Topics

- Academic Bank of Credits (ABC)

- No Immunities for the acts of Vandalism: Supreme Court

- Earth Overshoot Day

- World Economic Outlook by International Monetary Fund

- Factoring Regulation (Amendment) Bill, 2021

- Rafale squadron

1.Academic Bank of Credits (ABC)

#GS1 #Government Policies & Interventions in Various Sectors #Health, Gender, Education, etc #Issues Arising Out of Their Design & Implementation

Context: The University Grants Commission (UGC) recently notified the Academic Bank of Credits (ABC), an academic service mechanism for storing and transferring of academic credits of a student.

- The scheme is in line with the new National Education Policy.

Key Details:

- Academic Bank of Credits shall be a national-level facility to promote flexibility of curriculum framework and interdisciplinary or multidisciplinary academic mobility of students across higher education institutions in the country.

- It will be rolled out for students in over 290 top institutions from the current academic year 2021-22 onwards.

- All institutions in the top 100 of the National Institutional Ranking Framework as well as those who have achieved an A grade under the National Assessment and Accreditation Council will be allowed to participate in the credit transfer system.

- ABC shall be established, on the lines of the National Academic Depository (NAD), which stores a student’s academic documents and shall have a website providing all details of ABC and its operational mechanism for the use of all stakeholders of higher education.

Functions of ABCs:

- ABC will be responsible for opening, closing, and validating the academic accounts of students.

- With students as academic account holders, students will be able to avail a variety of services including credit verification, credit accumulation, credit transfer or redemption, and authentication of academic awards.

- The courses will also include online and distance mode courses offered through National Schemes like SWAYAM, NPTEL, V-Lab etc.

- The validity of these academic credits earned by students will be up to seven years. The validity can also vary based on the subject or discipline. Students can redeem these credits.

- For instance, if a student has accumulated 100 credits which are equivalent to say one year and they decide to drop out.

- Once they decide to re-join, they can redeem this credit and seek admission directly in the second year at any university. The validity will be up to seven years; hence, students will have to re-join within seven years.

Significance:

- The initiatives such as a credit transfer system will allow multiple entry and exit options in higher education, engineering programmes in regional languages.

- It will enable the integration of multiple disciplines of higher learning, leading to the desired learning outcomes including enhanced creativity, innovation, higher order thinking and critical analysis.

- The ABC will provide the opportunity for students to tailor their degrees or make specific modifications or specialisations rather than undergoing the rigid, regularly prescribed degree or courses of a single university or autonomous college.

- It will also permit students to choose a pace for their studies along with the associated logistics and costs.

National Educational Policy: Highlights

- All higher education institutions, except legal and medical colleges, to be governed by a single regulator.

- Common norms to be in place for private and public higher education institutions.

- MPhil courses to be discontinued.

- Board exams to be based on knowledge application.

- Home language, mother tongue or regional language to be medium of instruction up to class 5.

- Common entrance exams to be held for admission to universities and higher education institutions.

- School curriculum to be reduced to core concepts; integration of vocational education from class 6

Hurdles in the implementation of the National Education Policy:

- Opening universities every week is a herculean task:

- India today has around 1,000 universities across the country. Doubling the Gross Enrolment Ratio in higher education by 2035 which is one of the stated goals of the policy will mean that we must open one new university every week, for the next 15 years.

- The National Education Policy 2020 intends to bring 2 crore children who are currently not in schools, back into the school system, accomplishing this over 15 years requires the setting up of around 50 schools every week.

- Funding: The National Education Policy 2020 envisages an increase in education spending from 4.6% to 6% of GDP, which amounts to around INR 2.5 lakh crores per year.

- Funding is tricky when the economy has been in downlow by Covid-19 related lockdowns, government tax collections are abysmally low, and the fiscal deficit was high even pre-Covid.

- Certain reforms mentioned in the NEP such as the Higher Education Commission of India (HECI), the four-year undergraduate degree, and the common university entrance test are yet to be rolled out.

- The proposal for four-year undergraduate degrees has run into some opposition, especially from faculty at the premier University of Delhi. It will also have to wait for the National Higher Education Curricular Framework, which is still being prepared.

