Topics

- India, Sri Lanka and Maldives to work together on security issues.

- Permanent Forum of People of African Descent

- The Taxation Laws (Amendment) Bill, 2021

- Supreme court on an order by the Singapore International Arbitration Centre

- Abanindranath Tagore

- PM-DAKSH: To make Skill development schemes accessible

1.India, Sri Lanka and Maldives to work together on security issues.

#GS2 #India and its Neighbourhood – Relations

#Bilateral, Regional & Global Groupings #Security Challenges & their Management in Border Areas

Context: Recently, India, Sri Lanka and the Maldives have decided to work on “four pillars” of security cooperation, covering areas of marine security, human trafficking, counter-terrorism, and cyber security, in a Deputy National Security Adviser-level meeting held virtually by Sri Lanka.

- Bangladesh, Seychelles and Mauritius participated in the meeting as observers.

Background:

- This decision comes 9 months after India’s National Security Adviser Ajit Doval visited Colombo in November 2020, for discussions with Sri Lanka and Maldives in which all three agreed to enlarge the scope of intelligence sharing.

- Above meeting marked the restoration of NSA-level trilateral dialogs on maritime security in the Indian Ocean Region after a gap of 6 years.

- This Trilateral framework was established back in 2011.

- It was renamed as ‘Colombo Security Conclave’ in 2020 trilateral meet.

- The objective of the Conclave was to form a closer collaboration on maritime and security matters among the three Indian Ocean countries.

- The cooperation, based on military and security alliance, assumes significance in the region, in the wake of the present geostrategic dynamic that India has with Sri Lanka and the Maldives.

Current Geostrategic Dynamic:

- Sri Lanka: Earlier this year, India voiced its concerns over Sri Lanka’s approval to China to build development projects in an island, close to India’s southern border.

- The Maldives’s engagement with members of ‘Quad’ grouping, has been growing over the last year, especially in the area of defence cooperation.

- Maldives also signed a ‘Framework for a Defence and Security Relationship’ agreement with the US in 2020, a move that India welcomed.

Key minutes of the Latest Meeting:

- The purpose of the Meeting was to establish a maritime security mechanism through joint exercises of navies and Coast Guards for Indian Ocean Region (IOR) including the Bay of Bengal amidst China’s increasing presence in the area.

- The focus areas were extended with joining of observer countries and now it includes weapons and human trafficking, countering terrorism and violent extremism, protection of maritime environment, capacity building, transnational crimes including narcotics, and Humanitarian Assistance and Disaster Relief (HADR), etc.

- The members also deliberated ways of fighting the pollution in the waters.

- There have been accidents in the Indian Ocean Region like MV Xpress Pearl, MT New Diamond and MV Wakashio and this impacted the marine environment.

- Later this year, the 3 observer countries have been invited to be full members at the next NSA level meeting which is to be held in Maldives.

Significance of the conclave:

- The expansion of the areas of collaboration and membership to countries including Seychelles, Bangladesh, and Mauritius are suggestive of increasing convergence amongst the Indian ocean region countries.

- This also shows that all the countries are prepared to work together which will deepen the engagement in various domains under a regional framework.

- This convergence of countries in India’s immediate neighbourhood on a shared maritime and security stage is substantial in a wider global context as well.

- It highlights India’s willingness to play a leading security role in the neighbourhood.

Concerns:

- The advancement of the NSA-level trilateral meeting was affected when India’s ties with Maldives deteriorated under its President Abdulla Yameen.

- Subregional cooperation cannot be shielded from bilateral political relations and, hence, preserving good bilateral relations with individual countries and responding to the rising ambitions of smaller neighbours would be critical.

- Most of the smaller neighbours are more comfortable collaborating in non-traditional security than entering into hard military cooperation with India at the subregional level.

Road Ahead:

- A subregional tactic of building security cooperation has been gaining significance in India’s neighbourhood policy in present years. The revival of the NSA-level trilateral India-Sri Lanka-Maldives dialogue on maritime security cooperation underlines this policy approach.

