CURRENT AFFAIRS 20-11-2021

Topics

- RBI- Working Group (WG) Committee recommendations on Digital Lending

- CEEW-India needs about $10 trillion to meet net zero targets

- Shale Oil and Tight Oil

- ASEAN join the summit:

- Rani Lakshmibai

- RBI- Working Group (WG) Committee recommendations on Digital Lending

#GS3-Mobilization of Resources, Growth& Development

Context

- The Reserve Bank of India (RBI) Working Group (WG) Committee recently issued suggestions on digital lending, including the creation of a separate law to prohibit unlawful digital lending.

- In January 2021, the RBI established a working group on digital lending, which includes lending via online platforms and mobile apps.

- The panel was formed in response to concerns about corporate conduct and client protection that have arisen as a result of the surge in digital lending activity.

In depth information

- According to the RBI, digital lending in comparison to physical lending is still in its infancy among banks (Rs 1.12 lakh crore via digital mode against Rs 53.08 lakh crore through the physical mode).

- Whereas, for Non-Banking Financial Companies (NBFCs), the digital mode accounts for a bigger proportion of lending (Rs 0.23 lakh crore versus Rs 1.93 lakh crore in the physical mode).

- NBFCs have been at the vanguard of partnered digital lending, while banks have been increasingly implementing innovative ways in digital operations.

Key Recommendations:

- Digital lending apps should be subjected to a verification process put up in conjunction with stakeholders by a nodal body.

- To establish a Self-Regulatory Organization (SRO) for the digital lending ecosystem’s members.

- The proposed SRO will establish a code of behaviour for the use of unsolicited commercial communications for digital loans.

- The proposed SRO’s maintenance of a ‘negative list’ of loan service providers.

- Loans should be disbursed straight into borrowers’ bank accounts.

- All information will be stored on servers in India.

- The documentation of algorithmic characteristics employed in digital lending should offer the essential transparency.

Digital Lending

About:

- It entails lending via web platforms or mobile apps, with technology being used for verification and credit evaluation.

- To tap into the digital lending market, banks have developed their own independent digital lending platforms, leveraging existing traditional lending capabilities.

- Significance:

- Financial Inclusion: It aids in addressing India’s massive unmet credit demand, particularly among microenterprises and low-income consumers.

- Reduce Borrowing through informal channels: It aids in the reduction of informal borrowings by simplifying the borrowing procedure.

- It saves time by reducing the amount of time spent in-branch processing loan applications. In addition, digital lending platforms have been reported to reduce overhead costs by 30 to 50 percent.

Challenges:

- An increase in the number of unlicensed digital lending platforms and mobile apps, such as:

- They charge exorbitant interest rates as well as additional hidden fees.

- They use obnoxious and heavy-handed recuperation techniques.

- They take advantage of agreements to gain access to data on borrowers’ mobile phones.

The RBI has taken the following steps:

- Non-banking financial companies (NBFCs) and banks must state the names of the internet platforms with which they collaborate.

- The RBI has also mandated that digital lending platforms utilised on behalf of banks and non-bank financial companies (NBFCs) reveal the identity of the bank or NBFC to borrowers up front.

- Prior to the execution of the loan arrangement, the central bank has also requested lending apps to give a sanction letter to the borrower on the letterhead of the bank/NBFC concerned.

- Banks, NBFCs registered with the RBI, and other businesses authorised by state governments under statutory rules can engage in legitimate public lending activities.

Reforms that are simple to implement.

- India’s Digital Ecosystem: Public Sector Banks (PSBs) conduct about 72 percent of their financial transactions through digital channels, with the number of clients using digital channels more than doubling from 3.4 crore in FY 2019-20 to 7.6 crore in FY 2020-21.

- The percentage of financial transactions conducted through home and mobile channels has risen from 29% in FY 2018-19 to 76% in FY 2020-21.

Next Steps

- India is on the cusp of a digital lending revolution, and ensuring that this financing is done responsibly will ensure that the revolution’s benefits are fulfilled.

- Because numerous stakeholders have access to sensitive customer data, clear guidelines must be established about the types of data that can be stored, the amount of time it can be held, and data use restrictions.

- Digital lenders should create and agree to a code of conduct that emphasises the concepts of integrity, openness, and consumer protection, as well as clear disclosure and grievance redressal criteria.

- It is possible to establish a company that tracks all digital loans as well as consumer and lender credit histories.

- Aside from putting in place technological precautions, it’s also necessary to educate and train customers about digital lending.

2. CEEW-India needs about $10 trillion to meet net zero targets

#GS3- Biodiversity and Environment

Context

- According to an analysis by climate and energy research group CEEW Centre for Energy Finance, India will need close to $10 trillion to achieve its net zero targets, or being able to effectively eradicate carbon dioxide emissions by 2070. (CEEW-CEF).