Way Forward:

- A New Education Policy aims to facilitate an inclusive, participatory and holistic approach, which takes into consideration field experiences, empirical research, stakeholder feedback, as well as lessons learned from best practices.

- It is a progressive shift towards a more scientific approach to education. The prescribed structure will help to cater the ability of the child – stages of cognitive development as well as social and physical awareness. If implemented in its true vision, the new structure can bring India at par with the leading countries of the world.

2.No Immunities for the acts of Vandalism: Supreme Court

#GS2 # Doctrine of Checks & Balances #Judiciary #State Legislature

Context: Recently, the Supreme Court has rejected Kerala government’s plea to withdraw criminal cases against its MLAs who were charged in the assembly.

Background:

- The ruling Kerala government had appealed, to the Supreme Court, to withdraw a criminal case against their leaders who destroyed public property and disrupted a Budget speech on the State Assembly floor in 2015.

- MLAs in the Kerala Assembly had vandalised the Speaker’s dais, uprooted his chair, pulled out the mike system, computer, etc. in 2015.

- The accused leaders had claimed parliamentary privilege, arguing that the incident occurred inside the Assembly Hall. They claimed immunity from criminal prosecution.

- They had argued that the prior sanction of the Speaker was necessary before the registration of an FIR by the police.

- The Kerala High Court, in an order passed, had refused to give its nod saying that the elected representatives are expected to uphold the prestige of the House or face consequences.

Highlights of the Judgement:

- Supreme Court made it clear that destruction of public property in the House cannot be equated with freedom of expression and immunity to legislators can’t be extended as immunity against criminal law.

- The bench asserted that the privileges and immunity accorded to MLAs and MPs do not mean they will enjoy immunity from criminal acts within the House and the trial court was correct in rejecting the application for withdrawal of FIR.

- These privileges bear a functional relationship to the discharge of the functions of a legislator

- The legislators who indulge in vandalism and general mayhem cannot claim parliamentary privilege.

- Vandalism and destruction inside the House are not essential for exercising legislative function.

- Vandalism on the Assembly floor could not be equated with the right to protest by Opposition legislators.

- No member of an elected legislature can claim either a privilege or immunity to stand above the sanctions of the criminal law (Prevention of Damage to Public Property Act, 1984), which applies equally to all citizens.

- SC opined that Legislators should act within the parameters of the public trust imposed on them to do their duty.

- They had taken office swearing true allegiance to the Constitution.

- They had to uphold the sovereignty and integrity of India and had to perform the duty imposed on them by the people who elected them.

- The court explained that the purpose of bestowing privileges and immunities to elected members of the legislature was to enable them to perform their “essential functions” without hindrance, fear or favour.

About Parliamentary Privilege:

- Article 105 and Article 194 grant privileges or advantages to the members of the parliament so that they can perform their duties or can function properly without any hindrances.

- Such privileges are granted as they are needed for democratic functioning. These powers, privileges and immunities should be defined by the law from time-to-time.

- These privileges are considered as special provisions and have an overriding effect in conflict.

- When any of these rights and immunities are disregarded, the offence is called a breach of privilege and is punishable under law of Parliament.

- Rule No 222 in Chapter 20 of the Lok Sabha Rule Book and correspondingly Rule 187 in Chapter 16 of the Rajya Sabha rulebook governs privilege.

- Article 105(3) and Article 194(3) states that the parliament should from time to time define the laws or pass the laws on the powers, privileges and immunities of the members of the parliament and members of the legislative assembly.

Individualistic Privileges:

- Freedom of speech and publication under parliamentary authority:

- No member of parliament will be liable in any proceedings before any Court for anything said or any vote given by him in the Parliament or any committee thereof.

- Also, no person will be held liable for any publication of any report, paper, votes or proceedings if the publication is made by the parliament or any authority under it.

- Freedom from Arrest: No member shall be arrested in a civil case 40 days before and after the adjournment of the House and also when the House is in session.

- It also means that no member can be arrested within the precincts of the Parliament without the permission of the House to which he/she belongs.

Collective Privileges:

- Power to make rules: The Parliament has the power, which is given by the Constitution of India, to make its own rules but this power is subjected to the provisions of the Constitution.

