Topics

- Monetary Policy Committee

- Indemnity from liability

- World Environment Day 2021

- Industrial Deep Decarbonisation Initiative (IDDI)

- G7

- SAGE Portal

- Monetary Policy Committee

Context: Reserve Bank of India (RBI) today announced its bi-monthly monetary policy review.

Key Details:

- RBI keeps rates unchanged: RBI to keep policy rates unchanged with the Repo rate at 4% and reverse repo rate at 3.35%.

- This helps in maintaining its accommodative stance in an effort to continue supporting the revival of the Indian economy.

- The Marginal Standing Facility (MSF) rate and bank rate also remained unchanged at 4.25 percent.

- This is the sixth time in a row that the RBI has maintained a status quo on policy rate. The central bank had last revised its policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rate to a historic low.

- GDP forecast trimmed by RBI: The Reserve Bank of India has cut growth projections for the financial year 2021-22 from 10.5% to 9.5%.

- CPI inflation: It is projected at 5.1% in 2021-22

- RBI expects 5.2% inflation in Q1; 5.4 in Q2; 4.7 in Q3; 5.3 in Q4 with risks broadly balanced.

- Forex Exchange Reserves: RBI’s foreign exchange reserve touches $598 billion.

- Special liquidity window: RBI said that it will open a special liquidity window of Rs 15,000 crore till March 30, 2022, with tenors of up to 3 years at the repo rate.

- Under this banks can provide lending support to hotels, restaurants, travel firms, aviation ancillary services and other services that include private bus operators, car repair services, spa, and saloons.

- Another operation under Government Securities Acquisition Program 1.0 (G-SAP 1.0) for Rs 40,000 crore purchase will be conducted by the RBI.

- Also, G-SAP 2.0 worth Rs 1.2 lakh crore will be taken in the second quarter (Q2) of FY22 to support the market.

What is G-SAP?

- The RBI periodically purchases Government bonds from the market through Open Market Operations (OMOs).

- The G-SAP is in a way an OMO.

- But there is an upfront commitment by the RBI to the markets that it will purchase bonds worth a specific amount.

- The idea is to give a comfort to the bond markets.

- In other words, G-SAP is an OMO with a ‘distinct character.’

Monetary Policy committee:

- The Monetary Policy Committee is a statutory and institutionalized framework under the Reserve Bank of India Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- An RBI-appointed committee led by the then deputy governor Urjit Patel in 2014 recommended the establishment of the Monetary Policy Committee.

- The MPC is entrusted with the responsibility of deciding the different policy rates including MSF, Repo Rate, Reverse Repo Rate, and Liquidity Adjustment Facility.

- Composition of MPC: The committee will have six members. Of the six members, the government will nominate three. No government official will be nominated to the MPC.

- The other three members would be from the RBI with the governor being the ex-officio chairperson. Deputy governor of RBI in charge of the monetary policy will be a member, as also an executive director of the central bank.

- Term: Members of the MPC will be appointed for a period of four years and shall not be eligible for reappointment.

- Decisions will be taken by majority vote with each member having a vote.

- RBI governor’s role: The RBI Governor will chair the committee. The governor, however, will not enjoy a veto power to overrule the other panel members, but will have a casting vote in case of a tie.

- Indemnity from liability

Context: India is expected to grant indemnity to foreign vaccine makers including Pfizer and Moderna which would make it easier for their Covid vaccines to come to India.

- Now, Serum Institute has become the latest company to ask for indemnity from liability, stating that all vaccine manufacturers, whether Indian or foreign, should be protected against legal suits for any severe side effects.

What is indemnity clause?

- In simple terms, indemnity means security against a loss or other financial stress.

- In legal terms, it means a contractual obligation of one party to compensate another party due to the acts of the former.

- The clause is commonly used in insurance contracts.

There are a number of common exceptions to indemnification:

- An indemnification provision may exclude indemnification for claims or losses that result from the indemnified party’s:

- Negligence or gross negligence.

- Improper use of the products.

- Bad faith failure to comply with its obligations in the agreement.