- Some clarity on the boundary matters may help in proper framing of the objectives of subregional security cooperation and avoid overlapping of membership or duplication of activities.

2.Permanent Forum of People of African Descent

#GS2 # Important International Institutions

# Indian Diaspora #Issues related to minorities

Context: Recently, United Nations General Assembly created a new Permanent Forum of People of African Descent.

- The Forum focuses on the themes of recognition, justice and development.

What does the forum do?

- After years of discussions, the UN General Assembly recently established a new platform to improve the lives of Afro-descendants, who have for ages suffered the evils of racism, racial discrimination and the legacy of enslavement around the world.

- UNGA unanimously adopted the resolution establishing the Forum, a 10-member advisory body that will work closely with the Geneva-based Human Rights Council.

- The forum will offer expert assistance on addressing the challenges of racism, racial discrimination, xenophobia and intolerance.

- Further, it will work to recognize and analyse best practices, challenges, opportunities and initiatives to address issues pertinent to people of African descent as highlighted in the Durban Declaration and Programme of Action, which was adopted 20 years ago at a landmark UN summit against racism and discrimination.

- This acts as a first step in the direction of a legally binding instrument on the promotion and full respect of the rights of people of African descent.

- It was given a bunch of directives.

- They contain helping to guarantee “the full political, economic and social inclusion of people of African descent,” and providing recommendations on addressing racism to the Geneva-based Human Rights Council, the General Assembly’s main committees and UN agencies.

- 10 members of the forum includes:

- 5 nominated by Governments and then elected by the General Assembly.

- 5 appointed by the Human Rights Council.

People of African Descent and their issues:

- There are about 200 million people recognizing themselves as being of African descent live in the Americas.

- Many more African descendants live in other parts of the world, outside African continent.

- They constitute some of the poorest and most marginalized groups.

- They still have inadequate access to quality education, health services, housing and social security.

- They face high rates of police violence, together with racial profiling.

- Besides, their degree of political participation is often low, both in voting and in occupying political positions.

Racism:

- Racism, also called racialism is the belief that humans may be divided into separate and exclusive biological entities called “races”; that there is a causal link between inherited physical traits and traits of personality, intellect, morality, and other cultural and behavioural features; and that some races are innately superior to others.

- The term is also applied to political, economic, or legal institutions and systems that engage in or perpetuate discrimination on the basis of race or otherwise reinforce racial inequalities in wealth and income, education, health care, civil rights, and other areas.

Provisions Against Racial Discrimination in India:

- Article 15, Article 16 and Article 29 of the Constitution of India forbid discrimination on grounds of “race”.

- India also ratified the International Convention on the Elimination of All Forms of Racial Discrimination (ICERD) in 1968.

Way Forward

- Through new methods to intercultural dialogue and learning, youth and groups can be armed with skills to remove harmful stereotypes and foster tolerance.

- Recent and new appearances of racism and discrimination call for renewed obligations to mobilise for equality.

- Racism must be fought with anti-racist action.

- A global ethos of tolerance, equality and anti-discrimination should be built primarily in the minds of women and men.