- Right to prohibit the publication of its reporters and proceedings: The right has been granted to remove or delete any part of the proceedings took place in the house.

- Right to exclude strangers from its proceedings and hold secret sessions: The object of including this right was to exclude any chances of daunting or threatening any of the members. The strangers may attempt to interrupt the sessions.

- Right to Punish Members and Outsiders: In India, the Parliament/Assembly has been given punitive powers to punish those who are judged guilty of contempt of the House.

- Earth Overshoot Day

#GS3 # Conservation, Environmental Pollution and Degradation

#Impact of Pollution & Degradation # Reasons for Loss of Biodiversity

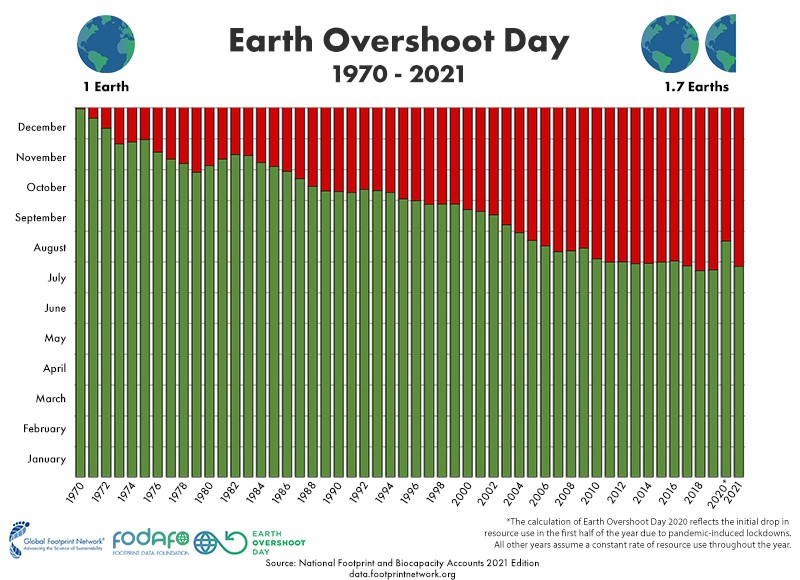

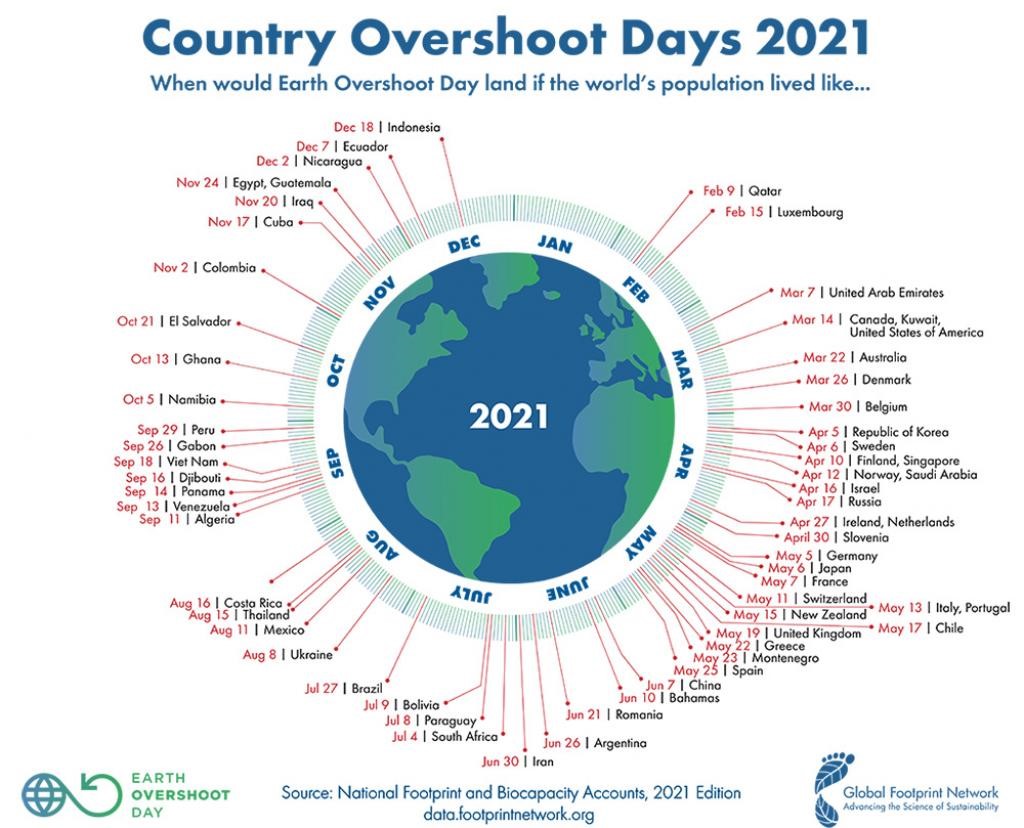

Context: As per World Wide Fund for Nature (WWF), Earth Overshoot Day’ has shifted back to July 29.

About the Earth Shoot Day:

- Earth Overshoot Day marks the date when humanity’s demand for ecological resources and services in a given year exceeds what Earth can regenerate in that year.

- We maintain this deficit by liquidating stocks of ecological resources and accumulating waste, primarily carbon dioxide in the atmosphere

- Earth Overshoot Day is hosted and calculated by Global Footprint Network, an international research organization that provides decision-makers with a menu of tools to help the human economy operate within Earth’s ecological limits.

- To determine the date of Earth Overshoot Day for each year, Global Footprint Network calculates the number of days of that year that Earth’s biocapacity suffices to provide for humanity’s Ecological Footprint.

- The remainder of the year corresponds to global overshoot.

- The Ecological Footprint is a metric that comprehensively compares human demand on nature against nature’s capacity to regenerate.

Highlights:

- According to the World Wide Fund for Nature (WWF), humanity has again used up all biological resources that our planet regenerates during the entire year by 29th July, 2021.

