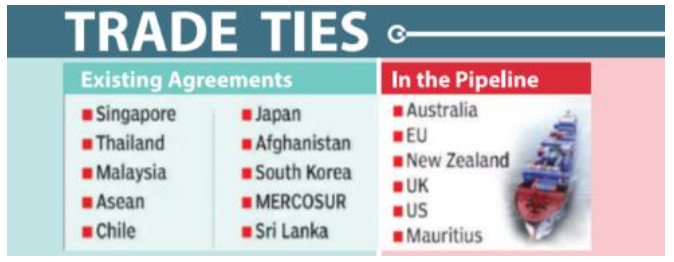

2) T+1 Settlement System

#GS3 #Mobilisation of Resources #Capital Market #Private Investment #Gs2 #Statutory Bodies

Context: Recently,Securities and Exchange Board of India (SEBI) allowed stock exchanges to start the T+1 settlement system as an option in place of T+2 for completion of share transactions.

Key Details:

- If the stock exchange opts for the T+1 settlement cycle for a scrip, the stock exchange will have to mandatorily continue with it for a minimum six months.

- A scripisa provisional certificate of money subscribed to a bank or company, entitling the holder to a formal certificate and dividends.

- Thereafter, if it intends to switch back to T+2, it will do so by giving 01 month’s advance notice to the market. Any subsequent switch (from T+1 to T+2 or vice versa) will be subject to a minimum period.

- A stock exchange may choose to offer the T+1 settlement cycle on any of the scrips, after giving at least one month’s advance notice to all stakeholders, including the public at large.

Why T+1 Settlement instead of T+2?

- The change to a shorter cycle is likely to benefit retail investors, who will get quicker access to cash and securities after trades are executed.

- It will also reduce the risks associated with fluctuations of stocks during the settlement cycle.

- T+1 also reduces the number of outstanding unsettled trades at any instant, and thus decreases the unsettled exposure to Clearing Corporation by 50%.

- The narrower the settlement cycle, the narrower the time window for a counter party insolvency/bankruptcy to impact the settlement of a trade.

- Additionally, the capital blocked in the system to cover the risk of trades will get proportionally reduced with the number of outstanding unsettled trades at any point of time.

- The move to T+1 will not require large operational or technical changes by market participants, nor will it cause fragmentation and risk to the core clearance and settlement ecosystem.

- A shortened settlement cycle will help in reducing systemic risk.

- Systemic risk depends on the number of outstanding trades and concentration of risk at critical institutions such as clearing corporations, and becomes critical when the magnitude of outstanding transactions increases.

Concerns:

- The stockbrokers’ lobby group Association of National Exchanges Members of India (ANMI), has concerns over short window period as it will be too short for securities lending and borrowing to practically work, and there could be spill over.

- At present, the infrastructure available with market infrastructure institutions is not able to efficiently meet timely issuance of pay-in and pay-out and to send files on time.

- Global investors have written to the Union government about operational issues they would face while operating from different geographies – time zones, information flow process, and foreign exchange problems.

- They will also find it difficult to hedge their net India exposure in dollar terms at the end of the day under the T+1 system.

- In 2020, SEBI had deferred the plan to halve the trade settlement cycle to one day (T+1) following opposition from foreign investors.

Working of T+2 Settlement:

- In T+2, if an investor sells shares, the settlement of the trade takes place in two working days (T+2) and the broker who handles the trade will get the money on the third day, but will credit the amount in the investor’s account only by the 04th

- In effect, the investor will get the money only after 03 days.

- In T+1, settlement of the trade takes place in one working day and the investor will get the money on the following day.

- In April 2002, stock exchanges had introduced a T+3 rolling settlement cycle. This was shortened to T+2 from April 1, 2003.

International Practices:

In February 2021, the US Depository Trust & Clearing Corporation (DTCC), released a 02-year industry roadmap for shortening the settlement cycle for US equities to one business day after the trade is executed (T+1).