Present status in India:

- In the case of India, if the government gives an indemnity to foreign vaccine makers to roll out their vaccine in the country, the government, and not the vaccine maker, would be liable to compensate any citizen who claims to have side effects after taking the vaccine jab.

- Section 124 of the Indian Contract Act 1872 defines the Contract of Indemnity as a contract by which one party guarantees to save the other person from loss caused to him by the action of the guarantor himself, or by the action of any other person.

- There appears to be no precedent for any company getting such indemnity in India for any drug. In the current context, the state has freed itself of all liability and shifted the liability to the vaccine manufacturers

- The law on drugs in India does not have a provision for indemnity related to the grant of approval for any new drug or vaccine in the country.

What does India gain by giving indemnity?

- In the absence of indemnity, overseas manufacturers may load the risk onto the price of the vaccines, making each dose more expensive. By indemnifying the companies in respect of these vaccines, the government of India may be able to negotiate lower prices and higher volumes. It may help accelerate India’s national vaccination drive.

What are other countries doing?

- Countries like Canada, Singapore, the United Kingdom, the United States, and the European Union, have assumed a considerable amount of liability as opposed to the manufacturers.

- In February, the USA invoked the Public Readiness and Emergency Preparedness Act. The 2005 law empowers the HHS (Health and Human Service) secretary to provide legal protection to companies making or distributing critical medical supplies, such as vaccines and treatments. The immunity will last till 2024.

- South African government has launched its own $250 million compensation fund for its citizens waiving off the liability of the manufacturers.

What are ‘Bridging trials’?

- ‘Bridging trials’ are localised clinical trials which generate data related to the impact of foreign medicines/vaccines on the indigenous population before they are rolled out for the public. These trials are important in ascertaining the efficacy and potential side-effects related to the medicine/vaccine.

- Besides clearance on indemnity clause, foreign vaccine makers including Pfizer and Moderna had sought relaxation on the requirement for a post-approval bridging trial for its vaccine.

Challenges for India Diplomacy in the near future

- To roll out a mass vaccination program India will need to negotiate with the US about various issues like indemnity, the release of vaccine ingredients, the release of stocks of vaccines lying idle, etc.

- India proposed a patent waiver on Vaccine production at the WTO. To make it a reality is the biggest challenge for diplomacy to convince the developed world.

- Managing the promise of Vaccine supply to African nations and the neighbouring countries is another challenge that Indian diplomacy faces. India has stopped the exports recently.

- World Environment Day 2021

Context: The World Environment Day is observed on the 5th of June.

- This year it is observed under the theme “Ecosystem Restoration”. It will be hosted by Pakistan.

Background:

- The United Nations Assembly established World Environment Day in 1972, which was the first day of the Stockholm Conference on the human environment.

- WED is celebrated on June 5 each year to encourage awareness and environmental protection.

- As United Nations says, this day provides us an opportunity to broaden basis for enlightened opinion and responsible conduct by individuals, communities and enterprises to preserve and enhance the environment.

- It is celebrated by engaging governments, celebrities, businesses, and citizens shift their focus on eradicating environmental issue.

Key Details:

- On the occasion of WED, UN kicked off “UN Decade on Ecosystem Restoration (2021-2030)”, which is a global mission to revive billions of hectares of forests, farmlands, mountains ecosystem and marine ecosystem.

- Therefore the theme for this year is ‘Ecosystem Restoration’

- The theme for this year’s in India is ‘promotion of biofuels for a better environment’.

Initiatives Taken by India:

- E-100 pilot project has been launched in Pune for the production and distribution of ethanol across the country.

- The government is releasing the E-20 notification that will allow oil companies to sell 20% ethanol blended petrol from 1st April, 2023, and BIS specifications for ethanol blends E12 and E15.

Ecosystem Restoration:

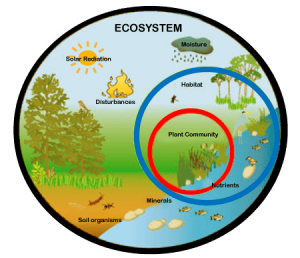

Ecosystem:

- It is a community of plants and animals interacting with each other in a given area, and also with their non-living environments. The non-living environments include weather, earth, sun, soil, climate and atmosphere.

