- Financial Stability Report

#GS3 #Economics #NPA’s #Fiscal Policy

Context: Recently, the Reserve Bank of India (RBI) released the 23rd issue of its Financial Stability Report (FSR).

Highlights of the report:

- Sustained policy support, benign financial conditions and the gathering momentum of vaccination are nurturing an uneven global recovery.

- Policy support has helped in shoring up financial positions of banks, containing non-performing loans and maintaining solvency and liquidity globally.

- On the domestic front, the ferocity of the second wave of COVID-19 has dented economic activity, but monetary, regulatory and fiscal policy measures have helped curtail the solvency risk of financial entities, stabilise markets, and maintain financial stability.

(Solvency risk is the risk of being unable to absorb losses, generated by all types of risks, with the available capital)

- The impact of the Covid-19 Second-Wave on the balance sheets of Indian banks has been less than what was projected before and capital buffers are reasonably resilient to withstand future shocks.

- The capital to risk-weighted assets ratio (CRAR) of scheduled commercial banks (SCBs) increased to 16.03 per cent and the provisioning coverage ratio (PCR) stood at 68.86 per cent in March 2021.

- Going forward, as banks respond to credit demand in a recovering economy, they will need to reinforce their capital and liquidity positions to fortify themselves against potential balance sheet stress.

- While banks’ exposures to better rated large borrowers are declining, there are incipient signs of stress in the Micro, Small and Medium Enterprises (MSMEs) and retail segments.

- The Reserve Bank of India has toned down its expectation of the stress that banks may face as a result of the Covid crisis, after initially cautioning that non performing assets could nearly double due to the hit to economic activity.

According to stress tests conducted by the RBI:

- The gross NPA ratio for the banking sector could rise to 9.8% by March 2022 under a baseline, as compared with 7.48 in March 2021. The baseline scenario used in the current stress tests in one where GDP growth for FY22 is at 9.5%.

- In January, the RBI had said the gross NPA ratio of banks could rise to 13.5% by Sept. 30, 2021 under the then assumed baseline scenario of 0% GDP growth in the second half of FY21.

- Under the medium stress scenario, where GDP growth is at 6.5%, the gross NPA ratio could rise to 10.36%

- Under the severe stress scenario, where GDP growth is at 0.9%, the gross NPA ratio for the banking sector may rise to 11.22%.

New Risks: While the recovery is underway, new risks have emerged which are:

- Nascent and mending state of the upturn (Revival of Economy).

- Economy Vulnerable to shocks and future waves of the pandemic.

- International commodity prices and inflationary pressures.

- Global spillovers amid high uncertainty.

- Rising incidence of data breaches and cyber attacks.

Suggestions:

Balance Sheet Stress:

- Banks need to reinforce their capital and liquidity positions to fortify themselves against potential balance sheet stress.

Policy Support:

- Sustained policy support and simultaneous increased fortification of capital and liquidity buffers by financial entities is important.

Financial Needs:

- Stronger capital positions, good governance and efficiency in financial intermediation can be the touchstones of this endeavour so that financing needs of productive sectors of the economy are met while the integrity and soundness of banks and financial institutions are secured on an enduring basis.

About Financial stability report:

- The FSR is a hugely useful publication as it receives contributions from all the financial sector regulators in the country.

- As such, it provides a rather comprehensive picture of the so-called macro-financial risks facing the economy.

- The FSR released by the RBI is the biannual alert of such risks in the Indian economy.

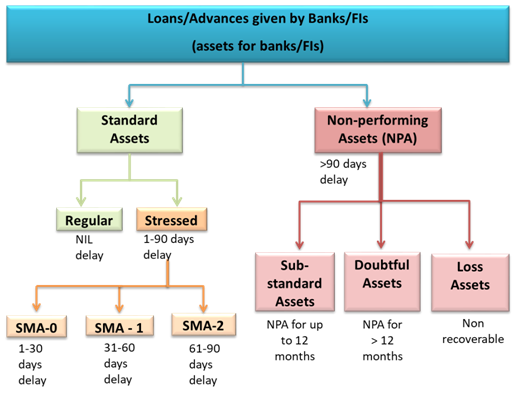

What is a Non-Performing Asset (NPA)?

- You may note that for a bank, the loans given by the bank is considered as its assets. So if the principle or the interest or both the components of a loan is not being serviced to the lender (bank), then it would be considered as a Non-Performing Asset (NPA)

- Any asset which stops giving returns to its investors for a specified period of time is known as Non-Performing Asset (NPA)

- Generally, that specified period of time is 90 days in most of the countries and across the various lending institutions. However, it is not a thumb rule and it may vary with the terms and conditions agreed upon by the financial institution and the borrower.

2.Freight Smart Cities Project by Ministry of Commerce.

