Topics

- CORBEVAX

- United Nations General Assembly

- Operation Blue Star

- Digital Service Tax and Retaliatory Tariffs

- MGNREGA

- CEO Water Mandate

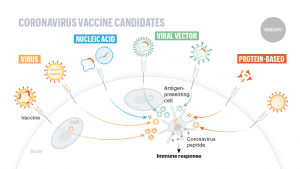

- CORBEVAX

Context: India has placed an advance order to block 300 million doses of a new Covid-19 vaccine, Corbevax, from Hyderabad-based Company Biological E.

Key Details:

- It is India’s indigenous Covid-19 vaccine which is currently undergoing Phase 3 clinical trials.

- Corbevax is a “recombinant protein sub-unit”

- It means it is made up of a specific part of SARS-CoV-2 – the spike protein on the virus’s surface.

- The spike protein allows the virus to enter the cells in the body so that it can replicate and cause disease.

- However, when this protein alone is given to the body, it is not expected to be harmful as the rest of the virus is absent.

- The body is expected to develop an immune response against the injected spike protein.

- Therefore, when the real virus attempts to infect the body, it will already have an immune response ready that will make it unlikely for the person to fall severely ill.

- Although this technology has been used for decades to make hepatitis B vaccines, Corbevax will be among the first Covid-19 vaccines to use this platform.

- Like most other Covid-19 vaccines, Corbevax is administered in two doses. However, as it is made using a low-cost platform, it is also expected to be among the cheapest available in the country.

- Novavax has also developed a protein-based vaccine, which is still waiting for emergency use authorisation from various regulators.

How Corbevax is different?

- Other Vaccine approved so far are either

- mRNA vaccines (Pfizer and Moderna),

- viral vector vaccines (Covishield and Sputnik V) or

- inactivated vaccines (Covaxin, Sinovac-CoronaVac and Sinopharm’s Vero Cell).

- Inactivated vaccines, includes killed particles of the whole SARS-CoV-2 virus and attempts to target the entire structure of the virus. On the other hand, Corbevax, like the mRNA and viral vector Covid-19 vaccines, targets only the spike protein, but in a different way.

- Viral vector and mRNA vaccines use a code to induce our cells to make the spike proteins against which the body has to build immunity.

- In the case of Corbevax, protein itself is given.

- mRNA vaccines work by using messenger RNA (mRNA), which is the molecule that essentially puts DNA instructions into action. Inside a cell, mRNA is used as a template to build a protein.

(Messenger ribonucleic acid (mRNA), which is a molecule that provides cells with genetic instructions for making proteins that are needed for numerous cellular functions in the body, including for energy and immune defence)

- Viral Vector Vaccines use a harmless virus, or adenovirus, as a delivery system to trigger the immune system to create antibodies to fight off an infection by SARS-CoV-2, which is the virus that causes COVID-19.

- The adenovirus is not SARS-CoV-2 itself, but rather a different, harmless virus that has been manipulated so it’s unable to replicate and cause illness.

- Adenoviruses are viruses that cause the common cold and there are many different types, which have been used for decades to deliver instructions for proteins,

Why Corbevax matters:

- This is the first time the Indian government has placed an order for a vaccine that has not received emergency use authorisation, paying Rs 1,500 crore in advance to block an order that could vaccinate 15 crore Indian citizens.

- The Centre has provided major pre-clinical and clinical trial support towards the vaccine’s development, including a grant-in-aid of Rs 100 crore from the Department of Biotechnology.

- A major reason for India placing such a big order is the difficulties it is facing in enhancing vaccine supplies.

Other Types of Vaccine:

- Live-attenuated Vaccines:

- Live-attenuated vaccines inject a live version of the germ or virus that causes a disease into the body. Although the germ is a live specimen, it is a weakened (or attenuated) version that does not cause any symptoms of infection as it is unable to reproduce once it is in the body.

- Live-attenuated vaccines can be made to create immunity against viruses or bacteria, but they are more commonly used for viruses

- This type of vaccine works by allowing a virus or germ to reproduce enough for the body to make memory B-cells, which are a type of cell that can recognize and remember a virus and generate an immune response against it for many years after their initial response.

- Live-attenuated vaccines trigger an immune response that is similar to what would occur during a natural infection.