In depth information

- The Council for Energy, Environment, and Water Research (CEEW) is a think tank based in New Delhi.

- The majority of this money, roughly $8.4 trillion, would be required to greatly increase renewable energy output and bring together the requisite integration, distribution, and transmission infrastructure.

- To accelerate the industrial sector’s decarbonization, another $1.5 trillion would have to be spent in green hydrogen generation capacity.

- Green hydrogen is hydrogen gas that is produced using renewable energy and can be used for a variety of purposes, including heating, battery charging, and automobile fueling.

- According to the report, India would need $3.5 trillion in investment support from developed economies to reach net-zero emissions by 2070, and $1.4 trillion in concessional credit from developed economies would be required to bridge the gap.

- Concessional finance refers to loans with interest rates that are lower than the market rate.

India’s objectives

- Prime Minister Narendra Modi outlined India’s national targets to dramatically increase the amount of renewable energy in installed capacity and achieve net zero by 2070 at the just concluded Glasgow summit in Scotland.

- The best chance for the planet is to reach net zero by 2050, preventing global average temperatures from reaching 1.5 degrees Celsius by the end of the century.

- Climate aims for the short and long term: India announced ambitious short- and long-term climate goals at COP26.

- Other goals: The commitment to 500 GW of renewable energy by 2030, which is more than twice the current installed capacity of coal, could pave the way for a rapid energy sector transition.

Nationally Determined Contribution (NDC) Update:

- According to the new NDC, renewable energy sources will generate 50% of power by 2030, and the objective of 450 GW non-fossil energy capacity has been boosted to 500 GW by 2030.

- India announced for the first time that it will achieve net zero emissions by 2070 and will reduce carbon emissions by one billion tonnes by 2030. These were not included in the 2015 Nationally Determined Contributions.

Future challenges to be confronted

- Injustice against developing countries:

- climate adaptation has received less attention than mitigation, which is an injustice against developing countries.

- Changes in cropping patterns, floods, and the need to make agriculture adaptable to these shocks are all examples of environmental shocks.

- Global carbon budget:

- To limit worldwide average temperature rise from pre-industrial levels to those agreed upon in the Paris Agreement, global cumulative carbon dioxide emissions must be regulated at the global carbon budget.

- Even after accounting for their net zero promises and improved emission reduction plans for 2030, the world’s top three emitters, China, the United States, and the European Union, will emit more than 500 billion tonnes of carbon dioxide before reaching net zero.

- Non-effective:

- Neither the Paris Agreement nor climate science mandate that countries achieve net zero emissions by 2050.

Actions to be made to ensure its successful implementation

- Investment support:

- According to the analysis, achieving net zero emissions will necessitate massive investment from industrialised countries.

- Developed country targets must be increased:

- Over the next few years, developed countries must increase their firm targets for climate funding.

- Domestically, financial regulators such as the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) must provide an enabling ecosystem for financing India’s transition to a green economy.

- Investments in existing and emerging clean technologies:

- Finally, given the magnitude of the investments required, private capital from both domestic and international institutions should account for the majority of the funds, with public funds serving as a catalyst by de-risking existing and emerging clean technology investments.

- Solar power:

- India’s total installed solar power capacity would need to expand to 5,630 GW by 2070 in order to attain net zero by 2070.

- Coal use, particularly for power generation, would have to reach a peak by 2040 and then decline by 99 percent between 2040 and 2060.

- Crude oil consumption:

- Crude oil use in all sectors would have to reach a peak by 2050, then drop by 90% between 2050 and 2070. Green hydrogen may meet 19 percent of the industrial sector’s total energy requirements.

- Change in lifestyles:

- If we can’t change how we live, we won’t be able to change the earth we live on.

- Lessons from India:

- sustainable modes of living practised by certain indigenous communities should be made part of school curricula, and the lessons learned from India’s adaptation efforts in programmes like Jal Jeevan mission, Swachh Bharat mission, and mission ujwala should be widely disseminated.

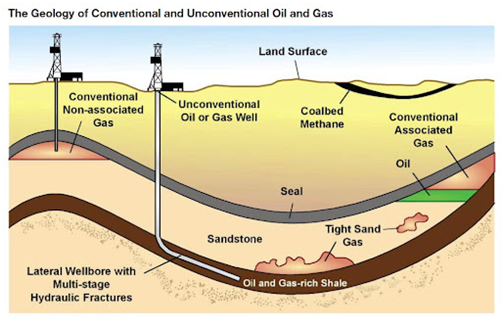

3. Shale Oil and Tight Oil

#GS3- Infrastructure

Context

- Cairn Oil & Gas recently established a partnership with Halliburton, located in the United States, to begin shale exploration in the Lower Barmer Hill deposit in Western Rajasthan.