#GS3 #Infrastructure #Urbanisation #Population and Associated issues

Context: Union Commerce Ministry’s Logistics Division unveils plans for ‘Freight Smart Cities’.

Highlights of the Plan:

- The objective is to improve the efficiency of urban freight and create an opportunity for reduction in the logistics costs.

- Under the freight smart cities initiative, city-level logistics committees would be formed and they will have related government departments and agencies at the local and state levels.

- These would also include the private sector from the logistics services and also users of logistics services.

- These committees would co-create City Logistics Plans to implement performance improvement measures locally.

- On the freight smart city initiatives, the India is working closely with GIZ (Germany) under Indo-German Development Cooperation, Rocky Mountain Institute (RMI) and RMI India.

- From the 10 cities to be identified on immediate basis, it is planned to expand the list to 75 cities in the next phase before scaling up throughout the country, including all state capitals and cities that have more than one million population.

Significance of the Plan:

- The need for focus on city logistics was first discussed with States/UTs during the first National Conference of States on Logistics on 19th January, 2021.

- There is a requirement of first and last mile freight movements with growing urbanisation for rapid economic growth including e-commerce.

- Increasing congestion, noise and sound pollution in the Indian cities is a menace affecting both public health and local economies. A proper plan will help in mitigating these problems.

- Final-mile freight movement in Indian cities is currently responsible for 50 per cent of total logistics costs in India’s growing e-commerce supply chains.

- Improving city logistics would also enable efficient freight movement and bring down the logistics costs boosting all sectors of the economy.

- Besides, Demand for urban freight is expected to grow by 140 per cent over the next 10 years.

3.Conservation of Endangered species:

#GS3 #Environment and ecology #Conservation #Government policies

Context: 150 vultures were seen in the Valmiki Tiger Reserve (VTR), Bihar recently, which has prompted a vulture conservation plan in the protected region of VTR.

About Vulture Conservation:

- It is one of the 22 species of large carrion-eating birds that live predominantly in the tropics and subtropics.

- They act an important function as nature’s garbage collectors and help to keep the environment clean of waste.

- India is most favourable region for Vultures: Hindus do not eat cows, which they consider sacred, and when a cow dies, it is left to be fed o n by vultures.

- Vultures also play a valuable role in keeping wildlife diseases in check.

- India is home to 9 species of Vulture namely the Oriental white-backed, Long-billed, Slender-billed, Himalayan, Red-headed, Egyptian, Bearded, Cinereous and the Eurasian Griffo

Threats:

- Poisoning from diclofenac that is used as a medicine for livestock.

- Loss of Natural Habitats due to anthropogenic activities.

- Food Dearth and Contaminated Food.

- Electrocution by Power lines.

Diclofenac:

- It is a common anti-inflammatory drug administered to livestock and is used to treat the symptoms of inflammation, fevers and/or pain associated with disease or wounds.

- Diclofenac leads to renal failure in vultures damaging their excretory system (direct inhibition of uric acid secretion in vultures).

- Gyps species were the most affected by diclofenac.

- The population of the White-rumped vulture (Gyps bengalensis) fell 99.7% between 1993 and 2002.

- The populations of the Indian vulture (Gyps indicus) and the slender-billed vulture (Gyps tenuirostris) fell 97.4%.

- The percentages differ slightly because the white-rumped vulture is more sensitive to diclofenac than the other two species, but all three were in danger of extinction.

- Two other species of Gyps, the Himalayan vulture (Gyps himalayensis) and the Eurasian griffon (Gyps fulvus) were less affected because they come to India only in winters

- They are exclusively mountain-dwelling and hence less vulnerable to diclofenac contamination.

Conservation Efforts:

- Recently, National Board for Wildlife(NBWL) has approved an Action Plan for Vulture Conservation 2020-2025.

Key Highlights of the Plan:

- Uttar Pradesh, Tripura, Maharashtra, Karnataka and Tamil Nadu will get a vulture conservation and breeding centre each.

- Establishment of at least one vulture-safe zone in each state for the conservation of the remnant populations in that state.

- Establishment of four rescue centres, in Pinjore (Haryana), Bhopal (Madhya Pradesh), Guwahati (Assam) and Hyderabad (Telangana). There are currently no dedicated rescue centres for treating vultures.

- A system to automatically remove a drug from veterinary use if it is found to be toxic to vultures with the help of the Drugs Controller General of India.

- To upscaling conservation four rescue centres will be opened like Pinjore in the north, Bhopal in central India, Guwahati in Northeast and Hyderabad in South India.

- To study the cause of deaths of vultures in India, a Vulture Care Centre (VCC) was set up at Pinjore, Haryana in 2001.

- At present, there are nine Vulture Conservation and Breeding Centres (VCBC) in India, of which three are directly administered by the Bombay Natural History Society (BNHS).