- A person will usually get lifelong immunity from disease through live-attenuated vaccines, and only one or two doses of the vaccine are usually needed to provide this immunity.

- The limitation of this approach is that these vaccines usually cannot be given to people with weakened immune systems.

- Live vaccines are used against: Measles, mumps, rubella (MMR combined vaccine), Rotavirus, and Smallpox among others.

2.Inactivated vaccines

- An inactivated vaccine uses a strain of a bacteria or virus that has been killed with heat or chemicals. This dead version of the virus or bacteria is then injected into the body.

- Inactivated vaccines are the earliest type of vaccine to be produced, and they do not trigger an immune response that is as strong as that triggered by live-attenuated vaccines.

- Inactivated vaccines do not offer lifelong immunity and need topping up over time, but they may cause fewer side effects than live-attenuated vaccines.

- The types of diseases that inactivated vaccines are used for include:

Hepatitis A, Flu, Polio, Rabies.

3.Subunit, recombinant, polysaccharide, and conjugate Vaccines:

- They use specific pieces of the germ – like its protein, sugar, or capsid (a casing around the germ). They give a very strong immune response.

- They can also be used on people with weakened immune systems and long-term health problems.

- These vaccines are used to protect against: Hib (Haemophilus influenzae type b) disease, Hepatitis B, HPV (Human papillomavirus), Pneumococcal disease among others.

4.Toxoid Vaccines:

- Toxoid vaccines use toxins created by the bacteria or virus to create immunity to the specific parts of the bacteria or virus that cause disease, and not the entire bacteria or virus. The immune response is focused on this specific toxin.

- Toxoid vaccines do not offer lifelong immunity and need to be topped up over time.

- Toxoid vaccines are used to create immunity against diphtheria and tetanus.

2.United Nations General Assembly:

Context: Maldives’ foreign minister Abdulla Shahid elected president of UN General Assembly.

Key details:

- The office of UNGA President is the highest office in the UN System, and reflects the collective goodwill of the 193 Member States of the UN.

- Foreign minister of the Maldives Abdulla Shahid was elected as the President of the 76th United Nations General Assembly with an overwhelming three-fourth majority.

- This is a post held on an annual basis, rotated amongst various regional groupings.

- This time the UNGA head will be chosen from the Asia-Pacific grouping.

- Asia- Pacific group of the UN:

- Consists of 53 Member States and is the second largest regional group by number of member states after the African Group.

- Its territory is composed of much of the continents of Asia and Oceania with the exception of a few countries.

- The 76th session (2021-22) is the turn of the Asia-Pacific group. This is the first time that the Maldives will be occupying the office of the President of the UN General Assembly.

- Shahid is eminently qualified to hold the top office of UN General Assembly, with vast diplomatic experience and strong credentials, especially in the multilateral fora.

- India announced its support to Maldives candidature during the visit of foreign secretary Harsh Shringla to the Maldives in November 2020.

About UNGA:

- The General Assembly is the main deliberative, policymaking and representative organ of the UN.

- All 193 Member States of the UN are represented in the General Assembly, making it the only UN body with universal representation.

- The President of the General Assembly is elected each year by assembly to serve a one-year term of office.

- The presidency rotates annually between the five geographic groups: African, Asia-Pacific, Eastern European, Latin American and Caribbean, and Western European and other States.

How are the decisions taken?

- Decisions on important questions, such as those on peace and security, admission of new members and budgetary matters, require a two-thirds majority of the General Assembly.

- Decisions on other questions are by simple majority.

- The Assembly has no binding votes or veto powers like the UN Security Council.

According to the Charter of the United Nations, the General Assembly may:

- Consider and approve the United Nations budget and establish the financial assessments of Member States.

- Elect the non-permanent members of the Security Council and the members of other United Nations councils and organs and, on the recommendation of the Security Council, appoint the Secretary-General.

- Consider and make recommendations on the general principles of cooperation for maintaining international peace and security, including disarmament.

- Discuss any question relating to international peace and security and, except where a dispute or situation is currently being discussed by the Security Council, make recommendations on it.

- Operation Blue Star

Context: Recently, the 37th anniversary of Operation Blue Star was observed by India.

Background and Key Details:

- Operation Blue Star is a code name given to an Indian Military Operation carried out by the Indian Army from 1 to 10 June 1984 in order to capture Sikh leader Jarnail Singh Bhindranwale and his group of supporters who had lodged at the Harmandir Sahib Temple Complex (also known as the Golden Temple) in Amritsar in Punjab.