- Humanity currently uses 74% more than what the planet’s ecosystems can regenerate — or 1.7 Earths.

- From Earth Overshoot Day until the end of the year, humanity operates on ecological deficit spending.

- This spending was currently some of the largest since the world entered into ecological overshoot in the early 1970s, according to the National Footprint & Biocapacity Accounts based on UN datasets.

What caused the date to come back to what it was in 2019?

- In 2020, Earth Overshoot Day fell on 22 August, partly induced by the COVID-19 pandemic.

- Going back to June 29th, the same date that the world reached in 2019 means that the modest gains accrued from the novel coronavirus disease (COVID-19) as far as humanity’s ecological footprint is concerned have been lost.

- This is mainly because of

- Carbon footprint: An increase of 6.6% from 2020

- Global forest biocapacity: A reduction of 0.5% from 2020 due in large part to the spike in Amazon deforestation. In Brazil alone, 1.1 million hectares were lost in 2020 and estimates for 2021 indicate up to 43% year-over-year increase in deforestation.

Predictions for Future:

- There would be a 43% year-over-year increase in deforestation in 2021.

- The carbon footprint of transportation will be lower this year than pre-pandemic levels.

- Carbon dioxide (CO2) emissions from road transport and domestic air travel will be five per cent below 2019 levels.

- As per the estimates from the International Energy Agency, CO2 emissions due to international aviation will be 33 per cent below 2019 levels.

- But global energy-related CO2 emissions will increase 4.8 per cent from last year as economies try to recover from the impact of COVID-19.

- Global coal use is estimated to constitute 40 per cent of the total carbon footprint.

Suggestions by WWF:

- It said “A business-as-usual scenario will simply not work if the date for World Overshoot Day is to be pushed behind”.

- It suggested a number of measures such as cutting down on food wastage, commercial technologies for buildings, industrial processes and electricity production and cutting down on transportation.