- The ecosystem relates to the way that all these different organisms live in close proximity to each other and how they interact with each other.

Ecosystem Restoration:

- Ecosystem restoration means assisting in the recovery of ecosystems that have been degraded or destroyed, as well as conserving the ecosystems that are still intact.

- It involves reviving old water bodies, building natural forests, providing space to wildlife and reducing water pollution to restore aquatic life.

- Healthier ecosystems, with richer biodiversity, yield greater benefits such as more fertile soil, bigger yields of timber and fish, and larger stores of greenhouse gases.

Significance of restoration:

- Amid the ongoing covid-19 pandemic, which the world has been fighting for 1.5 years, WED has become more significant. Pandemic has shown how disastrous ecosystem loss can be. As the area of natural habitat for animal is shrinking pathogens like coronavirus are easily spreading. Thus, only healthy ecosystems can enhance livelihoods, counter climate change and stop collapse of biodiversity.

- Ecosystem loss is depriving the world of carbon sinks, like forests and wetlands, at a time when humanity can least afford it.

- Global greenhouse gas emissions have grown for three consecutive years and the planet is one place for potentially catastrophic climate change.

India’s Restoration Initiatives:

- National Biodiversity Action Plan

- National Afforestation Programme.

- Rural Livelihood Schemes like the Mahatma Gandhi National Rural Employment

- Guarantee Scheme (MGNREGS) and the National Rural Livelihood Mission (NRLM).

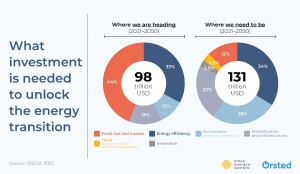

- Industrial Deep Decarbonisation Initiative (IDDI)

Context: India along with Govt. of United Kingdom launched new workstream to promote industrial energy efficiency under the Clean Energy Ministerial’s (CEM) – Industrial Deep Decarbonization Initiative (IDDI) at the 12th Chief Energy Ministerial (CEM).

- It is coordinated by UNIDO (United Nations Development Industrial organisation).

- It was launched in the ongoing 12th CEM (CEM12) Meeting, virtually hosted by Chile.

Key Details:

12th CEM Meeting:

- The objective is to infuse green technologies and stimulate demand for low-carbon industrial material.

- India is committed to cut emissions intensity per unit of GDP by 33 to 35% by 2030 (stated in Nationally Determined Contributions).

- The commitment hinges on effective deployment of low carbon technologies in Energy Intensive Sectors like Iron & Steel, Cement and Petrochemicals.

- Government policies have resulted in substantial savings in energy at the demand side such as AgDSM (Agriculture Demand Side Management programme), MuDSM (Municipal Demand Side Management) etc.

About Clean Energy Ministerial (CEM):

- CEM’S Mission: The CEM brings together a community of the world’s largest and leading countries, companies, and international experts to achieve one mission – accelerate clean energy transitions.

- The CEM is an international clean energy leadership platform, a convening platform, an action platform, and an acceleration platform.

- It was established in December 2009 at the UN’s Framework Convention on Climate Change conference of parties in Copenhagen.

- The Framework for the Clean Energy Ministerial, adopted at the seventh Clean Energy Ministerial in 2016, defines the CEM governance structure and outlines the mission statement, objectives, membership, and guiding principles.

- It serves as:

- A platform where its members help shape the global clean energy agenda and advance the deployment of specific clean energy technologies and solutions.

- A voluntary, bottom-up, government-owned forum for exchanging knowledge and insights, building networks and partnership, and facilitating coordinated actions on clean energy.

- An implementation vehicle that helps its members to achieve specific domestic clean energy objectives.

- 29 countries are part of CEM including India.

What is Industrial Deep Decarbonization Initiative (IDDI)?

- It is a global coalition of public and private organisations who are working to stimulate demand for low carbon industrial materials.

- In collaboration with national governments, IDDI works to standardise carbon assessments, establish ambitious public and private sector procurement targets, incentivise investment into low-carbon product development and design industry guidelines.

- Coordinated by United Nations Industrial Development Organization (UNIDO).

- Members: The IDDI is co-led by the UK and India and current members include Germany and Canada.