- The operation was ordered by the then Prime Minister Indira Gandhi, primarily to take control of the Golden Temple.

- The operation had two components to it,

- Operation Metal which was the invasion on the temple complex and

- Operation Shop which was confined to the countryside of the state.

- This Operation helped in eliminating Khalistani terrorism.

- It was the biggest internal security operation till date at that time

- It resulted in the death of Bhindranwale.

- The official death toll by the Army is 554 Sikh militants and civilians and 83 officers and soldiers of the military.

- In the wake of the operation, there was a total media blackout imposed by the government. Curfew was also imposed on the people.

Background:

- Insurgency in Punjab had begun in the early eighties and it was an armed movement largely for a separate Sikh homeland called Khalistan based out of Punjab in India.

- It is believed that there were Pakistani elements too that supported the Khalistani movement in order to weaken the country.

- Akali Dal, a regional political party in Punjab, had passed the Anandpur Resolution in 1973 which demanded more autonomy to the states, among other things.

- In 1982, Bhindranwale joined the Akali Dal and launched the Dharam Yudh Morcha to implement the Anandpur Resolution.

- Bhindranwale was a firebrand leader who was able to get support from the youth in the state, especially from the rural areas.

- Jarnail Singh Bhindranwale wanted the Indian government to pass the Anandpur Resolution, and thereby agree to the formation of a separate state of Khalistan for Sikhs.

- Failing to get the Anandpur Resolution implemented, he declared his intention to carve out a semi-autonomous homeland for Sikhs in the Punjab region of India.

- He stoked up emotions by increasing the rhetoric on the assault on Sikh values in India.

- He and his supporters started carrying firearms at all times with them.

- The number of violent incidents also increased in Punjab during this time.

- In 1983, Bhindranwale fortified the Akal Takht in the Golden Temple complex and started hiding there to avoid arrest. He and his men led the campaign for Punjab’s autonomy from the temple.

- Hence, Operation Blue Star was launched between 1st June and 6th June 1984, with the aim of getting rid of Bhindranwale and his demands.

Aftermath of Operation Blue Star:

- There was a lot of anguish among the Sikh community in India and abroad over the storming of their most holy place. The timing of the operation was also questioned since June 3, 1984, was the martyrdom day of Sikh Guru, Guru Arjan Singh and hence, a large number of devotees were present inside the temple complex.

- Then Prime Minister Indira Gandhi who approved the operation was assassinated in October 1984 by her own Sikh bodyguards as an act of revenge.

- This led to the anti-Sikh riots of 1984 in Delhi and other parts of north India.

- In 1986, the Chief of Army Staff at the time of the operation General A.S. Vaidya was assassinated in revenge by Sikh militants.

- The bombing of Air India Flight 182 in 1985 is believed to have been another act of revenge for the operation.

- Many Sikh soldiers in the Indian Army mutinied because of the operation. Many Sikhs resigned from administrative positions in the government.

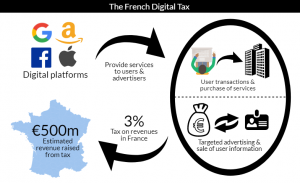

- Digital Service Tax and Retaliatory Tariffs

Context: Recently, the United States suspended retaliatory tariff imposition on digital service taxes (DST) on six countries including India for a period up to 180 days to provide additional time to complete the ongoing multilateral negotiations on international taxation at the OECD and in the G20 process.

Background:

- These retaliatory tariffs were imposed after the office of the United States Trade Representative (USTR) noted that the Digital services taxes on companies such as Facebook and Google adopted by India, Italy and Turkey discriminate against US companies and are inconsistent with international tax principles.

- Other than India, the countries slapped with this tariff proposal are Austria, Italy, Spain, Turkey, and the United Kingdom.

- The office of USTR in its 6 January findings into India’s digital services tax (DST) concluded that India’s 2% DST, by its structure and operation, discriminates against US digital companies

- The USTR pointed out that of the 119 companies that it identified as likely liable under the digital services tax, 86, or 72%, were American.

- Under Section 301 of the Trade Act of 1974, the USTR enjoys a range of responsibilities and authority to investigate and take action to enforce US national interests under trade agreements and respond to certain foreign trade practices.