- World Economic Outlook by International Monetary Fund

#GS3 # Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment

#GS2 # Important International Institutions, agencies and fora – their Structure, Mandate

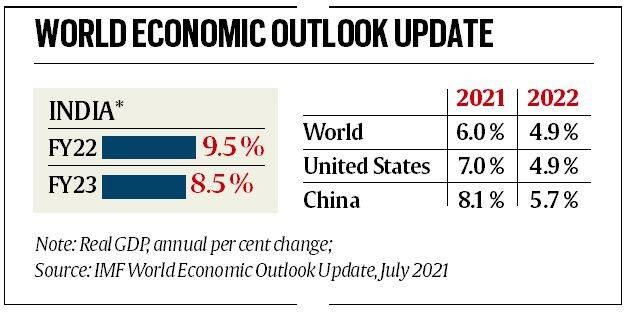

Context: The latest edition of the International Monetary Fund’s (IMF) World Economic Outlook has slashed its FY22 growth forecast for India by 300 basis points (bps) from its April projection to 9.5 per cent from 12.5%, the sharpest cut for any country, citing the damage caused by the second Covid wave that peaked in May.

Highlights of the report:

Indian Economy:

- For the next fiscal, however, it has raised the growth projection for the country to 8.5 per cent from 6.9 percent (projected in April 2020)

- Its April forecasts hadn’t factored in the impact of the resurgence of Covid infections in India.

- In 2020, India’s economy witnessed an estimated contraction of 8%.

- The IMF has cut its growth forecast because of the Covid-19 Second Wave that hit the recovery momentum, damaging consumer confidence and rural demand.

- While re-calibrating its forecast IMF considered two major factors which are access to vaccines and risk of new Corona-variants.

Global Economy:

- Retained its global growth forecast at 6% for the year 2021, and it is expected to grow at 4.9% for the year 2022.

- In 2020, the global economy contracted by 3.3%

- It trimmed its earlier projection by 40 bps for developing countries and raised it by 50 bps for advanced economies.

- It also cautioned that countries lagging in vaccination, such as India and Indonesia, would suffer the most among G20 economies.

- It estimated that the pandemic has reduced per capita incomes in advanced economies by 2.8 percent a year, relative to pre-pandemic trends over 2020-2022, compared with an annual per capita loss of 6.3 percent a year for emerging market and developing economies (excluding China).

Global Trade Volume:

- Revised up its predictions of global trade volume growth by a sharp 130 bps for 2021 to 9.7% and 50 bps for 2022 to 7%.

- India is set to benefit from an expected rise in global trade prospects once its supply side gains traction.

Reason behind these changes:

- These revisions reflect to an important extent differences in pandemic developments as the delta variant takes over.

- Close to 40 percent of the population in advanced economies has been fully vaccinated, compared with 11 percent in emerging market economies, and a tiny fraction in low-income developing countries. \

- Faster-than-expected vaccination rates and return to normalcy have led to upgrades, while lack of access to vaccines and renewed waves of COVID-19 cases in some countries, notably India, have led to downgrades

Suggestions:

- Tighter External Financial Conditions: Emerging markets should prepare for possibly tighter external financial conditions by lengthening debt maturities where possible and limiting the build-up of unhedged foreign currency debt.

- Fiscal actions should be nested within a credible medium-term fiscal framework to ensure debt remains sustainable. This will involve improving tax capacity, increasing tax progressivity, and eliminating wasteful expenditures.

- Avoid Premature Tightening Policies: Central banks should avoid premature tightening policies when faced with transitory inflation pressures but should be prepared to move quickly if inflation expectations show signs of de-anchoring.

- Prioritize Health Spending: Fiscal policy should continue to prioritize health spending, including on vaccine production and distribution infrastructure, personnel, and public health campaigns, to boost take-up.

- Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation’s economy.

5.Factoring Regulation (Amendment) Bill, 2021

#GS2 Government policies and Interventions #GS3 # Determinants of Growth & Development # Weaknesses and Failures of Industrial Policies

Context: Recently, the parliament passed the Factoring Amendment Bill to amend the Factoring Regulation Act 2011.

About the bill:

- The bill is aimed at helping MSMEs tide over problems of delayed payments as it seeks to broaden the participation of entities undertaking factoring.

- As per, governments delayed payments monitoring portal MSME Samadhaan, more than 83000 delayed payment applications have been filed by MSMEs which involve an amount of Rs 22,311 crore. Out of these applications 7920 applications involving Rs 1,433 crore were disposed.