- The initiative brings together a strong coalition of related initiatives and organizations including the Mission Possible Platform, the International Renewable Energy Agency (IRENA) and the World Bank to tackle carbon intensive construction materials such as steel and cement.

- Research from the IPCC predicts that if developing countries expand their infrastructure to average current global emissions, the construction sector alone will emit 470 billion tonnes of carbon dioxide by 2050. This is more than the remaining carbon budget to avoid dangerous climate change.

- Reaching net-zero CO2 emissions for these sectors will require improving design and reducing materials, more and higher value recycling, and switching to clean energy sourcing for primary production.

United Nations Development Industrial Organisation:

- It is the specialized agency of the United Nations that promotes industrial development for poverty reduction, inclusive globalization and environmental sustainability.

- Its Headquarters is located in Vienna, Austria.

- There are 170 Member countries as of 1st April 2019 including India.

- Members regularly discuss and decide UNIDO’s guiding principles and policies in the sessions of the Policy Making Organs.

- The mission of UNIDO, as described in the Lima Declaration adopted at the fifteenth session of the UNIDO General Conference in 2013, is to promote and accelerate inclusive and sustainable industrial development (ISID) in Member States.

- UNIDO’s mandate is fully recognized in SDG-9, which calls to “Build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation”.

- UNIDO’s programmatic focus is structured in four strategic priorities:

- Creating shared prosperity.

- Advancing economic competitiveness.

- Safeguarding the environment.

- Strengthening knowledge and institutions.

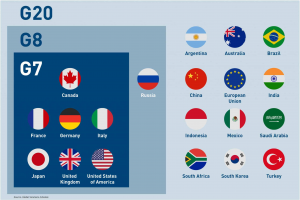

- G7

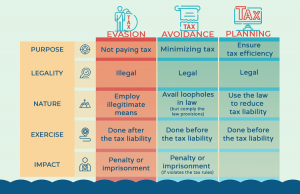

Context: Recently, Advanced economies making up the G7 grouping have reached a historic deal on taxing multinational companies.

Key Details:

What are the decisions taken?

- G7 Finance ministers meeting in London agreed to counter tax avoidance through measures to make companies pay in the countries where they do business.

- The second decision in the agreement commits states to a global minimum corporate tax rate of 15% to avoid countries undercutting each other.

- The agreement will now be discussed in detail at a meeting of G20 financial ministers and central bank governors in July.

Who are the targets?

- Apart from low-tax jurisdictions, the proposal for a minimum corporate tax is tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including digital giants such as Apple, Alphabet and Facebook, as well as major corporations such as Nike and Starbucks.

- These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries such as Ireland or Caribbean nations such as the British Virgin Islands or the Bahamas, or to central American nations such as Panama.

- The US Treasury loses nearly $50 billion a year to tax cheats, according to the Tax Justice Network report, with Germany and France also among the top losers. India’s annual tax loss due to corporate tax abuse is estimated at over $10 billion, according to the report.

What are the problems with the plan?

- Getting all major nations on the same page is the biggest Challenge.

- A global minimum rate would essentially take away a tool that countries use to push policies that suit them.

- For instance, in the backdrop of the pandemic, IMF and World Bank data suggest that developing countries with less ability to offer mega stimulus packages may experience a longer economic hangover than developed nations. A lower tax rate is a tool they can use to alternatively push economic activity. Also, a global minimum tax rate will do little to tackle tax evasion.

Where does India stand?

- In a bid to revive investment activity, Finance Minister Nirmala Sitharaman on September 21, 2019 announced a sharp cut in corporate taxes for domestic companies to 22% and for new domestic manufacturing companies to 15%.

- Also, existing domestic companies opting for the concessional taxation regime will not be required to pay any Minimum Alternate Tax.

- This, along with other measures, was estimated to cost the exchequer Rs 1.45 lakh crore annually.

- The cuts effectively brought India’s headline corporate tax rate broadly at par with the average 23% rate in Asian countries.

- China and South Korea have a tax rate of 25% each, while Malaysia is at 24%, Vietnam at 20%, Thailand at 20% and Singapore at 17%. The effective tax rate, inclusive of surcharge and cess, for Indian domestic companies is around 25.17%.