Reason for Suspension:

- Multilateral Solution:

- The United States is focused on finding a multilateral solution to a range of key issues related to international taxation, including our concerns with digital services taxes while maintaining the option of imposing tariffs under Section 301 if warranted in the future.

- The United States remains committed to reaching a consensus on international tax issues through the OECD and G20 processes.

- Damage to Global Economy:

- The six countries potentially impacted are passing through a weak post Covid-19 recovery and opening a new trade war front could be damaging not only to them, but also to the broader global economy.

- The combination of depressed economic activity owing to the effects of the pandemic and tectonic shifts in global supply chains engendered by the US’ trade war with China has already left many economies in a weakened condition.

- Change in Administration:

- Under the previous US government (Trump) USTR was used to promote what his administration considered to be free, fair and reciprocal trade, specifically to close the gap or balance of trade between the US and foreign governments.

- However, the new administration (Biden) wants to lower the tension on trade issues after Trump’s aggressive position.

Impact on India:

- In case of India, USTR’s proposed course of action includes additional tariffs of up to 25 per cent ad valorem on an aggregate level of trade that would collect duties on goods of India in the range of the amount of DST that India is expected to collect from US firms.

- Close to USD 118 million of India’s exports to the US would be subject to the tariff proposed by the USTR .

- Around 26 categories of goods are in the preliminary list of products that would be subject to the additional tariffs. This includes shrimps, basmati rice, cigarette paper, cultured pearls, semi precious stones, silver powder and silver articles of jewelry, gold mixed link necklaces and neck chains and certain furniture of bentwood.

- Initial estimates indicate that the value of the DST payable by US-based company groups to India will be up to approximately $55 million per year, the USTR report said.

- Negotiations with the US that may result in the scaling back of this tax would imply that a part of this revenue would be lost to the exchequer, depending on the final rate agreed.

- Any escalation matrix of retaliatory taxation with the US would damage its growth prospects at a crucial point in its laborious recovery.

- However, India will also not be able to simply abandon its articulated intent to tax global tech firms, which have generally enjoyed lowtax operations across numerous jurisdictions.

Digital Services Taxes:

- Digital companies are not adequately taxed because they don’t have a physical location in the markets where they operate.

- DST aims to ensure that non-resident, digital service providers pay their fair share of tax on revenues generated by supplying Digital services .

- The Organisation for Economic Cooperation and Development (OECD) is currently hosting negotiations with over 130 countries that aim to adapt the international tax system. One goal is to address the tax challenges of the digitalization of the economy.

- Some experts argue that a tax policy designed to target a single sector or activity is likely to be unfair and have complex consequences.

- Further, the digital economy cannot be easily separated out from the rest of the global economy.

- The DST should not be confused with the so-called “Netflix tax,” which one may find in some western countries.

- The Netflix tax is essentially a “value-added tax” on digital services where the consumer bears the entire tax burden on the value of the final product.

India’s Tax on Digital Companies:

- With effect from April 1st 2020, India expanded the scope of its equalization levy(at 6%) that was first brought into force in 2016 targeting offshore firms hosting advertisements aimed at Indian consumers, to cover other e-commerce supplies by non-resident players.

- It covers all sorts of digital e-commerce transactions in India as well as those transactions which use Indian data if the offshore digital economy firm’s revenue from India is ?2 crore or more.

- E-commerce operators are obligated to pay the tax at the end of each quarter.

- The idea is to tax payments made to offshore entities which do not have a physical presence here and therefore the income tax department cannot subject such income earned from India to tax.

- The USTR had pointed out that this levy covers revenue generated from a broad range of digital services offered in India, including digital platform services, digital content sales, digital sales of a company’s own goods, data-related services, software-as-a-service and several other categories of digital services.

- This has huge implications for US firms. “USTR estimates that the aggregate tax bill for US companies could exceed $30 million per year,” the report said.

Way Forward:

- Given that a global consensus at the OECD or even the UN level may take several more months, countries including India are likely to continue with their unilateral DSTs.

- At this juncture, when economies are reeling under the ill-effects of the pandemic, no country would want to give up its share of revenue and wait for a global consensus to emerge.

- Further, there needs to be international consensus on taxation on a digital economy.