- This bill will broaden the scope of the entities which can participate in the factoring business and also will ensure that strong oversight and regulatory mechanisms are put in place.

- The bill will also enhance traction on the TReDS platform which was introduced by the Reserve Bank of India in the year 2014 for the entrepreneurs so that they can unlock working capital which is tied to their unpaid invoices.

- The amendments to the factoring law are based on the recommendations of the U K Sinha Committee.

Key Provisions:

- Change in the definition of receivables: The Bill amends the definition of receivables to mean any money owed by a debtor to the assignor for toll or for the use of any facility or services.

- The 2011 Act defines receivables as (all or part of or undivided interest in) the monetary sum which is the right of a person under a contract.

- Change in the definition of assignment: The Act defines assignment to mean transfer (by agreement) of undivided interest of any assignor in any receivable due from the debtor, in favour of the factor.

- The Bill amends the definition to add that such a transfer can be in whole or in part (of the undivided interest in the receivable dues).

- Change in the definition of factoring business: The Bill amends this to define factoring business as acquisition of receivables of an assignor by assignment for a consideration. The acquisition should be for the purpose of collection of the receivables or for financing against such assignment.

- Registration of factors: Under the Act, no company can engage in factoring business without registering with the Reserve Bank of India (RBI).

- For a non-banking financial company (NBFC) to engage in a factoring business, its:

- (ii) income from the factoring business should both be more than 50% (of the gross assets/net income) or more than a threshold as notified by the RBI.

- (i) financial assets in the factoring business, and

- The Bill removes this threshold for NBFCs to engage in factoring business.

- Registration of transactions: The Bill removes the 30 day time period within which factors are required to register the details of every transaction of assignment of receivables in their favour with the central registry setup under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002.

- RBI to make regulations: The Bill empowers RBI to make regulations for:

(i) the manner of granting registration certificates to a factor,

(ii) the manner of filing of transaction details with the Central Registry for transactions done through the TReDS, and

(iii) any other matter as required.

TReDS

- TReDS is an electronic platform introduced by RBI for facilitating the financing and discounting of the trade receivables of MSMEs via various financiers.

- So far TReDS has processed nearly 43,000 crores worth of invoices that have helped more than 25,000 MSMEs with better access to funds and liquidity.