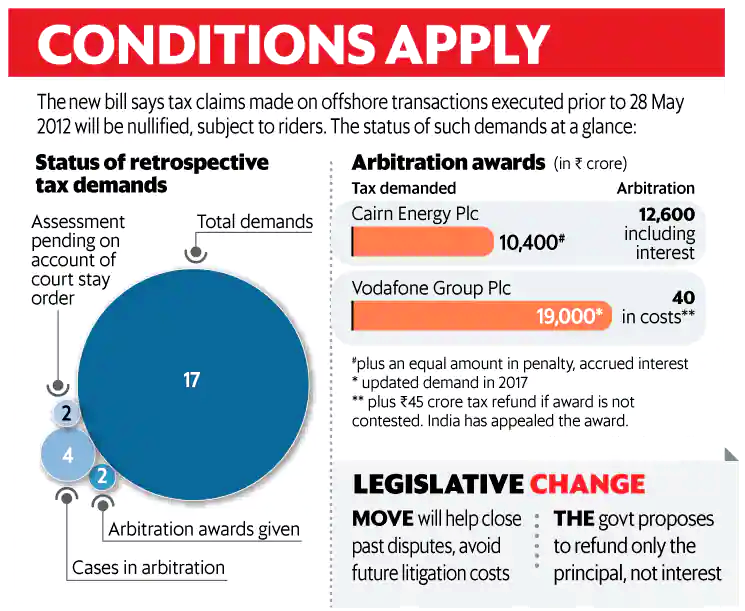

3.The Taxation Laws (Amendment) Bill, 2021

#GS2 #Policies and Interventions #Fiscal Policy #Mobilisation of Resources

Context: Recently, Lok Sabha passed The Taxation Laws (Amendment) Bill, 2021.

- The bill intends to withdraw tax demands made using a 2012 retrospective legislation to tax the indirect transfer of Indian assets.

Background:

- The retrospective tax law was passed in 2012 following a Supreme Court verdict in favour of US-based telecom company Vodafone.

- The 2012 Act had amended the IT Act to impose tax liability on the income earned from the sale of shares of a foreign company on a retrospective basis (i.e., also applicable to the transactions done before May 28, 2012).

- This Bill proposes to nullify this retrospective basis for taxation.

- While the amendment was intended at penalising Vodafone, many other companies got caught in between and have created a huge problem for India over the years.

Proposed Changes in Bill:

- Tax on income made from the sale of shares outside India: Under the IT Act, non-residents are required to pay tax on the income arising from any business connection, property, asset, or source of income situated in India.

- The amendments made by the 2012 Act clarified that if a company is registered or incorporated outside India, its shares will be deemed to be or have always been situated in India if they derive their value substantially from the assets located in India. As a result, the persons who sold such shares of foreign companies before the enactment of the Act (i.e., May 28, 2012) also became liable to pay tax on the income earned from such sale.

- New bill provisions effectively state that no tax demand shall be raised for any indirect transfer of Indian assets if the transaction was undertaken before 28th May 2012.

- Tax raised for the indirect transfer of Indian assets before May 2012 would be “nullified on fulfilment of specified conditions” such as the withdrawal of pending litigation and an undertaking that no damages claims would be filed.

- It also proposes to refund the amount paid by companies facing trail in these cases without interest thereon.

Significance of the Bill:

- The bill marks a step in the course of addressing the long-pending demand of foreign investors seeking the removal of retrospective tax for better tax clarity.

- This will also likely to help settle disputes with Cairn Energy Plc, Vodafone Group Plc and 15 other companies over retrospective tax demands raised by the Union government.

- This would help in creating an investment-friendly business environment, which can increase economic activity and help bring more revenue over time for the government.

- This could help re-establish India’s reputation and improve ease of doing business.

Retrospective Taxation:

- It permits a country to authorization a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Government usually take this course to correct any irregularities in their taxation policies that have, in the past, allowed companies to take advantage of such ambiguities.

- Retrospective Taxation hurts companies that had knowingly or unknowingly interpreted the tax rules differently.

- Apart from India, many countries including the USA, the UK, the Netherlands, Canada, Belgium, Australia and Italy have retrospectively taxed companies.

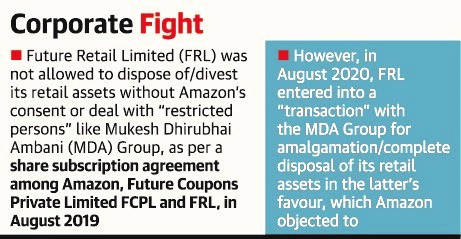

4.Supreme court on an order by the Singapore International Arbitration Centre

#GS3 #Dispute redressal mechanisms and Institutions #Judiciary #Ease of Doing business

Context: The Supreme Court has ruled in favour of e-commerce giant Amazon against the proposed ?24,713 crore merger deal between Future Retail Limited (FRL) and Reliance Retail.

- The court has also sustained the validity and enforceability of a Singapore-based Emergency Arbitrator (EA) award, which put on hold the Future Group’s deal with Reliance Industries Limited.

Background:

- Last year, Future Retail Limited (FRL) had declared that it would sell its retail and wholesale business to Reliance Retail.

- Before the deal could be completed, Amazon opposed it, claiming a breach of contract it had with Future Coupons (the promoter firm of Future Retail).

- Amazon said that its arrangement with Future Coupons had given it a “call” option, which permitted it to work out the option of acquiring all or part of Future Retail’s shareholding in the company, within 3 to ten years of the arrangement.

- Subsequently, Amazon took Future Retail into Emergency Arbitration before the SIAC, where an emergency arbitrator barred the latter from proceeding with the deal.

- Emergency arbitration is a instrument which “allows a disputing party to apply for urgent interim relief before an arbitration tribunal has been lawfully constituted”.

Supreme court ruling:

- By dismissing Dismissed FRL’s argument that the “Emergency Arbitrator is not an arbitral tribunal” under the Arbitration and Conciliation Act of 1996, supreme court upheld the award by Emergency Arbitrator in SIAC is “exactly like an order of an arbitral tribunal” contemplated under Section 17 of the Arbitration and Conciliation Act, 1996 Act Hence, an award by the EA was like an order under Section 17(1) (interim measures ordered by an arbitral tribunal) of the Act.

- Thus, they cannot appeal further under Section 37 of the Arbitration Act against an order of enforcement of an Emergency Arbitrator’s order.

- Section 17 of the Act prescribes the mechanism for parties to an arbitration to seek interim reliefs from the arbitral tribunal during the pendency of the arbitral proceedings.

- The court pointed out a recommendation of Justice B N Srikrishna (retd) on reviewing the institutionalisation of the arbitration mechanism in India and look into the provisions of the Arbitration Act after the 2015 Amendment Act.

- It said that “given that international practice is in favour of carrying out emergency awards (Singapore, Hong Kong and the United Kingdom) it is time that India allowed the enforcement of emergency awards in all arbitral proceedings”.

- The ruling would work as a cue to the parties to carefully agree to the terms and conditions of the arbitration.

- Thus, they cannot appeal further under Section 37 of the Arbitration Act against an order of enforcement of an Emergency Arbitrator’s order.

Procedure followed by SIAC

- Once a dispute is referred to arbitration, the procedure of selection of the arbitral tribunal takes place.

- Arrangement: Usually, in case of a 3-member tribunal, both the parties appoint 1 member each to the tribunal, while the 3rd member is jointly appointed by the two nominees or, if they fail to agree, by SIAC.

Compliance:

- At present under Indian law, there is no direct apparatus for enforcement of the orders of the Emergency Arbitrator.

- But the parties voluntarily comply with the Emergency Award.

- However, if the parties don’t comply with the order voluntarily, then the party which has won the emergency award, in this case Amazon, can move the High Court in India under Section 9 of the Arbitration & Conciliation Act, 1996, to get similar reliefs as granted by the Emergency Arbitrator.

What makes Singapore the centre of international arbitration?

- Foreign investors in India naturally want to circumvent the hassle of the Indian courts.

- Foreign investors feel that Singapore is impartial ground for dispute resolution.

- Singapore itself with time has built a good reputation as jurisdiction driven by rule of law with global standards and high integrity. This gives comfort to investors that the arbitration process will be quick, fair and just”.

- According to the 2019 annual report of SIAC, India was the top user of its arbitration seat with 485 cases being referred to SIAC, followed by Philippines at 122, China at 76 and the United States at 65.

Singapore International Arbitration Centre (SIAC):

- It is a not-for-profit international arbitration organisation grounded in Singapore, which administers arbitrations under its own rules of arbitration and the United Nations Commission on International Trade Law (UNCITRAL) Arbitration Rules.

5.Abanindranath Tagore

#GS1 #Modern Indian History # significant events, personalities, issues.

Context: The year-long celebrations marking 150 years of Abanindranath Tagore to be held, with a host of online workshops and conferences paying tributes to him and his work on Bengal School of Painting.

About:

- Abanindranath Tagore was born in 1871 in Jorasanko, Kolkata.

- He was a nephew of Rabindranath Tagore.

- He was the principal artist and creator of the “Indian Society of Oriental Art”

- In his youth, Abanindranath got trained in European and Academic style from various European artists.

- However, during the last decade of the 19th century, he developed an aversion from European naturalism.

- He then grew interest in painting images with historic or literary allusions. He drew inspiration from Mughal miniatures.

- Another source of inspiration came from the visit of the Japanese philosopher and aesthetician Okakura Kakuzo to Kolkata in 1902.

Contribution to Indian Freedom Struggle:

- He was the first major advocate of Swadeshi ideals in Indian art, thereby finding the influential Bengal school of art, which led to the development of modern Indian painting.

- This majorly led to a new art movement in the last decades of the nineteenth century, which got its primary stimulus from the growing nationalism in India.

- In Bengal, a new school of nationalist artists gathered around Abanindranath Tagore.

- He was probably the 1st major advocate of an artistic idiom that sought to modernise the Mughal and the Rajput styles in order to counter the impact of Western models of art under the colonial rule which he considered as materialistic.

- Though many of the paintings of this new trend mainly focused on themes of Indian mythology and cultural heritage, they are significant sources for studying the modern art movement in India and for the art historians.

- Tagore voiced in favour of a nationalistic Indian art derived from Indian art history, finding inspiration from the Ajanta Caves.

- He was the creator of the iconic ‘Bharat Mata’ painting.

- one of his finest achievements was the Arabian Nights series which was painted in 1930. In these paintings he uses the Arabian Nights stories as a means of looking at colonial Calcutta and picturing its emergent cosmopolitanism.

- His work was so successful that it was ultimately acknowledged and promoted as a national Indian style within British art institution.

Bharath Mata Painting by Abanindranath Tagore

Bengal School of Painting:

- The Bengal School of Art was an art movement and a style of Indian painting that originated in Bengal, primarily Kolkata and Shantiniketan, and flourished all over the Indian subcontinent, during the British rule in the early 20th century.

- It is also called the Renaissance School or the Revivalist School, as it characterized the first modern movement of Indian art.

- It relived the glories of Indian art and consciously tried to produce what it considered a truly Indian art inspired by the creations of the past.

- Its main proponents and artists were Abanindranath Tagore and its theoretician was E.B. Havell, the principal of the Calcutta School of Art.

6.PM-DAKSH: To make Skill development schemes accessible

#GS2 # Welfare Schemes for Vulnerable Sections

# Issues Relating to Development & Management of Social Sector/Services

Context: Recently, Union Ministry of Social Justice and Empowerment launched ‘PM-DAKSH’ Portal and ‘PM-DAKSH’ Mobile App.

Key Details:

- They have been developed by the Ministry of Social Justice and Empowerment, in partnership with National E-Governance division (NeGD), to make the skill development schemes reachable to the target groups.

- It ensures accessibility of all information regarding skill development at one place for Scheduled Castes, Backward Classes and Safai Karamcharis.

- Portal also provides the facility to register with the training institute and for the programme of one’s interest and

- The facility to upload desired credentials related to personal information,

- The facility to register the attendance of trainees through face and eye scanning during the training period and monitoring facility through photo and video clip during training etc.

Background:

- The Pradhan Mantri Dakshta Aur Kushalta Sampann Hitgrahi (PM-DAKSH) Yojana is being implemented by the Ministry of Social Justice and Empowerment from the year 2020-21.

- Under this scheme, qualified target group are being provided skill development training programmes on

- Up-skilling/Re-skilling,

- Short Term Training Programme,

- Long Term Training Programme and

- Entrepreneurship Development Program (EDP).

- These training programs are being executed through government training institutes, sector skill councils established by the Ministry of Skill Development and Entrepreneurship and other credible institutions.

- During the year 2021-22, a target has been set to provide skill development training to approximately 50,000 p ersons of the target groups.