- The government is open to participate and engage in the emerging discussions globally around the corporate tax structure.

- To address the challenges posed by the enterprises who conduct their business through digital means and carry out activities in the country remotely, the government has the ‘Equalisation Levy’, introduced in 2016.

- Also, the IT Act has been amended to bring in the concept of “Significant Economic Presence” for establishing “business connection” in the case of non-residents in India.

Tax Avoidance: An action taken to lessen tax liability and maximize after-tax income.

Double Tax Avoidance Agreements (DTAAs):

- A DTAA is a tax treaty signed between two or more countries. Its key objective is that tax-payers in these countries can avoid being taxed twice for the same income.

- A DTAA applies in cases where a taxpayer resides in one country and earns income in another.

- DTAAs can either be comprehensive to cover all sources of income or be limited to certain areas such as taxing of income from shipping, air transport, inheritance, etc.

Significance of DTAA

- DTAAs are intended to make a country an attractive investment destination by providing relief on dual taxation. Such relief is provided by exempting income earned abroad from tax in the resident country or providing credit to the extent taxes have already been paid abroad.

- DTAAs also provide for concessional rates of tax in some cases.

- However, DTAAs can become an incentive for even legitimate investors to route investments through low-tax regimes to sidestep taxation. This leads to loss of tax revenue for the country.

About G7:

- It is an intergovernmental organisation that was formed in 1975.

- The bloc meets annually to discuss issues of common interest like global economic governance, international security and energy policy.

- The G-7 does not have a formal constitution or a fixed headquarters. The decisions taken by leaders during annual summits are non-binding.

- G-7 is a bloc of industrialized democracies i.e. France, Germany, Italy, the United Kingdom, Japan, the United States, and Canada.

- The G7 was known as the ‘G8’ for several years after the original seven were joined by Russia in 1997.

- The Group returned to being called G7 after Russia was expelled as a member in 2014 following the latter’s annexation of the Crimea region of Ukraine.

- Summits are held annually and hosted on a rotation basis by the group’s members.

- The groundwork for the summit, including matters to be discussed and follow-up meetings, is done by the “sherpas”, who are generally personal representatives or members of diplomatic staff such as ambassadors.

- The leaders of important international organizations like European Union, IMF, World Bank and the United Nations are also invited.

- SAGE Portal

Context: The Minister of Social Justice and Empowerment, launched the SAGE (Senior care Aging Growth Engine) initiative and SAGE portal to support India’s elderly persons.

About SAGE Project:

- SAGE project will be launched to select, support and create “one-stop access” of elderly care products and services provided by credible start-ups.

- Project was formulated following the recommendations of empowered expert committee report on start-ups for elderly.

- Once the project is launched, start-ups can apply to be a part of it through dedicated portal. This dedicated portal will also be launched along with the scheme.

- The start-ups selected under SAGE will be those which will provide new innovative products and services to elderly persons in various areas like health, travel, finance, legal, housing, food among others.

- The Ministry of Social Justice & Empowerment will act as a facilitator for this scheme.

- A fund of uptoRs.1 crore as one-time equity will be granted to each selected start-up.

What was the need of this scheme?

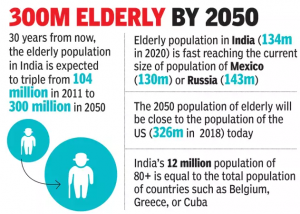

- This scheme was required in the light of increasing share of elders. As per a survey, share of elders with respect to total population in percentage term is expected to increase from 7.5 per cent in 2001 to about 12.5 per cent by 2026.

- There is an urgent need to create a more robust eldercare ecosystem in India, especially in the post-COVID phase.

Silver Economy:

- Silver economy is the system of production, distribution and consumption of goods and services aimed at using the purchasing potential of older and ageing people and satisfying their consumption, living and health needs.

- The silver economy is analyzed in the field of social gerontology (study of aging) not as an existing economic system but as an instrument of ageing policy and the political idea of forming a potential, needs-oriented economic system for an aging population.

- Its main element is gerontechnology (Technology pertaining to aged people) as a new scientific, research and implementation paradigm.