In depth information

- In collaboration with Halliburton, the corporation hopes to raise the recoverable reserves of its offshore assets by ten times through improved technology.

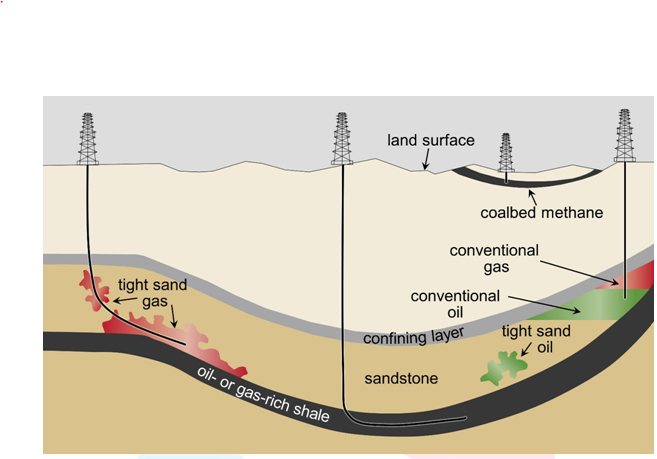

Shale Oil

- Shale gas is a type of natural gas that is one of numerous types of unconventional gas (also known as methane or CH4).

- It is confined within low-permeability shale formations, which are fine-grained sedimentary rock that serves as both a source and a reservoir.

- It’s an unconventional oil made by pyrolysis, hydrogenation, or thermal dissolution from oil shale rock fragments.

- The organic content within the rock is converted into synthetic oil and gas through these methods.

Distinction from crude oil:

- The primary distinction between shale oil and conventional crude is that the former, sometimes known as ‘tight oil,’ is found in smaller quantities and at greater depths than conventional crude deposits.

- Hydraulic fracking is a procedure that involves creating fissures in oil and gas-rich shale in order to liberate hydrocarbons.

- The biggest producers are:

- Russia and the United States are two of the world’s top shale oil producers, with the United States’ boom in shale oil output helping to shift the country from a crude importer to a net exporter in 2019.

- Citizens living in locations next to shale production sites have sued a number of US shale exploration companies, including Halliburton, claiming that hydraulic fracking has contributed to groundwater contamination.

- Methods for extracting shale oil include transporting mined shale oils to processing plants, heating them to 500°F, and extracting oil from the rocks.

- In-situ technique: Oil shale is blown up, releasing Kerogen in the form of crude oil.

Tight Oils

- Tight oil is light crude oil found in low-permeability petroleum-bearing strata, such as shale or tight sandstone.

- Production: The same hydraulic fracturing and horizontal well techniques used in the production of shale gas are often utilised in the production of tight oil deposits.

- It can be found in shale and limestone rock layers that are impermeable. Tight oil, sometimes known as “shale oil,” is processed into gasoline, diesel, and jet fuels in the same way as conventional oil is, but it is obtained using hydraulic fracturing, or “fracking.”

Shale oil exploration prospects in India

- In India, there is currently no large-scale commercial production of shale oil and gas.

- Limited success: State-owned ONGC began exploring in 2013, and by the end of FY21, had assessed shale oil and gas potential in 25 nomination blocks. However, after relatively limited success in shale exploration operations, ONGC has cut investments in recent years.

- While ONGC’s assessment found shale oil prospects in Gujarat’s Cambay basin and Andhra Pradesh’s Krishna Godavari basin, the company concluded that the quantity of oil flow observed in these basins did not indicate “commerciality” and that the general characteristics of Indian shales differ significantly from those of North America.

- Policy Guidelines from the Government of India: ONGC has selected 50 nomination PML (Petroleum Mining Lease) blocks under Phase-I of the policy guidelines announced by the Government of India (GoI) for exploration and exploitation of shale gas and oil in India by National Oil Companies (NOCs).

- So far, exploration operations have resulted in the finding of 65 small-to-medium sized hydrocarbon fields with an initial in-place on-land reserve of 356 million tonnes (oil and oil equivalent gas).

- The present oil and gas production rates are 750-800 tonnes per day for oil and 2.5-3 million cubic metres for gas, respectively.

Challenges

- Fracking necessitates a lot of water.

- Contamination of groundwater is a possibility.

- The recycling and leakage difficulties related with the flowback water, which is frequently methane-contaminated, are another hurdle posed by the fracking process.

- Methane emissions that are too high

- Drill cuttings that haven’t been properly treated

- Techniques for removing waste water aren’t up to par.

- Shale oil often produces more pollution to extract than conventional sources, though the extent depends on whether or not the operators prevent wasteful and needless emissions.