- Rafale squadron

#GS3 # Security Challenges & their Management in Border Areas

# Various Security Forces & Agencies & Their Mandate

#Indigenization of Technology and Developing New Technology

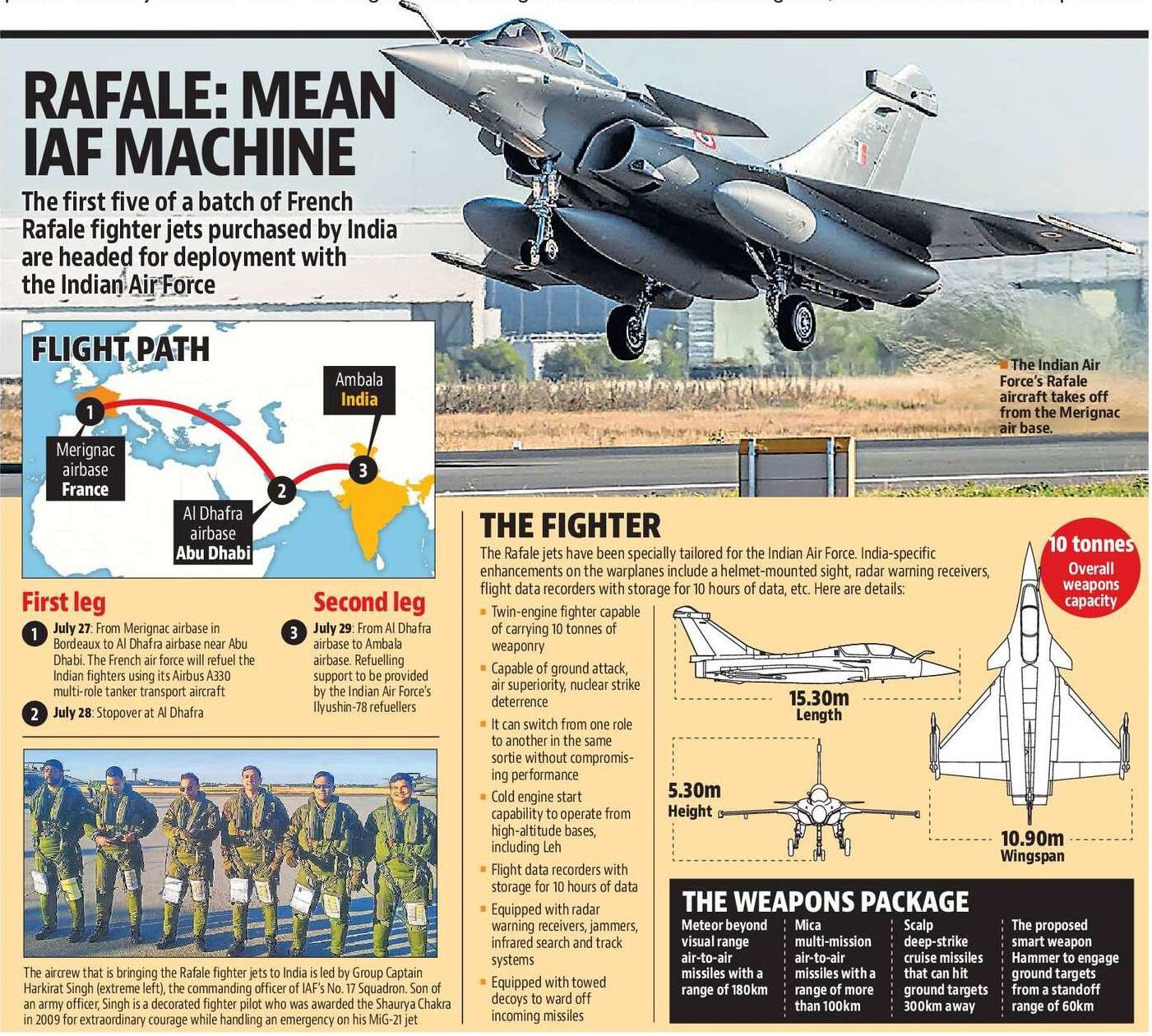

Context: Indian Air Force recently operationalises the second Rafale squadron at Hasimara, West Bengal.

Key Details:

- The Indian Air Force (IAF) operationalised its second Rafale fighter squadron by formally inducting jets into the No. 101 Squadron at Air Force Station Hasimara in West Bengal.

- The IAF has so far inducted 26 Rafale jets in eights batches.

- The squadron is given the title ‘Falcons of Chamb and Akhnoor’

- It was formed on May 1, 1949 at Palam and has operated the Harvard, Spitfire, Vampire, Su-7 and MiG-21M aircraft in the past.

- The squadron saw active participation in 1965 and 1971 Indo-Pak wars.

- The first Rafale squadron, the No.17 Golden Arrows, is based at Ambala.

- In September 2020, the IAF inducted the first batch of five Rafales of 36 jets, contracted under a €7.87 billion Inter-Governmental Agreement signed in September 2016 with 13 India Specific Enhancements (ISE).

Significance:

- The induction of Rafale had been carefully planned at Hasimara, keeping in mind the importance of strengthening IAF’s capability in the Eastern Sector.

- The deployment of the Rafales in the eastern sector, along with the Sukhoi-30MKI fighters already operating from the airbases like Tezpur and Chabua, will lead to a greater offensive punch against China

- Rafale aircraft were deployed for patrolling along the China front in eastern Ladakh and other fronts during the height of the India-China faceoff at the Line of Actual Control (LAC).

- The Chinese air bases facing India are located at high altitude with rarefied air, which severely limits the weapon and fuel-carrying capacity of fighter. Now the latest Rafales, are technically superior to the bulk of Chinese fighters.

- With a combat range of 780-km to 1,650-km depending on mission, the Rafales are armed with long stand-off weapons like the over 300-km range `Scalp’ air-to-ground cruise missiles. They also have the top-notch Meteor air-to-air missiles, which with a strike range of 120 to 150-km are better than any missiles currently carried by Chinese or Pakistani jets.

About Rafale: