UPSC Civil Services Daily Current Affairs 10th March 2022

Topics for the day:

- SC grants Rajiv case convict bail despite Centre’s objection

- Cabinet nod for new firm to monetise land assets

- Upper age limit for NEET-UG removed

- NaBFID to be regulated as AIFI under RBI Act

- War risks weighing, Indian companies face higher reinsurance rates

- Karewas of india

- UPI123Pay

- Amendment to Mines and Minerals (Development and Regulation) Act

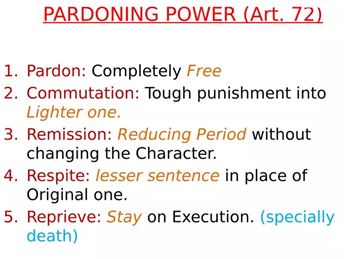

SC grants Rajiv case convict bail despite Centre’s objection :

Context :

- The Supreme Court on Wednesday released Rajiv Gandhi assassination case convict A.G. Perarivalan on bail, taking into account the fact he has suffered over 30 years of imprisonment

- At the end of a nearly hour-long hearing, the court listed Perarivalan’s case for further hearing in April on the powers of the Governor to decide the question of his early release, which was approved by the Tamil Nadu Cabinet, and the Governor’s reference of the matter to the President

Pardoning powers of the Governor :

- He can pardon,reprieve,respite,remit,suspend or commute the punishment or sentence of any person convicted of any offence against a state law.

- He cannot pardon a death sentence. Even if a state law prescribes for death sentence, the power to grant pardon lies with the President and not the governor.

- However, the governor can suspend, remit or commute a death sentence. In other words, both the governor and the President have concurrent power in respect of suspension, remission and commutation of death sentence.

- While the president can grant pardon, reprieve, respite, suspension, remission or commutation in respect to punishment or sentence by a court-martial (military court) the governor cant do so.

Cabinet nod for new firm to monetise land assets

Context :

- The Union Cabinet on Wednesday approved the setting up of a new government owned firm for pooling and monetising sovereign and public sector land assets.

- The National Land Monetisation Corporation (NLMC) is being formed with an initial authorized share capital of Rs.5,000 crore and paid-up capital of Rs.150 crore.

More about the national land monetisation corporation :

- The government will appoint a chairman to head the NLMC through a “merit-based selection process” and hire private sector professionals with expertise.

- The NLMC will undertake monetisation of surplus land and building assets of Central public sector enterprises (CPSEs) as well as government agencies

Key functions of NLMC:

- NLMC is expected to own, hold, manage and monetize surplus land and building assets of CPSEs under closure and the surplus non-core land assets of Government owned CPSEs under strategic disinvestment.

- This will speed up the closure process of CPSEs and smoothen the strategic disinvestment process of Government owned CPSEs.

- These assets may be transferred to NLMC to hold, manage and monetize these assets.

- NLMC will also advise and support other Government entities (including CPSEs) in identifying their surplus non-core assets and monetizing them in a professional and efficient manner to generate maximum value realization – In these cases, NLMC will undertake surplus land asset monetization as an agency function.

- It is expected that NLMC will act as a repository of best practices in land monetization, assist and provide technical advice to Government in implementation of asset monetization programme.

Composition of the NLMC:

- The Board of Directors of NLMC: will comprise senior Central Government officers and eminent experts to enable professional operations and management of the company.

- The Chairman, and non-Government Directors of the NLMC will be appointed through a merit-based selection process.

Benefits of monetising assets :

- With monetization of non-core assets, Government would be able to generate substantial revenues by monetizing unused and under-used assets.

- This will also enable productive utilization of these under-utilized assets to trigger private sector investments, new economic activities, boost local economy and generate financial resources for economic and social infrastructure.

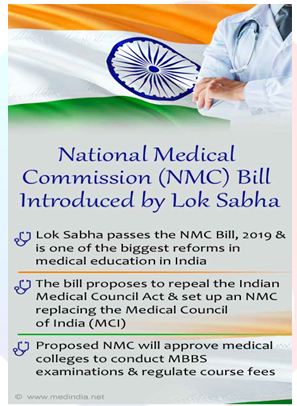

Upper age limit for NEET-UG removed

More on the news :

- National Medical Commission (NMC) recently removed the upper age limit for appearing in the National Eligibility- cum-Entrance Test (Undergraduate).

- NMC: Regulates medical education and medical professionals in India while National testing agency conducts the entrance examinations.

- Earlier, the age limit was 25 for general category candidates and 30 for those in the reserved category.

What is the NMC ?

- The National Medical Commission (NMC) had replaced the Medical Council of India (MCI), as per the gazette notification issued by the Ministry of Health and Family Welfare. The NMC was formed under the National Medical Commission Act.

- The NMC will function as the country’s top regulator of medical education.

- It will have four separate autonomous boards for:

- Undergraduate medical education

- Postgraduate medical education

- Medical assessment and rating

- Ethics and medical registration.

- The common final year Bachelor of Medicine and Bachelor of Surgery (MBBS) examination will now be known as the National Exit Test (NEXT), according to the new medical education structure under the NMC.

- NEXT will act as licentiate examination to practice medicine, the criteria for admission to postgraduate medical courses, and also for screening of foreign medical graduates.

- The NEXT will also be applicable to institutes of national importance such as all the All India Institutes of Medical Sciences (AIIMS) in a bid to ensure a common standard in the medical education sector in the country.

- Composition of the NMC : The commission consists of 33 people. It has one chairman and NMC will consist of 10 ex-officio members and 22 part-time members appointed by the Central government.

- Functions of NMC:

- Laying down policies for regulating medical institutions and medical professionals.

- Assessing the requirements of human resources and infrastructure in healthcare.

- Ensuring compliance by the State Medical Councils with the regulations made under the Bill.

- Framing guidelines for determination of fee for up to 50% of the seats in the private medical institutions.

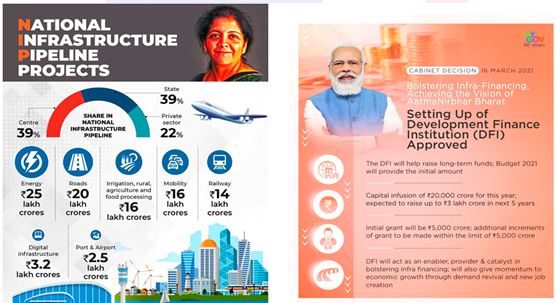

NaBFID to be regulated as All India Financial Institution(AIFI) under RBI Act

Context :

- RBI announced that NaBFID will be regulated and supervised as an All India Financial Institution by it under the RBI Act, 1934.

- It shall be the fifth AIFI after EXIM Bank, NABARD, NHB and SIDBI.

- NaBFID has been set up as a Development Financial Institution (DFI) to support the development of long-term infrastructure financing in India

- Unlike banks, DFIs do not accept deposits from people. They source funds from the market, government, as well as multi-lateral institutions, and are often supported through government guarantees.

- The National Bank for Financing Infrastructure and Development (NaBFID) Act, 2021 was enacted earlier to form the NABFID.

More about the NABFID :

- NABFID will be set up as a corporate body with authorised share capital of one lakh crore rupees.

- Shares of NBFID may be held by:

- central government

- multilateral institutions

- sovereign wealth funds

- pension funds

- Insurers

- financial institutions

- Banks

- any other institution prescribed by the central government.

- Initially, the central government will own 100% shares of the institution which may subsequently be reduced up to 26%.

- ??NABFID may raise money in the form of loans or otherwise both in Indian rupees and foreign currencies

- NABFID will have both financial as well as developmental objectives.

- Financial objectives will be to directly or indirectly lend, invest, or attract investments for infrastructure projects located entirely or partly in India.

- Developmental objectives include facilitating the development of the market for bonds, loans, and derivatives for infrastructure financing

- Functions of NABFID include:

- extending loans and advances for infrastructure projects

- taking over or refinancing such existing loans

- attracting investments from private sector investors and institutional investors for infrastructure projects

- organising and facilitating foreign participation in infrastructure projects

- facilitating negotiations with various government authorities for dispute resolution in the field of infrastructure financing

- providing consultancy services in infrastructure financing.

War risks weighing, Indian companies face higher reinsurance rates

Context :

- Global reinsurers have intimated Indian general insurers about the hardening of pricing and tighter terms and conditions in the coming days for Indian business in the wake of Russian invasion of Ukraine and subsequent imposition of severe sanctions by Western countries on Russia.

- Domestic general insurers, who were waiting for April 1reinsurance renewal, might have to rush for early renewals of their annual business to avert a price hike.

- The higher pricing will be impacting marine cargo, particularly movements in Black Sea initially but if war continues, it can include property prices.

- Though there is no impact on Indian clients immediately, they need to move fast as situation can further escalate in the international markets

- Industry officials said the sanctions will also hit the placement of business of Indian joint ventures with Russian partnership.

- Insurance Act (1938) requires insurance companies take ‘re-insurance’ on their business

Karewas of India

Context :

- In the name of development, Kashmir’s highly fertile alluvial soil deposits called ‘karewas’ are being destroyed.

- Despite its agricultural and archaeological importance, karewas are now being excavated to be used in construction.

What are karewas ?

- Karewas are the thick deposits of glacial clay and other materials embedded with moraines.

- These are unconsolidated lacustrine deposits. Lacustrine means “associated with lakes”

How were they formed in Kashmir valley?

- Kashmir valley resides between the Great Himalayas and the Pir Panjal ranges of the Kashmir Himalayas.

- In earlier times, when the upliftment of the Pir Panjal ranges happened, the flow of the river had stopped.

- As a result, the whole of Kashmir valley became a large lake.

- Slowly, the glacial deposits have accumulated here in this lake. Thus creating a large lacustrine plain.

- Later on, the water drained away and these unconsolidated deposits remained there.

- These unconsolidated gravel and mud deposits are known as Karewa formation.

Economic significance of Karewas:

- Karewa deposits have different soil and sediments such as sand, clay, silt, shale, mud, lignite and loesses.

- Hence, these are very useful for agricultural and horticulture activities.

- Karewa formations are useful for the cultivation of Zafran is a local variety of Saffron in Kashmir valley.

- These are also important for the cultivation of almond, walnut, apple, and orchards.

UPI123Pay

Context :

- The Reserve Bank of India has launched a new Unified Payments Interface (UPI) payments solution for feature phone users dubbed ‘UPI123Pay’.

What is UPI123Pay?

- UPI ‘123PAY’ is a three-step method to initiate and execute services for users which will work on simple phones.

- It will allow customers to use feature phones for almost all transactions except scan and pay.

- It doesn’t need an internet connection for transactions.

- Customers have to link their bank account with feature phones to use this facility.

The new UPI payments system offers users four options to make payments without internet connectivity :

-

Interactive Voice Response (IVR):

- Users would be required to initiate a secured call from their feature phones to a predetermined IVR number and complete UPI on-boarding formalities to be able to start making financial transactions like money transfer, mobile recharge, EMI repayment, balance check, among others.

-

App-based functionality:

- One could also install an app on feature phone through which several UPI functions, available on smartphones, will be available on their feature phone, except scan and pay feature which is currently not available.

-

Missed call facility:

- The missed call facility will allow users to access their bank account and perform routine transactions such as receiving, transferring funds, regular purchases, bill payments, etc., by giving a missed call on the number displayed at the merchant outlet.

- The customer will receive an incoming call to authenticate the transaction by entering UPI PIN.

-

Proximity sound-based payments:

- One could utilise the proximity sound-based payments option, which uses sound waves to enable contactless, offline, and proximity data communication on any device.

Amendment to Mines and Minerals (Development and Regulation) Act 2022

Context :

- The Union Cabinet has approved amendments to the Second Schedule of the Mines and Minerals (Development and Regulation) Act, 1957 for specifying the rate of royalty in respect of Glauconite, Potash, Emerald, Platinum Group of Metals (PGM), Andalusite, Sillimanite and Molybdenum.

More on the amendment :

- The approval would ensure auction of mineral blocks in respect of Glauconite, Potash, Emerald, Platinum Group of metals, Andalusite and Molybdenum for the first time in the country.

- Minerals like Glauconite and Potash are used as fertilizer in agriculture.

- Platinum Group of Metals (PGM) are high value metal used in various industries and new innovative applications.

- Minerals like Andalusite, molybdenum are vital minerals used in industrial applications.

Implications of the move:

- Encouraging indigenous mining of these minerals is in the National interest that would lead to a reduction in imports in potash fertilizers and other minerals.

- This step taken by the Ministry of Mines is also expected to increase the generation of employment in the mining sector.

- It will also ensure increased availability of minerals for the downstream industries and support agriculture.

- The approval will lead to import substitution in respect of many important minerals for the economy of the country thereby saving valuable forex reserves.

- It will reduce the country’s foreign dependency through the local production of minerals.

UPSC Civil Services Daily Current Affairs 10th March 2022

Our Courses

Watch Our Videos on YouTube