Ahead of Schedule

- Using less oil and switching to greener transportation technology would reduce the need for unconventional energy sources such as tight oil and tar sands.

- More fuel-efficient automobiles and trucks, as well as alternative fuels, can significantly reduce our oil use, with significant benefits for drivers, the economy, and the country.

- Oil corporations should ensure that the oil we do use does not deteriorate as others work toward a greener transportation system.

- Minimizing shale oil emissions would entail minimising wasteful flaring, limiting fugitive emissions, and eliminating the dirtiest sources entirely.

4. ASEAN join the summit:

#GS2-Important International institutions

Context:

- A Chinese diplomat has persuaded Southeast Asian countries to allow Myanmar’s military ruler to attend a regional meeting hosted by China’s President next week, but other leaders have objected.

In depth information

What exactly is the problem?

- Myanmar’s membership in the Association of Southeast Asian Nations (ASEAN) has been brought into the spotlight following a coup on February 1 that deposed Nobel Laureate Aung San Suu Kyi’s elected government, resulting in bloodshed.

- As a result, ASEAN leaders barred Myanmar’s military chief, Senior General Min Aung Hlaing, from attending an ASEAN meeting after he failed to follow through on promises to enable an ASEAN envoy to meet with parliamentarians deposed in the coup.

- Later, ASEAN leaders suggested that a non-political representative from Myanmar be invited. Myanmar was not represented in the end.

What exactly is ASEAN?

- The Association of Southeast Asian Nations (ASEAN) is a regional organisation that was founded to maintain political and social stability among Asia’s post-colonial states amid escalating tensions.

- The motto of ASEAN is “One Vision, One Identity, One Community”.

- The ASEAN Declaration (Bangkok Declaration) was signed by the founding fathers of the organisation in 1967.

- Indonesia, Malaysia, the Philippines, Singapore, and Thailand are the founding fathers of ASEAN.

- Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam are among the ten members.

ASEAN’s Importance for India:

- In the face of China’s aggressive activities, notably the Ladakh standoff, India placed the ASEAN at the heart of its Act East policy, arguing that a coherent and responsive ASEAN is critical for regional security and growth.

- The fulfilment of the SAGAR Vision (Security and Growth for All in the Region) depends on ASEAN.

- The region is important for supply chain diversification and resilience in the post-Covid-19 economic recovery.

- With USD 86.9 billion in commerce, it is India’s fourth largest trading partner.

5. Rani Lakshmibai

#GS1-Personalities

Context

- Recently, the Prime Minister of India has paid tributes to Rani Lakshmibai on her Jayanti.

In depth information

- Rani Lakshmi Bai’s Biography

- Lakshmi Bai was born in Kashi, India, on November 19, 1835.

- Early Years: Raised in the family of Peshwa (ruler) Baji Rao II.

- She grew up in the Peshwa’s court with the boys, learning martial arts and becoming skilled at sword fighting and horseback riding.

- She married Gangadhar Rao, Maharaja of Jhansi, but she was widowed without bearing a surviving successor to the kingdom.

- Just before his death, the Maharaja adopted a boy as his heir.

- According to the Doctrine of Lapse, Lord Dalhousie, the British governor-general of India, refused to acknowledge the adopted successor and conquered Jhansi.

The Doctrine of Lapse

- When Lord Dalhousie was India’s Governor-General from 1848 to 1856, he had a strong annexation agenda.

- Any princely state that was under the direct or indirect control of the East India Company and whose king lacked a valid male successor would be annexed by the company, according to this.

- Satara (1848), Jaitpur and Sambalpur (1849), Baghat (1850), Chota Udaipur (1852), Jhansi (1853), and Nagpur (1853) were among the cities where it was enacted (1854).

- She refused to hand over Jhansi to the British in an uprising against them. Shortly after the start of the mutiny in Meerut in 1857.

- She was named Jhansi’s regent, and she ruled on behalf of the minor heir.

- By January 1858, the East India Company’s forces in Bundelkhand had began their counteroffensive under the command of Gen. Hugh Rose.

- Rose advanced from Mhow, capturing Saugor (now Sagar) in February and turning her attention to Jhansi in March.

- At the Battle of Betwa, she stood firm against the invading armies, and the rescuing army of Tantia Tope, another rebel commander, was destroyed.

- Tantia Tope and Lakshmi Bai then launched a successful attack on Gwalior’s city-fortress.

- The armoury and the treasury were seized, and Nana Sahib, a powerful commander, was named Peshwa (ruler).

- Lakshmi Bai marched east to Morar after capturing Gwalior to face a British onslaught led by Rose.

- On June 17, 1858, in Gwalior, she fought a terrible battle and was killed in combat.