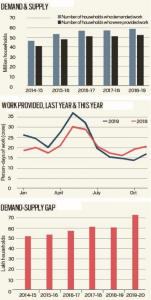

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

Context: The Union Finance Ministry has asked the States to split wage payments under the MGNREGA scheme into separate categories for the Scheduled Castes, the Scheduled Tribes and others from this financial year.

Reasons behind the move:

- The existing system for wages under the scheme is for only one type, that is there is no category wise provision of wage payment.

- This new reform is being done in order to assess and highlight the benefits flowing from budgetary outlay towards Scheduled Castes and Scheduled Tribes.

- The measure is to a large extent aimed at highlighting what the Centre is doing for the SC and ST communities.

- There is some inbuilt positive discrimination in the scheme, reflected in the fact that more than 50% of workers are women and almost 40% are SC/ST.

- However, it felt that the proposed reform would not help SC/ST workers, but would expose all workers to further uncertainties as the system struggles with changes.

Directives to states

- States were asked to verify if job cards for SC and ST beneficiaries were being properly allocated at the field level.

- They were told they would be given fund allocations according to this criterion, indicating that labour budgets would also be segregated on a caste basis.

- It was aimed at timely wage payments.

Issues with the announcement

- Workers’ advocates feared this move would cause unnecessary delays and complications in the payment system.

- It may lead to reduction in scheme funding.

- This may also restrict MGNREGA to districts with high SC/ST populations.

About MGNREGA

- The scheme was introduced in 2005.

- This is a labour law and social security measure that aims to guarantee the ‘Right to Work’.

- The act was first proposed in 1991 by P.V. Narasimha Rao.

- The key tenet of this social measure and labour law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Objectives of MGNREGA

- To enhance the livelihood security of the rural poor by generating wage employment opportunities for minimum of 100 days.

- Proactively ensuring social inclusion by strengthening the livelihood base of rural poor.

- Creation of durable assets in rural areas such as wells, ponds, roads and canals.

- Reduce urban migration from rural areas.

- To create a rural asset base that would enhance productive ways of employment, augment and sustain a rural household income.

Implementation of the scheme:

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- The failure of provision for employment within 15 days of the receipt of job application from a prospective household will result in the payment of unemployment allowance to the job seekers.

- Any Indian citizen above the age of 18 years who resides in rural India can apply for the NREGA scheme. The applicant should have volunteered to do unskilled work.

- Employment is to be provided within 5 km of an applicant’s residence, and minimum wages are to be paid.

- Thus, employment under MGNREGA is a legal entitlement.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fix their priority.

MGNREGA TRENDS

- CEO Water Mandate

Context: India’s largest power utility, NTPC Ltd, has become a signatory of UN Global Compact’s CEO Water Mandate.

Key Details:

- CEO Water Mandate is a coveted league of companies focusing on efficient water management.

- Chairman and Managing Director of NTPC, Shri Gurdeep Singh, has joined a select group of business leaders who recognize importance of water stewardship and is working to conserve water.

- NTPC has taken several measures across its plant locations for water management.

- Now, it will follow the policy of 3 R’s that is; reduce, reuse, recycle for water conservation and management while generating power.

What is CEO Water Mandate?

- It is a UN Global Compact initiative which demonstrates commitment and efforts of companies to enhance their water and sanitation agendas in line with Sustainable Development Goals.

- It has been designed to assist companies in developing, implementing and disclosing comprehensive water strategies and policies.

- It provides a platform for companies to link with like-minded businesses, public authorities, UN agencies, civil society organizations etc.

What is UN Global Compact initiative?

- The United Nations Global Compact is a strategic initiative that supports global companies that are committed to responsible business practices in the areas of human rights, labour, the environment, and corruption.

- This initiative promotes activities that contribute to sustainable development goals to create a better world.

- Under the Global Compact, companies are brought together with UN agencies, labour groups and civil society.

- Cities can join the Global Compact through the Cities Programme.

NTPC Limited:

- This Indian government owned electricity board was formerly called as National Thermal Power Corporation Limited.

- It is engaged in business of generation of electricity and allied activities. NTPC was incorporated under Companies Act 1956 and is working under Ministry of Power.

- Headquarters of NTPC is located at New Delhi.

- Apart from electricity generation, it also undertakes consultancy & turnkey project contracts involving engineering, construction management, project management and operation & management of power plants