- As per DTCC studies, immediate advantages of moving to T+1, including cost savings, reduced market risk and lower margin requirements.

- Based on studies by DTCC, early indications suggest market participants favour the move to T+1, especially during times of high volatility and stressed markets.

- DTCC estimates that a move to T+1 could bring a 41 per cent reduction in the volatility component.

Settlement System:

- Trade settlement is the process of transferring securities into the account of a buyer and cash into the seller’s account following a trade of stocks, bonds, futures or other financial assets.

- The date

- an order is filled is the trade date, whereas the security and cash are transferred on the settlement date.

- On the last day of the settlement period, the buyer becomes the holder of record of the security.

3) Revised guidelines for trade credit insurance

#GS3 #Mobilisation of resources #Capital Market

Context: The Insurance Regulatory and Development Authority of India (IRDAI) recently issued revised guidelines for trade credit insurance that will come into effect on 1 November 2021.

IRDAI (Trade Credit Insurance) Guidelines, 2021

- Trade credit insurance protects businesses against the risk of non-payment for goods and services by buyers.

- It usually covers a portfolio of buyers and indemnifies an agreed percentage of an invoice or invoices that remain unpaid as a result of protracted default, insolvency/bankruptcy.

- It contributes to the economic growth of a country by facilitating trade and helps improve economic stability by addressing trade losses because of payment risks.

- These guidelines will apply to all insurers transacting general insurance business, registered under the Insurance Act, 1938.

- However, ECGC Ltd (formerly Export Credit Guarantee Corporation of India Ltd) is exempted from the application of these guidelines.

These guidelines set out the regulatory framework;

(a) to promote sustainable and healthy development of trade credit insurance business.

(b) to facilitate general insurance companies to offer trade credit insurance covers to suppliers as well as licensed banks and other financial institutions to help businesses manage country risk, open up access to new markets and to manage non-payment risk associated with trade financing portfolio.

(c) to enable general insurance companies to offer trade credit insurance with customised covers to improve businesses for the SMEs and MSMEs, considering the evolving insurance risk needs of these sectors.

Coverage:

- The scope of cover under the policy will be the credit risk that has a direct link with an underlying trade transaction, the delivery of goods or services.

- If no such direct link exists, the outstanding amount is not insurable under a trade credit insurance policy.

- The cover may include commercial risks such as insolvency or protracted default of the buyers of good and services.

- The trade credit policy will also cover rejection by the buyer after the delivery, subject to conditions of a policy contract.

- The cover could also include non-receipt of payment because of the collecting bank’s failure.

- This will help suppliers and licensed banks and other financial institutions get insurance protection.

- It can be issued to sellers or suppliers of goods or services, factoring companies as defined in the Factoring Regulation Act, 2011 and banks and financial institutions.

- For banks and financial institutions and factoring companies, it covers the loss on account of non-receipt of payment from a buyer, due to commercial or political risks, against the bills and invoices purchased or discounted.

- Political risk cover is available only in case of buyers outside India andin respect of those countries agreed upon.

- These risks include occurrence of war between the buyer’s country and India and also war, hostilities, civil war, rebellion, revolution, insurrection or other disturbances in the buyer’s country.

- It usually covers a portfolio of buyers and indemnifies an agreed percentage of an invoice or invoices that remain unpaid as a result of protracted default or insolvency.

Significance:

- Corporates will now be able to free up capital and invest in businesses as trade credit insurance policy will enable them to monetize the account receivables.

- This new system comes at a time when a sustained recovery in global trade and demand from key external markets like the US and the European Union in product categories such as textiles and garments have helped boost India’s exports, which recorded the sixth consecutive month of growth in August.

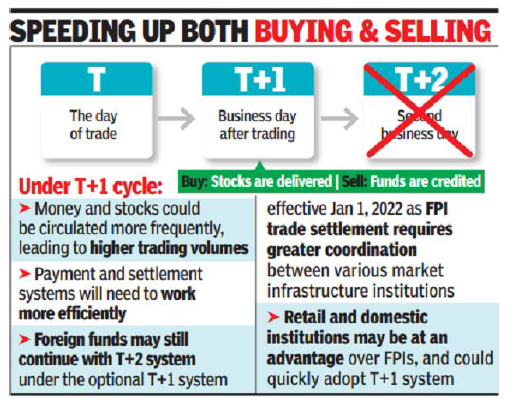

4) Task Force on Coal-Based Hydrogen Production

#GS2 #Government Policies & Interventions for Development #GS3 #Environmental Pollution & Degradation #National Environment Agencies, Legislations and Policies

Context: Recently, Ministry of Coal Constitutes Task Force and Expert Committee to Prepare Road Map for Coal based Hydrogen Production.

- This is aimed at realising Prime Minister Narendra Modi’s agenda of a hydrogen-based economy in a clean manner.

Key Details:

- The task force has been constituted under the chairmanship of Coal Additional Secretary Vinod Kumar Tiwari.

- Its broad terms of reference include monitoring of activities towards achieving coal-based hydrogen production and usage and coordination with Coal Gasification Mission and NITI Aayog.

- The broad terms of reference of the expert committee include identifying experts in India and co-opting as members, desk-based review of progress in hydrogen technology and also reviewing ongoing research projects in hydrogen technology.

Coal-Based Hydrogen Economy: Benefits and Challenges

- Coal is one of the important sources of hydrogen making (Brown Hydrogen).

- However, Coal has not been encouraged in the production because of the fear of carbon emission while extracting hydrogen via coal (from the moisture embedded in coal)

- Almost 100% of Hydrogen produced in India is through Natural Gas.

- Globally, 73 MT Hydrogen is used for refining, ammonia making and other pure use and about 42 MT is used for Methanol, steel making and other mixed uses.

- Cost of Hydrogen produced from coal can be cheaper and less sensitive to imports when compared with hydrogen production through electrolysis and Natural Gas respectively.

- Production of hydrogen from coal will have challenges in terms of high emissions.

- However, when the carbon monoxide and carbon dioxide formed during coal to hydrogen process are trapped and stored in an environmentally sustainable manner (CCS and CCUS), then, Indian coal reserves could become a great source of hydrogen.

Hydrogen fuel Economy:

- In his Independence Day speech, the Prime Minister announced Mission Hydrogen. This mission is targeted towards India becoming a global leader and enabling a substantial domestic hydrogen economy.

- In 1970, the term ‘Hydrogen Economy’ was coined by John Bockris. He mentioned that a hydrogen economy can replace the current hydrocarbon-based economy, leading to a cleaner environment.

- Hydrogen has the promise of transforming India from an energy-deficient to an energy-rich country. It can even make India a net exporter of energy.

National Hydrogen Mission:

- The National Hydrogen Mission and the green hydrogen sector will give India a significant push in meeting its climate targets.

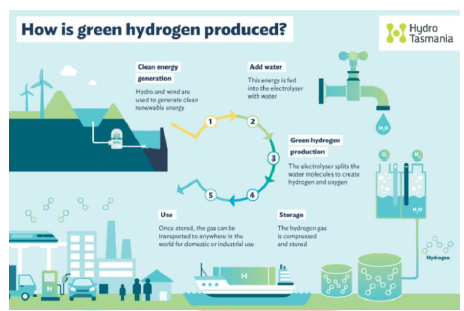

- Green Hydrogen is generation of hydrogen (a universal, light and highly reactive fuel) through a chemical process known as electrolysis.

- This method uses an electrical current to separate the hydrogen from the oxygen in water. If this electricity is obtained from renewable sources we will, therefore, produce energy without emitting carbon dioxide into the atmosphere.

- It will also help India to become energy independent which imports 85% of its oil and 53% of its gas demand.

- Leveraging the India’s large land mass and low solar and wind tariffs to produce low-cost green hydrogen and ammonia for exports, thereby strengthening India’s geopolitical heft.

- The Union government is also planning to implement the Green Hydrogen Consumption Obligation (GHCO) in fertilizer production and petroleum refining, similar to what was done with renewable purchase obligations (RPO).

- RPOs require electricity distribution companies to buy a fixed amount of renewable energy to cut reliance on fossil fuels.

- The present cost of green hydrogen produced by electrolysis is estimated at around ?350 per kg, the idea is to more than halve it to ?160 per kg by 2029-30.

- The government is also working onextending the production-linked incentive (PLI) scheme for manufacturing electrolysers to produce green hydrogen.

Various uses of Hydrogen:

- Hydrogen use today is dominated by industry, namely: oil refining, ammonia production, methanol production and steel production. Virtually all of this hydrogen is supplied using fossil fuels, so there is significant potential for emissions reductions from clean hydrogen.

- In transport, the competitiveness of hydrogen fuel cell cars depends on fuel cell costs and refuelling stations while for trucks the priority is to reduce the delivered price of hydrogen. Shipping and aviation have limited low-carbon fuel options available and represent an opportunity for hydrogen-based fuels.

- In buildings, hydrogen could be blended into existing natural gas networks, with the highest potential in multifamily and commercial buildings, particularly in dense cities while longer-term prospects could include the direct use of hydrogen in hydrogen boilers or fuel cells.

- In power generation, hydrogen is one of the leading options for storing renewable energy, and hydrogen and ammonia can be used in gas turbines to increase power system flexibility. Ammonia could also be used in coal-fired power plants to reduce emissions.

5) Battle of Saragarhi

#GS1 #Modern Indian History- Middle of the Eighteenth Century Until the Present #British Conquest of India #Important personalities

Context:Battle of Saragarhi was recently remembered on its 124th anniversary.

- The Indian Army’s 4th battalion of the Sikh Regiment commemorates the battle every year on the 12th of September, as ‘Saragarhi Day’.

What is the Battle of Saragarhi?

- The Battle of Saragarhi was a last-stand battle fought before the Tirah Campaign between the British Raj and Afghan tribesmenon 12 September 1897.

- 21 soldiers from British Army were pitted against over 8,000 Afridi and Orakzai tribals but they managed to hold the fort for 07 hours.

- Led by Havildar Ishar Singh, the 21 soldiers in the fort—all of whom were Sikhs—refused to surrender and were wiped out in a last stand after killing 200 tribals and injuring 600.

- The post was recaptured two days later by another British Indian contingent.

- The soldiers were not only outnumbered, they also had limited ammunition with around 400 rounds per man.

Significaance of Saragarhi:

- Saragarhi was the communication tower between Fort Lockhart and Fort Gulistan.

- The two forts in the rugged North West Frontier Province (NWFP), now in Pakistan, were built by Maharaja Ranjit Singh but renamed by the British.

- Saragarhi helped to link up the two important forts which housed a large number of British troops in the rugged terrain of NWFP.

- Fort Lockhart was also home to families of British officers.

How are they remembered?

- Making a departure from the tradition of not giving gallantry medals posthumously, Queen Victoria awarded the 21 dead soldiers — leaving out the non-combatant — of the 36th Sikh the Indian Order of Merit (comparable with the Victoria Cross) along with two ‘marabas’ (50 acres) and Rs 500 each.

- The British, who regained control over the fort after a few days, used burnt bricks of Saragarhi to build an obelisk for the martyrs.

- They also commissioned gurdwaras at Amritsar and Ferozepur in their honour.

- In 2017, the Punjab government decided to observe Saragarhi Day on September 12 as a holiday.

- Even today the Khyber Scouts regiment of the Pakistani army mounts a guard and salutes the Saragarhi memorial close to Fort Lockhart.

Our Courses

Watch Our Videos on Youtube